/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

Health insurance provider UnitedHealth (UNH) is experiencing a volatile time on Wall Street. Reasons for the volatility include the sudden announcement of its CEO’s departure. Before that, the company came under national attention when its previous CEO was murdered last year. UnitedHealth has also come under investigation by the DOJ.

Amid all this, Warren Buffett decided to trust in the company’s longstanding prowess, as Berkshire Hathaway (BRK.A) (BRK.B) revealed a $1.57 billion stake in the company, sending this stock sharply higher. Over the past month, its shares gained close to 40%.

With signs of stabilization in UNH stock, should you consider investing in it now?

About UnitedHealth Group Stock

Based in Minnetonka, Minnesota, UnitedHealth stands as a significant force in the American healthcare and insurance landscape. It operates primarily through two core divisions: UnitedHealthcare, which offers a range of insurance plans, and Optum, which specializes in health services, technology, and pharmacy care. Serving millions of people, the company combines data-driven solutions with extensive care networks to enhance health outcomes and manage costs effectively.

UnitedHealth plays a significant role in both private and public healthcare sectors, including Medicare and Medicaid. With a market capitalization of $315.10 billion, its vast reach, financial strength, and focus on innovation have secured its position as one of the largest and most influential healthcare organizations in the U.S.

Shifting investor sentiment, driven by rising healthcare costs and regulatory uncertainties, has led to significant fluctuations in UnitedHealth’s stock. Over the past 52 weeks, UNH stock has declined by 42.3%, while it is down 31.6% year-to-date (YTD).

However, it has recently shown some positivity. Over the past month, UNH stock has gained 38.7%, while over the past five days, it has increased by 12.7%. It reached a three-month high of $351.71 on Sept. 9 and is only down 1.7% from this high.

UNH is trading at a reasonable valuation. Its price sits at 15.05 times earnings, which is cheaper compared to the current industry average of 26.55 times.

UnitedHealth Reported Topline Growth for Q2

On July 29, UnitedHealth reported growth in its topline for the second quarter of fiscal 2025. The company’s total revenues increased 12.9% year-over-year (YoY) to $111.62 billion. This was also higher than the $111.50 billion figure that Wall Street analysts were expecting. At the heart of this growth was UnitedHealth’s revenue from premiums, which increased by 14.3% from the prior year’s period to $87.91 billion.

On the other hand, insurers are noting higher medical costs. There have been more emergency room visits. UnitedHealth has also noted that doctors are billing for more tests during those visits.

The company’s Q2 consolidated medical care ratio increased 430 basis points YOY to reach 89.4%. This increase was primarily driven by medical cost trends significantly exceeding pricing trends, including both unit costs and the intensity of services delivered, as well as the ongoing effects of Medicare funding reductions.

UnitedHealth’s profitability declined during the quarter as costs grew. The company’s earnings from operations were $5.15 billion, down 34.6% from the same period last year. Its adjusted EPS declined by 40% annually to $4.08, which was also lower than the $4.48 that Wall Street analysts were expecting.

UnitedHealth’s management, while acknowledging the issues the company faces, is also optimistic about returning to profitability growth. For the full year 2025, the company’s revenues are expected to range from $344 billion to $345.50 billion, representing a growth of more than 15% compared to the previous year. Earnings from operations are expected to be in the range of $9 billion to $9.30 billion.

Wall Street analysts have a mixed outlook about UnitedHealth’s future earnings. For the current fiscal year, EPS is projected to decline 42.2% annually to $16, followed by a 9.4% growth to $17.51 in the next fiscal year.

What Do Analysts Think About UNH Stock?

Wall Street analysts are still hopeful about UNH stock. Analysts at Truist Securities maintained their “Buy” rating on the company’s shares while raising the price target from $310 to $365. The price target upgrade follows the company’s release of information indicating that approximately 78% of its membership will be in 4+ star plans for the 2027 payment year.

Analysts at Bernstein SocGen reiterated their “Outperform” rating and a $379 price target on UnitedHealth’s shares, citing the same reason. Implying robust sentiments, Barclays analyst Andrew Mok also raised the price target on the stock from $337 to $352, while keeping the “Overweight” rating on its shares.

