/Las%20Vegas%20Sands%20Corp%20sign%20by-%20Andy%20Borysowski%20via%20Shutterstock.jpg)

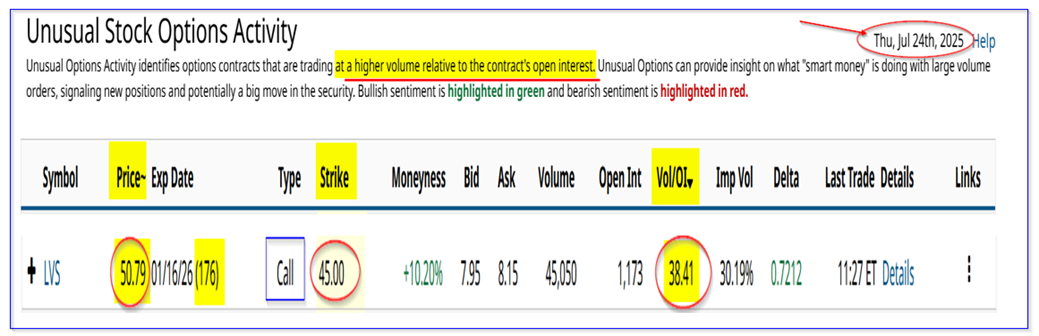

There has been a huge, unusual volume in long-dated call options for Las Vegas Sands Corp. (LVS) today after its Q2 results release yesterday. It showed investors are bullish on the Macao gambling scene.

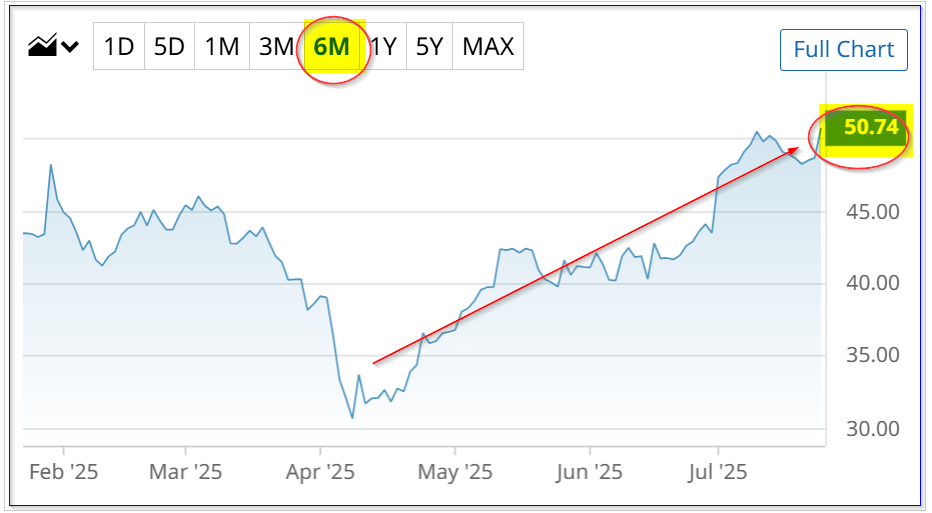

LVS stock is up over +4.0% today at $50.67 per share after the earnings release. A huge volume of in-the-money (ITM) LVS call options for expiration on Jan. 16, 2026.

That is a very strong signal that the investors who bought these calls expiring in 176 days (almost 6 months from now), expect to see LVS stock much higher. In effect, it works out to a cheaper way to buy into the stock.

This can be seen in today's Barchart Unusual Stock Options Activity Report. It shows that over 45,000 call option contracts have traded at the $45.00 call option exercise price, even though the stock price is over $50.00. That means the trades were bought “in-the-money” by the call option buyers.

The midpoint price for these calls is just over $8.00 (i.e., $7.95 bid, $8.15 ask, or $8.05 midpoint). So, instead of paying $50.67 per 100 shares, an investor buying these calls only has to shell out $8.05.

