Thursday wasn’t a good day for regional banks Zions Bancorp (ZION) and Western Alliance Bancorp (WAL), as both admitted to being victims of suspected fraud related to loans to troubled property funds. Their stocks dropped 13% and 10% respectively, on the news.

With numerous other investor concerns, including the ongoing federal government shutdown, the major indexes all declined yesterday. Early Friday morning, long before the markets opened for trading, the S&P 500 futures were down 1.2%. As I write this, about an hour from the opening, they’ve recovered about half those losses.

It could be a bumpy Friday.

In yesterday’s unusual options activity, there were 1,188 call and put options with Vol/OI (volume-to-open-interest) ratios of 1.0 or higher.

To change things up, I altered my screening criteria. In addition to the change in the Vol/OI ratio minimum, I excluded any options with open interests of less than 500 and option volume greater than 250. I maintained the 7-day DTE (days to expiration) minimum.

Breaking it down, calls outpaced puts, 754 to 434, a reasonably bullish indicator. The highest Vol/OI ratio was Teladoc’s (TDOC) Nov. 21 $12 call, with volume of 36,982, 53.06 times the open interest.

Based on yesterday’s, I’ve got three long strangles to watch.

Have an excellent weekend.

Tilray Brands Gets a Hit

By no means is the cannabis and alcoholic beverage producer a sure thing, but yesterday’s Nov. 14 $3 call sets up for potential profits from a long strangle.

The long strangle involves simultaneously buying a long call and long put OTM (out of the money) with the put strike price lower than the call. They expire on the same date.

Although Tilray’s (TLRY) options volume yesterday was reasonable at 148,312, nearly 10% of its open interest, the Nov. 14 $3 call was the only unusually active option on the day. Therefore, I’ll have to find a suitable lower-priced put expiring in the middle of next month.

