The defining stock of the meme stock frenzy, GameStop (GME), is again in the limelight after its shares soared by over 15% over the past month. A set of strong numbers for the most recent quarter and a unique dividend announcement have been identified as the primary reasons for the recent rally.

However, from its meme stock heydays of early 2021, when its market cap reached levels of about $34 billion, GameStop's current market cap is almost one-third of those levels. And despite the recent jump, GME stock is down 15% on a year-to-date (YTD) basis. Coincidentally, analyst coverage has also reduced by the same quantum.

So, what to make of GME stock now? Is this rally sustainable, or should investors steer clear of the counter? Let's find out.

Q2 Results Genuinely Good (But Not Enough)

GameStop not only reported a beat on both revenue and earnings, but it also grew by considerable margins from the previous year. Net sales of $972.2 million marked an annual growth of 21.8%, with earnings showing a particularly significant jump to $0.25 per share from just $0.01 per share in the year-ago period. The earnings also surpassed the Street's expectations of an EPS of $0.19 comfortably, marking the fifth consecutive quarter of earnings beat from the company.

Encouragingly, cash flow from operating activities also moved into the black. For the fiscal six months ended Aug. 2, 2025, GameStop had a net cash flow from operating activities of $309.9 million, compared to an outflow of $41.2 million in the same period a year ago. This was mirrored in the case of free cash flow as well, with the figure standing at $113.3 million for the same period, vis-à-vis a negative flow of $49.2 million in the prior year. Overall, GameStop ended the quarter with a cash balance of $8.7 billion, much higher than its short-term debt levels of $101.5 million.

Notably, the company also announced a special warrant dividend wherein each shareholder gets one warrant per 10 shares held. Each warrant gives the right (but not the obligation) to buy one share at roughly $32 anytime until October 2026.

Thus, undeniably, GameStop's Q2 results have been praiseworthy. However, the “game” looks uglier when one zooms out a bit.

Over the past 10 years, GameStop's revenue and earnings have actually declined at CAGRs of 8.54% and 0.98%, respectively. Moreover, the company's growth projections do not inspire confidence either. In fact, analysts are forecasting a forward revenue growth rate of -11.84%, contrasting with the sector median of 3.17%.

Lastly, the recent increase in the stock's price has resulted in it reaching overvalued levels. GME stock is trading at a forward P/E and P/S of 27.05 and 2.88, higher than the sector medians of 17.82 and 0.97, respectively.

Strategic Shift and a Crypto Story

GameStop is undergoing a profound strategic transformation as the management has demonstrated significant urgency in implementing cost-reduction initiatives. This includes the systematic closure of retail locations that have been identified as unprofitable. Notably, this strategic divestment from its legacy business model facilitates a pronounced focus on its higher-margin online commerce platform.

Overall, the inherent brand recognition of GameStop, particularly within the gaming merchandise sector, provides a robust foundation for this pivot. The ongoing strategic rebranding and expansion into the trading card market are central to this strategic shift, a decision anticipated to diversify revenue streams and accelerate the company's growth profile. The efficacy of this strategy is evidenced by the fact that trading cards and collectibles constituted approximately 23.4% (+63.3% YoY) of the company's net sales in the second quarter of fiscal year 2025, underscoring strong market demand and a substantial opportunity for market share capture.

A pivotal element of this growth strategy is the official partnership established in 2024 with Collector's Professional Sports Authenticator (PSA) division. By becoming an authorized dealer, GameStop is now equipped to offer trading card grading and authentication services across the United States. This collaboration with PSA, an entity recognized as the industry's most reputable and widely utilized authentication service, is positioned to become a central pillar of GameStop's future growth strategy. The integration of this service allows customers to submit their trading cards for professional grading and authentication directly through GameStop, thereby enhancing its value proposition.

Concurrently, the company is demonstrating a progressive and forward-thinking financial posture, as evidenced by its recent adoption of Bitcoin as a treasury reserve asset. The acquisition of 4,700 Bitcoin (BTCUSD) highlights management's willingness to engage in out-of-the-box strategies and secure an early position in the domain of corporate cryptocurrency adoption.

Despite these strategic maneuvers, several pertinent concerns persist. The successful execution of this pivot away from the legacy business and toward a new focus on collectibles requires a flawless implementation framework. The potential for a decline in market demand or the cessation of key partnerships could disrupt the bullish investment thesis and result in a recalibration of growth expectations from the current double-digit projections.

Furthermore, the company's legacy business is experiencing an accelerated decline, a trend that has been exacerbated by the strategic store closures but is fundamentally rooted in waning consumer interest. The successful mitigation of this decline is contingent upon the growth in the collectibles segment being of a sufficient magnitude to offset the reduction in top-line revenue, as a failure to do so could exert considerable downward pressure on the stock valuation.