But the breakeven price, after paying the exercise price (on or before Jan. 16, 2026), is less than 5% over today's price:

$45.00 +8.05 = $53.05

$53.05 / $50.67 = 1.047 -1 = +4.69% premium over the trading price

The investor has almost 6 months for LVS to rise over $53.05, the intrinsic value of these long-dated calls. That seems very likely to occur, based on its results today. Let's look at that.

Strong Gambling Activity Results in China

Despite the company's name, Las Vegas Sands makes all of its money in Macao, China, gambling and resorts (as well as one in Singapore). So, this stock is a play on the Chinese gambling scene.

The Chinese are gambling a lot, and Las Vegas Sands is making good money, based on its Q2 results.

For example, LVS reported that revenue at $3.175 billion in Q2 rose by over +15.2% from last year's $2.76 billion. Moreover, its operating income skyrocketed +32.5% from $591 million last year to $783 million.

In addition, its “Consolidated adjusted property EBITDA” (i.e., earnings before interest, taxes, depreciation, and amortization) was up +24.3% to $1.33 billion. So far, the company has not released its cash flow statement, so there is no indication yet of its free cash flow.

Nevertheless, its operating income margin was 24.66% compared to 21.4% last year in Q2. Given that its capex was $286 million, we can estimate that its free cash flow was about $500 million (i.e., $781m-$286m) before any net working capital flows. That works out to a FCF margin of 15.74% (i.e., $500m/$3,175m revenue) for the quarter.

This is a strong FCF result, and implies LVS could be worth substantially more.

Price Target for LVS Sands Stock (LVS)

For example, based on analysts' estimates over the next two years, revenue could range between $12.13 billion in 2025 and $12.65 billion next year (i.e., $12.39 billion on average).

So, using a 15% FCF margin (slightly lower than in Q2), we can estimate $1.86 billion in FCF over the next 12 months (NTM):

$12.39b x 0.15 = $1.86 billion FCF

That is significantly higher than my estimate of $1.237 billion FCF it made over the last 12 months (ending Q2).

Moreover, using a 3.6% FCF yield (i.e., the same as multiplying by 27.8x), Las Vegas Sands stock could be worth over $51 billion

$1.86b x 27.8 = $51.7 billion market value

Just to be conservative, let's call it $50 billion. That is still 45.3% over today's market cap of $34.4 billion.

In other words, LVS stock is worth +45% more than its price today of $50.67, or $73.62 per share

Why ITM Call Buying Works Here

So, you can see why an investor in these in-the-money (ITM) call options likes LVS stock. For example, let's say that the stock rises to $73.62. The estimated return (ER) is as follows:

Intrinsic value = $73.62 - $45.00 exercise price = $28.62

ER = $28.62 / $8.05 price paid for ITM calls = 3.57 -1 = +257% Expected Return

And remember that is just for a slightly less than this 6-month period. Moreover, given that all calls have extrinsic value, it's likely that the call options will trade higher than the $28.62 intrinsic value price (at least up until several weeks or days before expiration, assuming it's in-the-money by this amount).

The bottom line is that investors in the calls expect to make a very good expected return. However, keep in mind that buying calls entails a large amount of risk, especially if they are not hedged. You can lose 100% of your investment.

But, at least the calls have good intrinsic value as they are in-the-money. For example, let' say that the stock stays at $50.67 over the next 6 months. The investor would only lose:

$8.05 - ($50.67-$45.00) = $8.05 - $5.67 = -$2.38 potential loss at expiration.

$2.38/$8.05 = -29.6%

Expected Value (EV) Return

So, let's use an advantage player (AP) mentality with this situation. For example, let's assume that there is a 30% probability that the investor can make a 257% return, and a 70% probability that a loss of 29.6% could occur:

0.30 x 2.57 = +77.1% , plus

0.70 x -0.296 = -20.7% =

Expected Value Rtn: +56.4%

In other words, the investor doing this trade has a better than +56% expected value (EV) return. This assumes that there is a 70% likelihood that the in-the-money call option purchase fails. That is a very good expected return.

So, you can see why there is so much volume in today's Las Vegas Sands in-the-money calls expiring on Jan. 16, 2026.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.