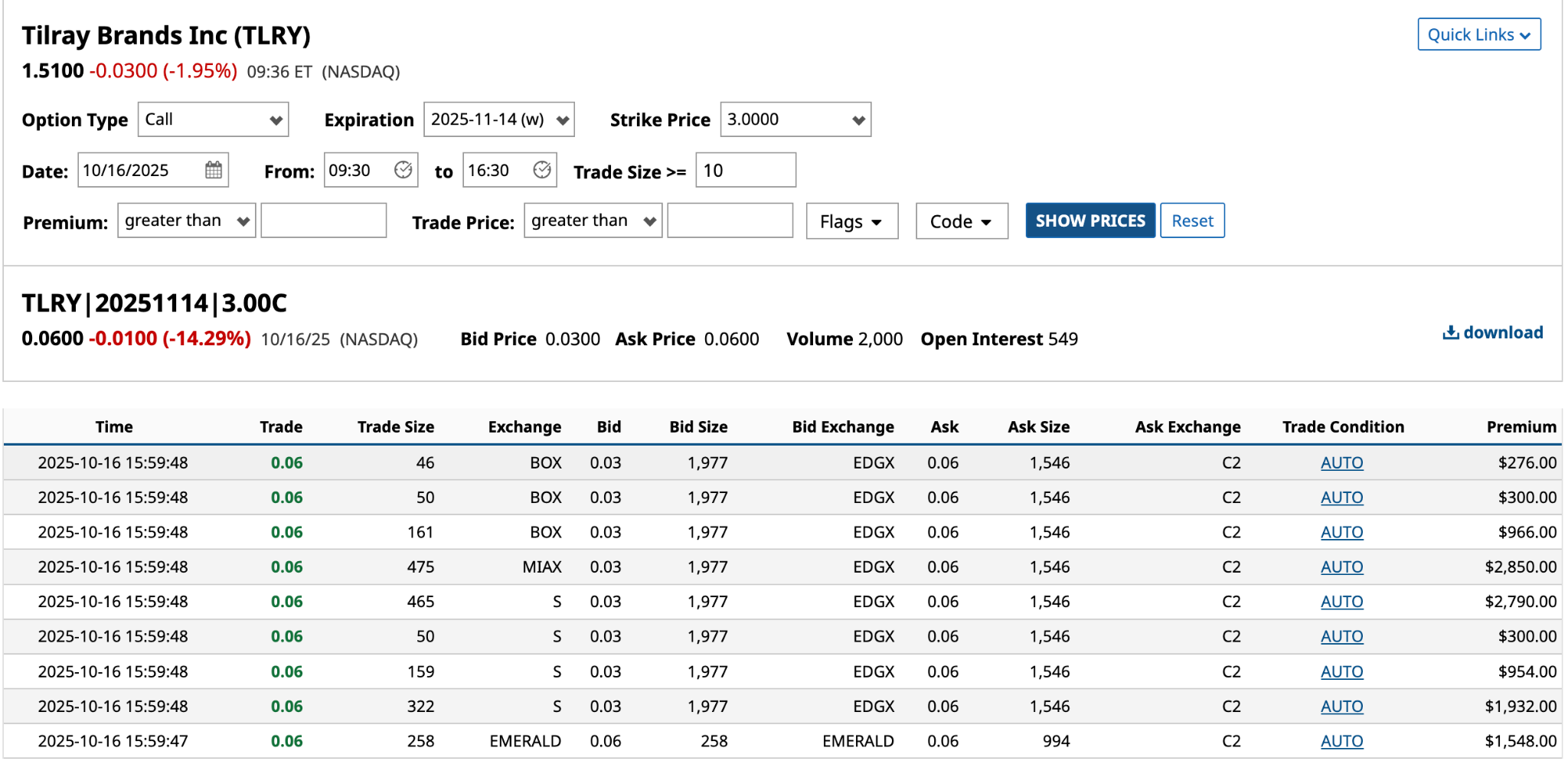

However, before I do that, let’s consider yesterday’s 2,000 call option contracts traded for the $3 call.

The $3 call’s Vol/OI ratio was 3.64. That’s not double-digits, but it’s still considered unusually active. The first thing I notice is that 99% of the trades were for 10 contracts or more, with five accounting for 89% of the trades of 10 contracts or more.

When the premiums are in the millions, you’re looking at bigger fish. Furthermore, the price was right. All of these 10+ trades were for $0.06, just 3.96% of the $1.51 share price.

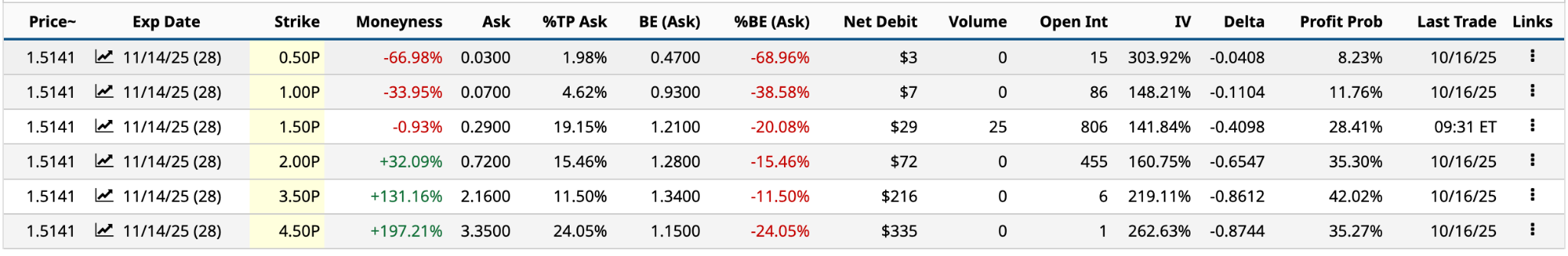

Of the potential puts (less than $3) expiring on Nov. 14, there are four under $3. However, to execute the long strangle, you need some volume, so I’ll go with the $1.50 put and the $0.29 ask price.

Between the $0.06 ask price for the call and $0.29 ask price for the put, the net debit is $0.35 or 23.1% of the $1.5141 share price. On the one hand, that’s a relatively high percentage. On the other hand, it’s only $35 per long strangle.

With the long strangle, you want the share price to move significantly in either direction above the upside breakeven price of $3.35 [$3.00 strike price + $0.35 net debit] or below the downside breakeven price of $1.15 [$1.50 strike price - $0.35 net debit].

You profit if the stock rises by 121.3% [($3.35 upper breakeven - $1.5141 share price) / $1.5141] or more, or falls by 24.04% or more [($1.15 lower breakeven - $1.5141 share price) / $1.5141].

The expected move, up or down, is 27.49%. The downside is where you’ll be more likely to profit. That said, it recently got a significant raise in its target price from Roth Capital Partners to $2, so you never know.

What’s Up With Palantir?

I’ve been very bullish about Palantir (PLTR) for over two years. In May 2023, I discussed three of the AI stock’s best unusually active options.

“I don’t think there’s any question that Palantir is heading in the right direction. However, if Karp [Palantir CEO] is only marginally correct about its AIP opportunities, the profits will come in waves. A profitable Palantir is a scary proposition,” I wrote.

I said then, and I’ll say it now, Palantir is a long-term buy.