Analyst Opinion

Thus, considering all this, GameStop can be given another chance by investors, its stable financial position and a strategic pivot being the primary reasons. The management should also be lauded for their efforts in managing the financial situation effectively, even when its core business was dwindling, while also being proactive enough to recognize an opportunity in the collectibles market.

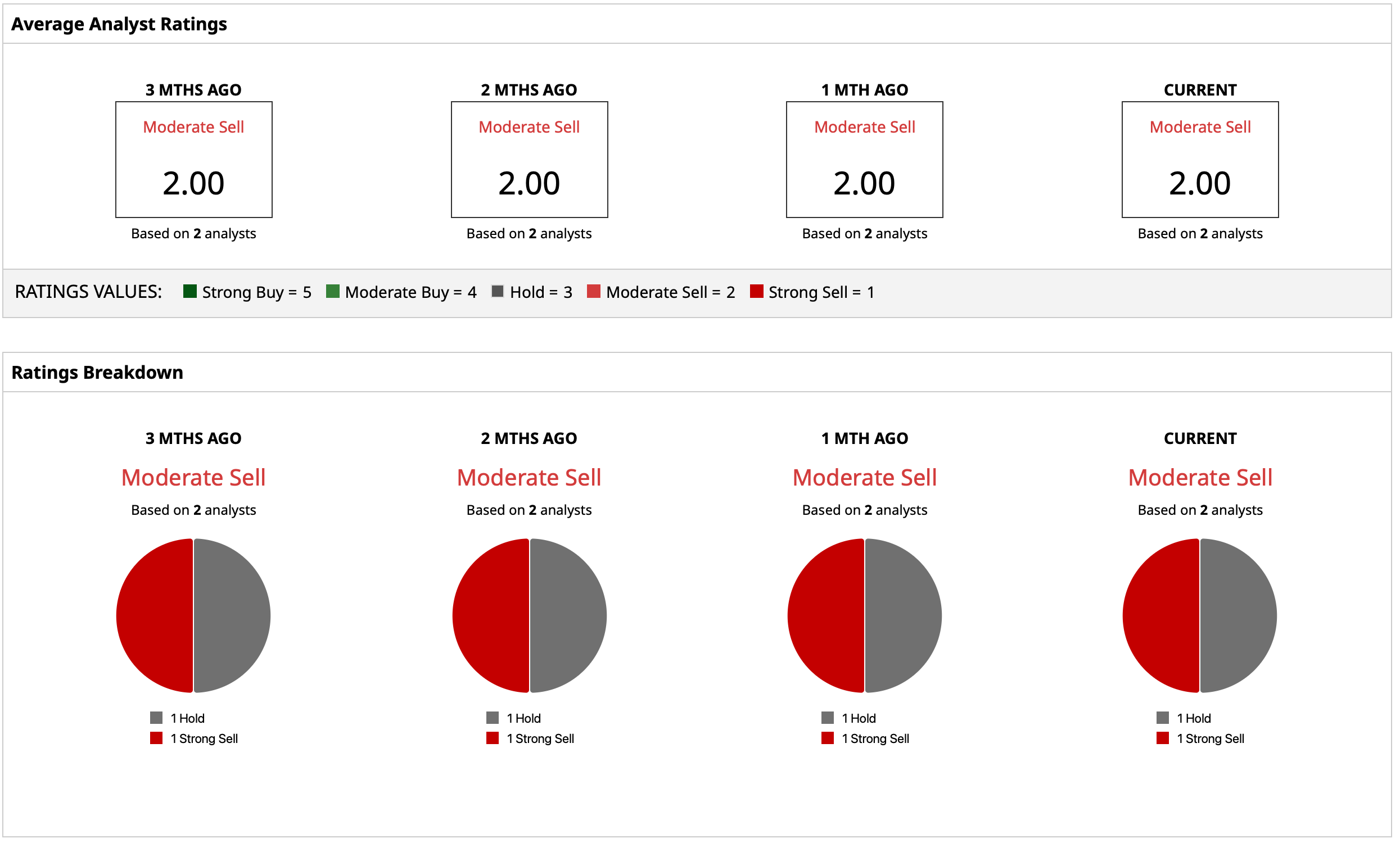

Overall, analysts have attributed a rating of “Moderate Sell” for GME stock, with a mean target price and high target price of $13.50, which has already been surpassed. Out of two analysts covering the stock, one has a “Hold” and one has a “Strong Sell” rating.