Credo Technology (CRDO) has been one of the hottest stocks of 2025. Its shares have more than doubled year-to-date and surged by over 421% in the past year. Behind this stellar rally is the strong demand for Credo’s products, driven by the artificial intelligence (AI) infrastructure boom.

Credo’s products support high-speed connectivity needed for AI, cloud computing, and hyperscale networks. It specializes in solutions like Active Electrical Cables (AECs), integrated circuits, and Serializer/Deserializer (SerDes) IP, all designed to deliver faster and more reliable connections while minimizing power consumption. As demand for AI computing accelerates, so does the need for Credo’s power-efficient technologies, positioning the company as a critical enabler of the ongoing AI buildout.

Credo’s Record-Breaking Start to Fiscal 2026

The company’s latest results show the robust demand for its products. In the first quarter of fiscal 2026, Credo reported $223.1 million in revenue, representing a 31% jump from the prior quarter and a 274% increase year-over-year. Its product business, which makes up the vast majority of sales, grew even faster, climbing 279% year-over-year. Much of this momentum stems from AECs, which are becoming increasingly essential in data center buildouts due to their efficiency and cost advantages.

Credo’s 3 Growth Catalysts

A key driver of Credo’s growth has been deepening partnerships with hyperscalers. In the latest quarter, three customers each represented more than 10% of revenue. While such concentration might raise concerns, management has signaled that this base is expected to broaden as additional hyperscalers begin ramping up purchases later this year, reducing reliance on just a handful of clients. While customer mix can fluctuate quarter to quarter, the bigger story is that data center operators across the board are scaling deployments, which will drive demand for Credo’s products.

Looking ahead, AECs will continue to drive Credo’s financials as the demand remains high, owing to the energy efficiency and cost advantages associated with it that are essential for building AI clusters. With shipments to hyperscalers already underway and a fourth customer beginning to contribute revenue, Credo’s grip on the AEC market looks increasingly solid.

Credo is also likely to benefit from the strength in the optical market, where it provides digital signal processor (DSP) solutions. The company is on track to double optical revenue in fiscal 2026, driven by strong adoption from module makers and hyperscalers.

Its retimer business is another catalyst for growth. These products enable greater reach and lower latency for switching and AI appliance applications. Early traction with its PCIe retimers is promising, with design wins anticipated in 2025 and production revenue expected to commence in 2026.

All told, fiscal 2026 is off to a record-breaking start. Credo reported its highest-ever quarterly revenue and demonstrated improved profitability, a sign that its rapid scaling is being managed efficiently. More importantly, the growth pipeline doesn’t appear to be slowing. Management sees strong growth ahead, as AI training and inference architectures evolve and as data centers demand faster and more efficient connectivity solutions.

Management sees strong growth ahead, expecting each of its top three customers from the first quarter to deliver strong year-over-year growth in fiscal 2026. On top of that, revenue is set to become more balanced, with a fourth customer projected to cross the 10% revenue mark for the year.

The Bottom Line: Is Credo Technology Stock a Buy?

Credo Technology’s remarkable surge reflects its key role in powering the AI and data center revolution. With solid revenue growth, deepening hyperscaler partnerships, and significant demand for its products, including AECs and retimers, the company is well-positioned for continued momentum.

While valuation risks and customer concentration remain valid concerns, Credo’s ability to deliver energy-efficient, high-performance connectivity solutions makes it a key company in the AI infrastructure buildout. As hyperscalers ramp investments and adoption broadens, demand should remain robust.

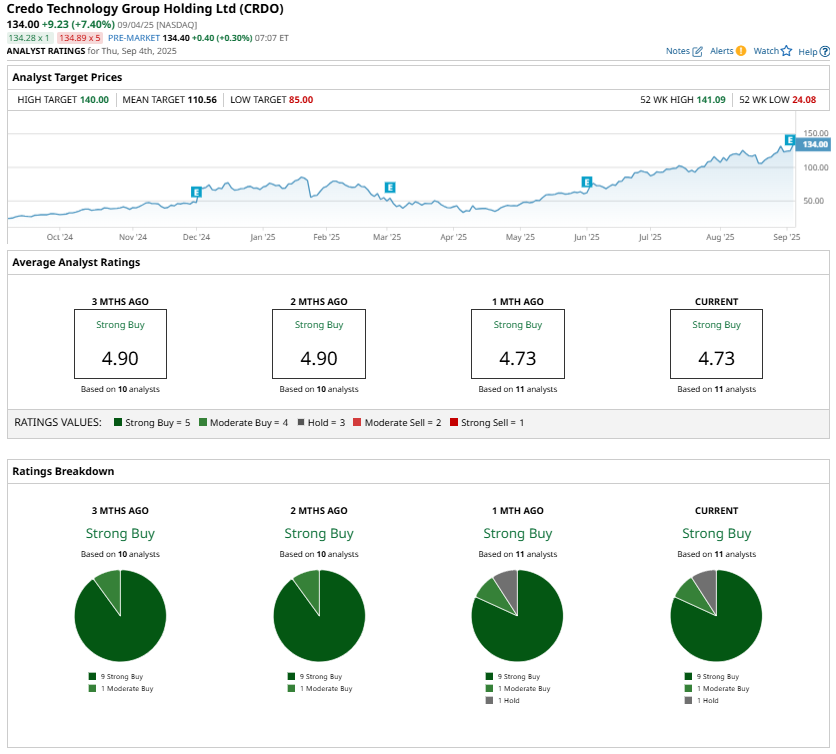

While Credo offers compelling upside in the long run, its steep run-up suggests that a pullback could be a solid buying opportunity. Wall Street analysts remain upbeat, with a consensus rating of “Strong Buy.”