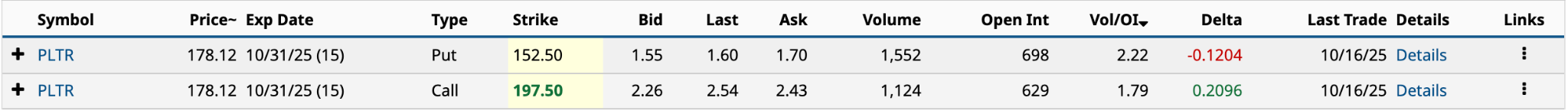

In yesterday’s unusual options activity, it had plenty of calls and puts with Vol/OI ratios over 1.0. Of all of them, a call and put with an Oct. 31 expiry stand out--and they just happen to set up for a long strangle.

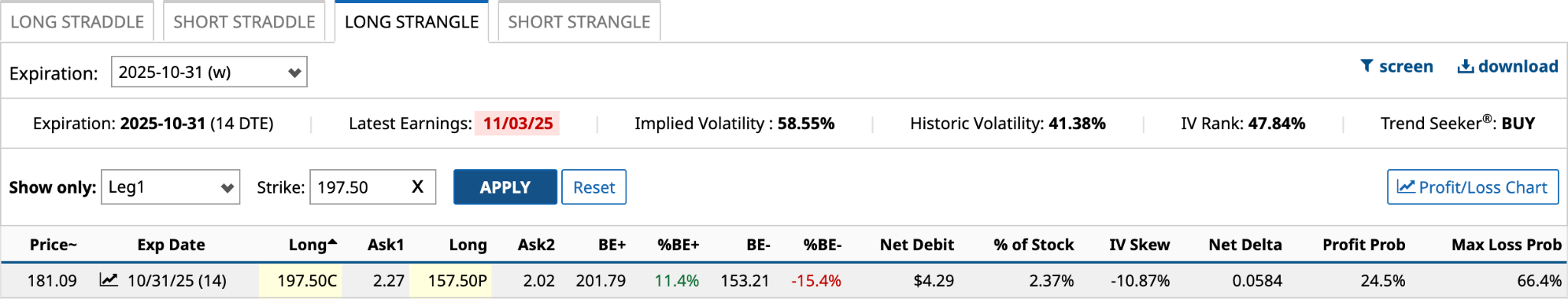

The net debit is $4.13, or a low 2.3% of Palantir’s closing price of $178.12 from Thursday. The upper break-even is $201.63 [$197.50 strike price + $4.13 net debit], while $148.37 [$152.50 strike price - $4.13 net debit] is the lower break-even.

The net debit is $4.13, or a low 2.3% of Palantir’s closing price of $178.12 from Thursday. The upper break-even is $201.63 [$197.50 strike price + $4.13 net debit], while $148.37 [$152.50 strike price - $4.13 net debit] is the lower break-even.

To make money on this bet, you’ll need the share price to move 13.2% on the upside and 16.7% on the downside. The expected move is 7.82%, so you’ll have your work cut out for you.

Based on today’s trading for the $157.50 put (2 strike intervals higher), your profit probability is likely around 20%, perhaps lower than that.

That said, the Barchart Technical Opinion for Palantir is a Strong Buy in the near term. It reports its quarterly results on November 3 after the market closes and after the options expire.

That said, the Barchart Technical Opinion for Palantir is a Strong Buy in the near term. It reports its quarterly results on November 3 after the market closes and after the options expire.

Is Amer Sports a $20 or $40 Stock?

My most recent commentary about Amer Sports was on Sept. 25. I discussed the sporting goods company’s unusually active Oct. 17 $35 call option.

“Interestingly, while AS stock is up 163% from its January 2024 IPO price of $13, it has declined 16% in the past month, suggesting that investors believe its August 25 all-time high of $42.36 marked a market top,” I wrote.

Amer’s stock has lost another 11% in the three weeks since. Halfway between $20 and $40, investors are wondering if the gains from the January 2024 IPO are overdone.

In my article, I admitted that I was mildly bearish, taking a shine to the bear call spread with a short $30 call and long $35 call. It expires today. You would have made a maximum profit of $300 if AS stock were below $30. As I write this, its share price is $30.55, so you would have made a profit, just not the maximum, but close.

