/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

Oracle (ORCL) has been on a solid run. Over the past six months, ORCL stock has soared 100%, making it one of the best-performing large-cap technology names. The catalyst behind this rally in Oracle stock is the surge in demand for Oracle Cloud Infrastructure (OCI), driven by artificial intelligence (AI) workloads.

While Oracle is seeing significant AI-driven demand, will the momentum in its business sustain, supporting its share price?

The AI Catalyst Behind Oracle’s Growth

The rapid adoption of AI is redefiningf enterprise IT priorities, and Oracle’s cloud infrastructure has become a key beneficiary. Companies building AI models or deploying AI-driven applications require vast computing resources and specialized infrastructure, and Oracle is aggressively positioning itself to capture this demand.

Its strategy of embedding OCI capabilities directly into other major cloud ecosystems, such as Amazon’s (AMZN) AWS, Google Cloud Platform (GCP), and Microsoft Azure, is paying off handsomely.

The most striking figure was the company’s remaining performance obligations (RPO), a key measure of future revenue, which ballooned to $455 billion. That represents a 359% increase from the prior year, reflecting the depth of Oracle’s cloud backlog. Such RPO growth signals multi-year revenue visibility and provides the confidence to invest aggressively in infrastructure expansion.

Oracle’s Financial Firepower: A Record Quarter

Oracle’s latest quarterly results reflect this extraordinary growth story. In the first quarter of fiscal 2026, the company reported total revenue of $14.9 billion, representing an 11% year-over-year increase that outpaced the 8% growth reported in the same quarter of the prior year.

Total cloud revenue, including both applications and infrastructure, rose 27% to $7.2 billion. Oracle’s cloud infrastructure revenue surged 54% to $3.3 billion, on top of a 46% increase in the same period last year. Consumption revenue, a proxy for usage-based growth, jumped 57%, and Oracle’s cloud database services expanded 32% to reach nearly $2.8 billion in annualized revenue.

The multi-cloud database business was solid, with revenue skyrocketing 1,529% as Oracle embedded its database technology directly into AWS, Azure, and GCP regions. This approach is creating new avenues for growth and helping Oracle win enterprise clients who prefer multi-cloud strategies. With 34 multi-cloud data centers already operational across Azure, GCP, and AWS, and 37 more planned, Oracle is strengthening its competitive positioning in the AI infrastructure space.

On the applications side, cloud revenue rose 10% to $3.8 billion, while back-office applications grew 16% to $2.4 billion.

Oracle Is Scaling for the AI Era

Oracle is ramping up capital expenditures to capitalize on the growing demand for AI. The company expects capital expenditures for fiscal 2026 to reach around $35 billion, primarily directed toward revenue-generating equipment in new data centers. While this spending spree may impact near-term margins and cash flows, it is aimed at converting the massive RPO backlog into revenue and profit.

Oracle forecasts cloud infrastructure revenue to surge 77% to $18 billion this fiscal year and then expand to $144 billion through fiscal 2030. Notably, much of it is already locked into long-term contracts.

Valuation: The Key Question

The sharp rally in ORCL stock has elevated its valuation. Oracle shares now trade at a forward price-earnings multiple of 54.16x, which appears high considering analysts’ earnings growth projection of 22.3% for fiscal 2026 and 23.1% for fiscal 2027.

While Oracle’s valuation may appear stretched, AI adoption has placed unprecedented demands on computing power, data storage, and networking capacity, positioning the company to deliver significant growth in the years to come. Furthermore, Oracle’s long-term growth trajectory justifies the premium, highlighting its massive RPO, its role as a leading AI infrastructure provider, and its increasingly diversified multi-cloud partnerships.

Final Thoughts: Can the Momentum Last in ORCL Stock?

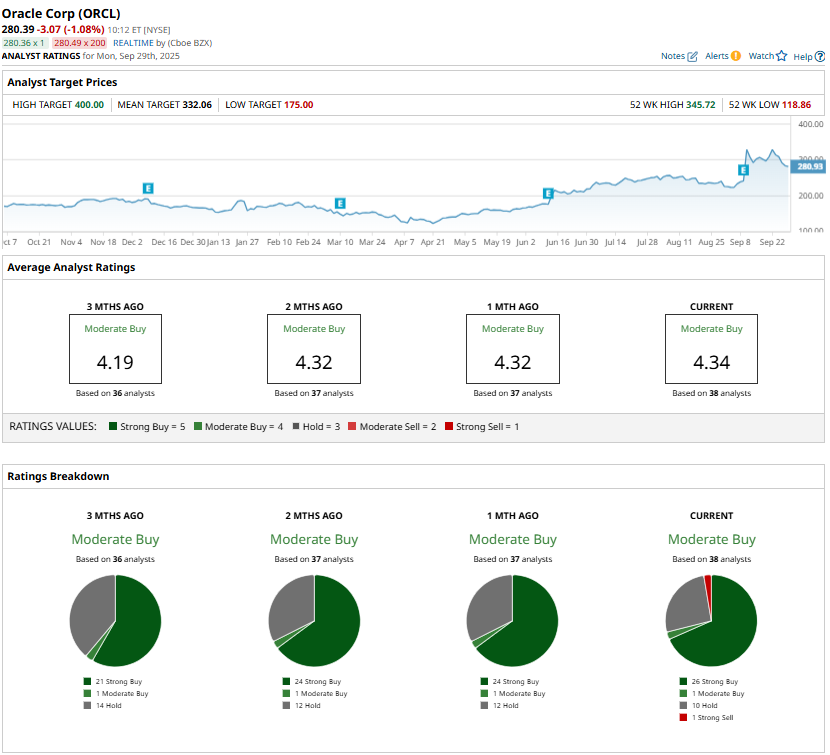

With record RPO growth, accelerating multi-cloud adoption, and aggressive infrastructure expansion, Oracle is laying the groundwork for sustained revenue and earnings growth. While its valuation looks elevated, the company’s solid positioning in the AI infrastructure market and visibility over future growth suggest that Oracle’s momentum is far from over, making it an attractive long-term investment. Analysts’ highest price target of $400 reflects significant upside potential for ORCL stock from current levels.