Today, 20 minutes after the opening bell, Market Rebellion’s Unusual Options Activity service alerted its subscribers to a king-sized call option trade in (FUBO).

The Trade

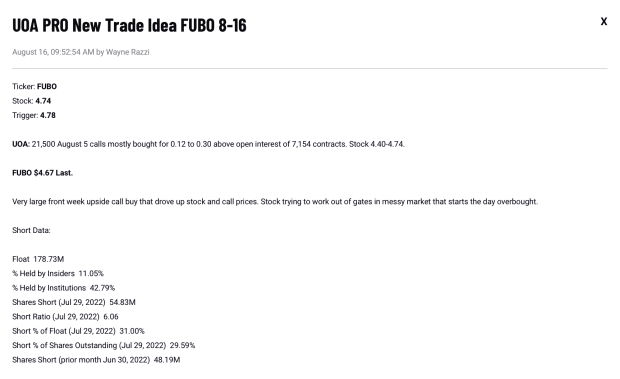

$5-strike call options with four days to expiration, bought out-of-the-money for between $0.12 and $0.30, for a total trade cost of roughly $441K.

Discover how we trade UOA, with Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!

Immediately after the trade, FUBO shares went wild, surging as much as 83% within a matter of hours. As a result, these options which were bought initially for as little as $0.12 ($12) traded as high as $3.15 ($315) — a gain of 2,728% at FUBO’s high of the day.

That means this trader's $441K bet was at one point today worth as much as $6,615,000 — and is currently worth $3,045,000 (if the trader didn’t already sell).

Not bad for a day’s work.

Ready to start trading the technicals? Try Rebel Weekly. Ride the waves of market momentum with two actionable trade ideas designed to capture technical break outs and break downs — delivered to your inbox every week.

The Catalyst

Very little happened today to change the FUBO story — one of a cash-burning small-cap company with no P/E ratio. The company did have its investor day today, however the event didn’t result in any major news being broken about the company.

More likely, FUBO’s run today was the result of a short squeeze. A short squeeze is when a highly-shorted stock rallies, forcing short-sellers of the stock to buy back their short positions at a loss, which in turn can drive up the price (particularly in small-cap, low-float stocks where there are few shares up for grabs) — triggering a powerful cycle in which a stock can gain a large amount of value quickly.

This isn’t the first time that FUBO has been squeezed. The stock is up more than 150% this month. FUBO performed a similar rally back in late 2020 and early 2021 (where the stock ran from $9 to $48 in a short period of time) before falling back down to eEarth.

Unusual Options Activity is on a Roll Lately

Whoever this option buyer was, they picked a great candidate. These options multiplied more (and faster) than the (TWTR) options we identified ahead of Elon Musk’s Twitter Takeover. And trades like these are becoming more and more frequent as the “smart money” begins to hone-in on these likely short squeeze candidates.

Last week, Market Rebellion notified traders of a similar unusual options activity purchase in the highly shorted genomics company Invitae (NVTA). With shares of Invitae trading at just $2.78, a buyer began picking up thousands of the far-out-of-the-money $5 calls, paying as little as $0.05 per contract. Within the same day, similar to FUBO, shares of (NVTA) gained more than 200% following the purchase, turning a bet worth a few thousand dollars into $1.8M.

Trades like these are why we follow the smart money.