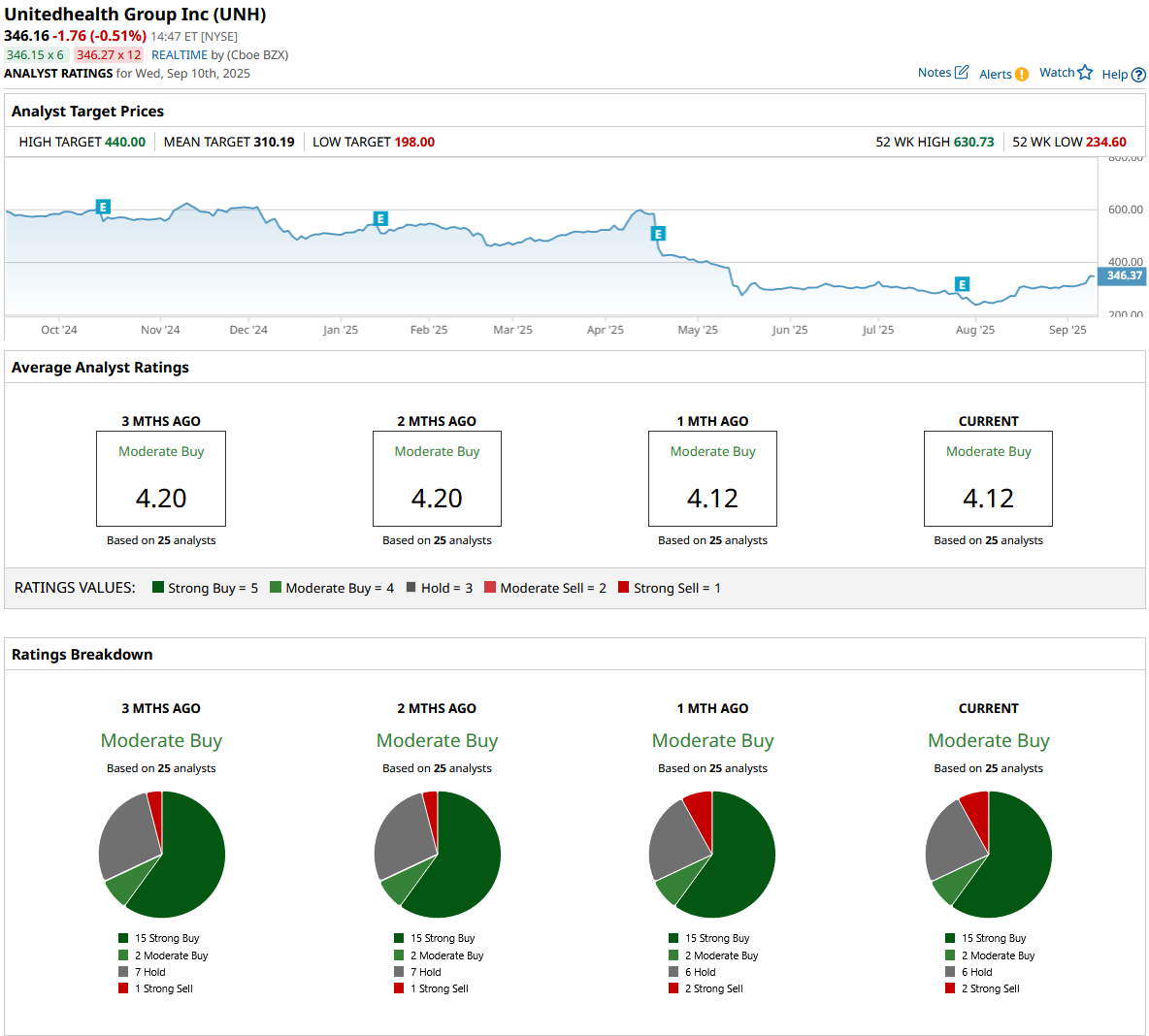

Analysts are soundly bullish on UNH stock, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 25 analysts rating the stock, a majority of 15 analysts have rated it a “Strong Buy,” two analysts suggest a “Moderate Buy,” six analysts are playing it safe with a “Hold” rating, while two analysts gave a “Strong Sell” rating. The consensus price target of $310.19 represents a 10.8% downside from current levels. However, the Street-high price target of $440 indicates a 26.5% upside.

UnitedHealth’s longstanding operational prowess and shareholder returns have kept analysts optimistic about the stock’s prospects. Moreover, its expected higher-grade plans percentage should keep its operations on track. Therefore, the stock may still be a buy at this reasonable valuation.