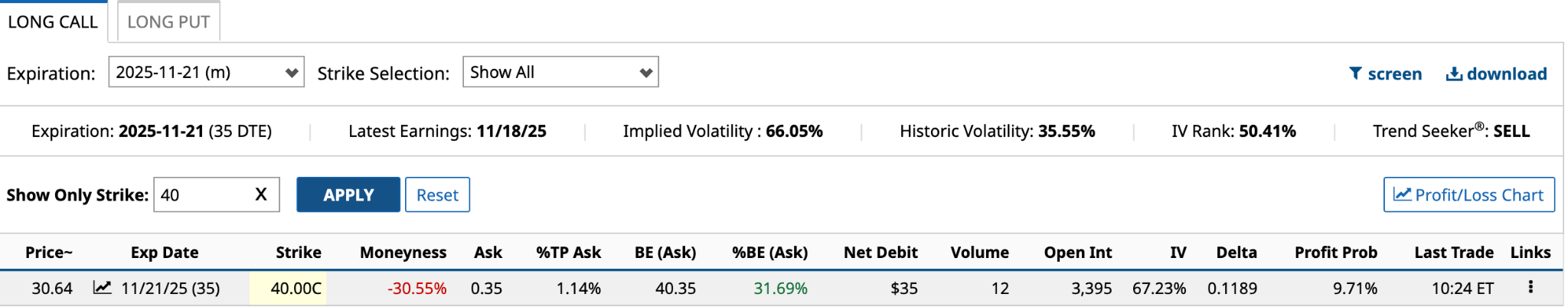

In yesterday’s trading, Amer had one unusually active option, the Nov. 21 $40 call, with a Vol/OI ratio of 8.74. Here’s how it looks today.

I’m looking for a put expiring on Nov. 21, with a strike price lower than $40.

I’m looking for a put expiring on Nov. 21, with a strike price lower than $40.

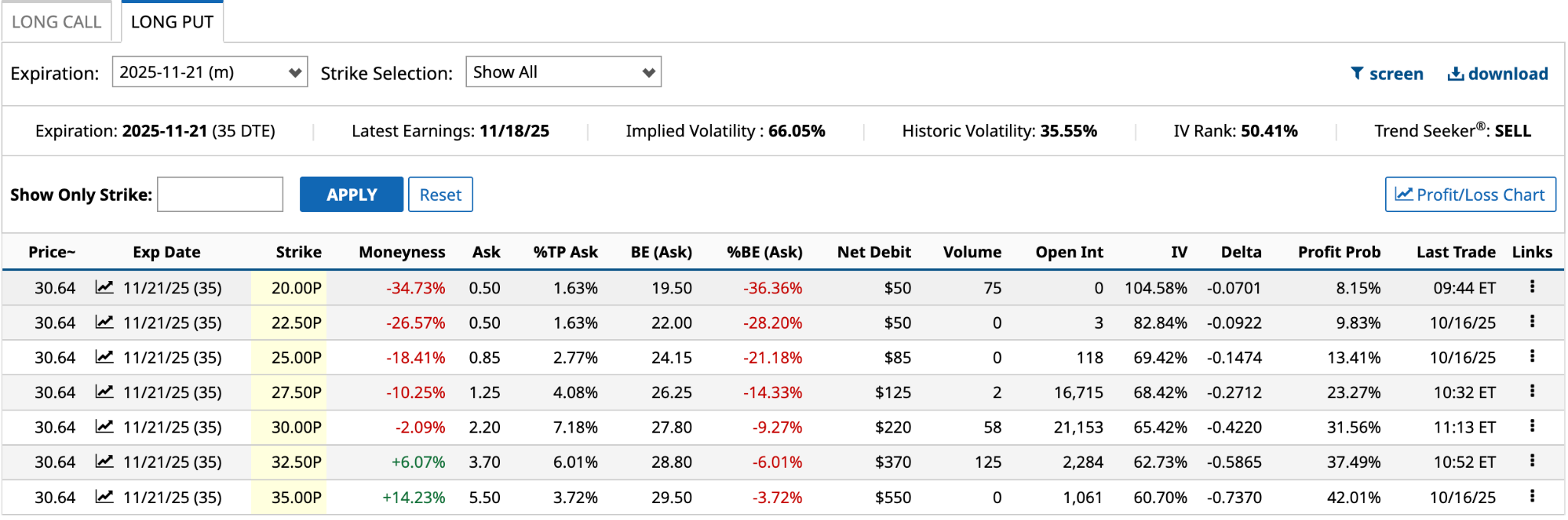

Amer’s expected move is 14.05%, which means it’s unlikely to break through the upper breakeven price of $40.35. Your best bet for the long puts shown is the $35 strike with a 42.01% profit probability. The share price only needs to fall by 3.72% to break even.

Amer’s expected move is 14.05%, which means it’s unlikely to break through the upper breakeven price of $40.35. Your best bet for the long puts shown is the $35 strike with a 42.01% profit probability. The share price only needs to fall by 3.72% to break even.

I’d go with the long $40 call and long $35.00 put. The net debit is $5.85. The breakeven point on the downside is $29.15, which is 4.9% lower than its current share price. It’s achievable.