/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies (PLTR) cemented its place among America’s tech royalty after jumping over 498% in the past 12 months alone and most recently overtaking blue-chip giants Procter & Gamble (PG) and Home Depot (HD) in market value. Led by historic government contracts and skyrocketing demand for its artificial intelligence-driven technology, the firm now exceeds over $375 billion in valuation and ranks among the top-20 most valuable publicly traded U.S. companies.

The rally reflects investor confidence in the long-term health of Palantir’s AI advantage in the defense and public spaces. Its Q1 report reinforced the optimism, with revenue from the U.S. government surging 45% year-over-year to $373 million.

Now, looking out to its next report on Aug. 4, the Street is looking to see if Palantir’s remarkable breakout continues.

About Palantir Stock

Palantir Technologies (PLTR) is a leading developer of data analytics and AI software platforms. Its solutions support the U.S. and allied governments and commercial businesses in the defense, healthcare, energy, and financial services industries. The Denver, Colorado-headquartered company was founded in 2003 by Peter Thiel and Alex Karp.

Over the past 52 weeks, shares of PLTR have risen from the lowest point of $21.23 to the all-time high of $160.89, set on July 31, an almost 500% surge in 12 months. The stock has doubled over the year to date.

That outperformance comes at a cost. Palantir has a forward price-earnings ratio of 426.89x and trailing P/E of 1,302x. Its price-sales ratio is a mind-boggling 128.67x, and its price-book ratio is 66.8x. Those figures are far higher than industry multiples. Bull argue that the premium is justified given its dominance in the world of AI, but bears note the valuation presumes years of flawless execution ahead.

Palantir Wins on Earnings as Government Revenue Grows

Palantir’s latest quarterly report shattered estimates. The firm’s Q1 revenue reached $884 million and rose 39% year over year while net income reached $214 million. Revenue from the U.S. alone jumped 45%, and once again confirmed the ascendancy of Palantir in the field of national security and defense deployments.

Entering Q2, Street revenue and EPS estimates stand at $939.3 million and $0.14, implying 38% and 54% year-over-year growth, respectively. These figures, should they come to pass, would further solidify Palantir’s position as among the fastest-growing vendors in the market for AI infrastructure.

Palantir will report its Q2 results on Aug. 4. Investors should watch for further updates on its commercial business growth, international expansion, new customer additions, and renewed, multi-year government contracts.

What Do Analysts Expect for Palantir Stock?

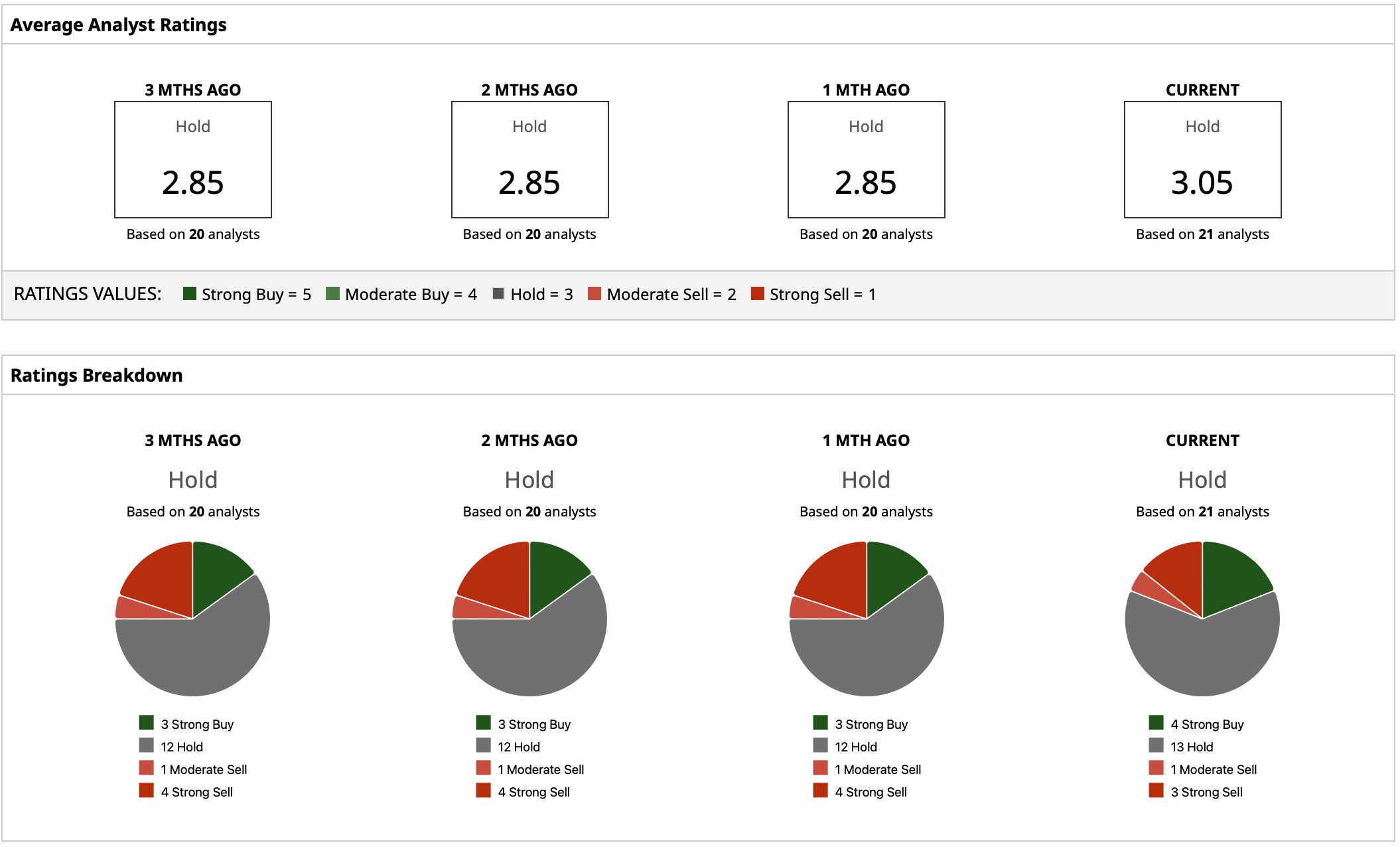

The consensus rating of Palantir stands at “Hold,” with 21 analysts covering the stock. Its consensus price target is $110.72, which suggests the possibility of a decline of approximately 30% from the current levels of about $158. Although the top estimate remains at $170, the lowest target reduces to only $40, highlighting the valuation debate present over Palantir.

Palantir’s long-term success is dependent on sustained hypergrowth while defending its moat in the commercial and governmental sectors. A successful Q2 report would require analysts to revise their targets higher, but any missteps could trigger a selloff in PLTR.