Heavy, unusual call options activity in American Airlines (AAL) stock may indicate that investors are turning bullish on AAL stock after its recent Q2 earnings release. The company showed strong free cash flow, implying its value could be higher.

AAL is at $13.05 in midday trading today. This is higher than $11.46 on July 24, when it released earnings. Investors may have turned bullish. This article will look into why that might be.

Heavy Call Option Trading in AAL

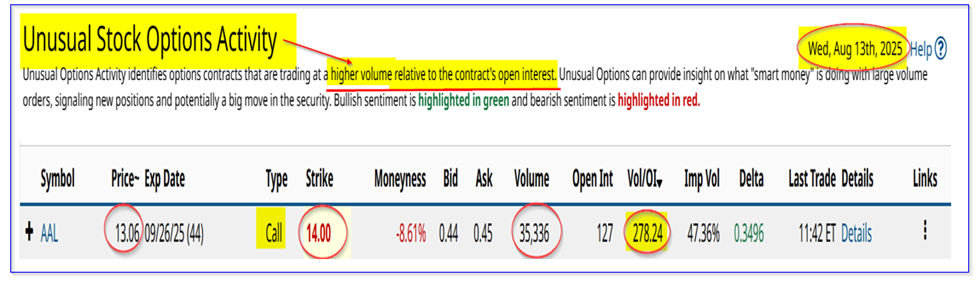

Today's Barchart Unusual Stock Options Activity Report shows that over 35,000 call options contracts at the $14.00 strike price have traded for the expiry period ending Sept. 26. That is 44 days from now, or a month and a half in the future.

This huge number of call option contracts is over 285x more than the prior number of outstanding contracts at the $14.00 exercise price for expiry on Sept. 26. That implies heavy trading by institutional investors initiating contracts on both sides of the trade.

For example, investors who are buying these calls believe that AAL will rise over $14.45, or +10.6% from today over the next month and a half in order for the intrinsic value of the calls to rise over cost:

$14.45 - $14.00 cost = $0.45 (i.e., the ask side today of the call option premium)

However, it's likely that if this occurs in the next two to three weeks, the price of the options will be significantly higher than 45 cents. That way, the investor won't have to wait until expiration to make a profit.

That is due to the extrinsic value that is left in the premium, as there is time left for the stock to rise further.

On the other hand, sellers of these calls believe that they are getting a good deal as well. They may be long AAL stock today or bought shares at today's price. That way, selling covered calls brings them an immediate yield of 3.37%:

$0.44 premium received / $13.06 cost of 100 shares = 0.03369 = 3.369% for just 44 days

That works out to an annualized expected return (ER) of at least 26.95% (i.e., 3.369% x 8x). This, of course, assumes that the same yield could be made by a trader repeating this play 8 times in a year (which may not be the case).

Let's look at why investors may be bullish on AAL stock.

Strong Cash Flow and Forecasts

American Airlines reported $14.392 billion in Q2 revenue, up slightly from last year's $14.332 billion (i.e., +0.4% Y/Y). Its first-half revenue was up slightly (+0.14%) to $26.943 billion.

Moreover, the airline was able to squeeze out more cash flow from this revenue.

For example, its operating cash flow (OCF) was $3.419 billion for the first half, compared to $3.308 billion last year (according to Stock Analysis quarterly cash flow data), a +3.35% growth rate in OCF.

That also means that its operating cash flow margin (i.e., OCF/revenue) rose to 12.7% (i.e. $14.392b/$26.943b) from 12.3% last year ($3.308b/$26.904b).

This increase was also reflected in its free cash flow (after lower capex spending this H1). For example, FCF in H1 was $2.096 billion (according to Stock Analysis) vs. $1.833 billion last year (H1 2024).

That means the airline generated stronger FCF margins (i.e., 7.78% FCF margin in H1 2025 vs. 6.81% last year's H1). (Note the company talks about adj. FCF in its report, but we have not adjusted the FCF figures).

Forecasts. As a result, we can forecast significantly higher FCF going forward.

For example, analysts now project revenue between $54.408 billion in 2025 and $57.8 billion in 2026. So, using the next 12-month (NTM) revenue forecast of $56.1 billion with a 7.7% FCF margin, we can forecast FCF:

$56.1 b revenue NTM x 0.077 = $4.32 billion in FCF

That would be well over the $1.563 billion in FCF American Airlines has generated in the last 12 months, according to Stock Analysis. It could push AAL stock significantly higher over the next 12 months (NTM).

Price Targets for AAL Stock

For example, even though American Airlines does not now pay a dividend, let's assume it eventually paid out less than half (33%) of the $4.3 billion forecast free cash flow. Let's also assume the market gives AAL stock a 10% dividend yield.

Here is how that would value AAL stock:

$4.32 billion x 33% = $1.43 billion dividend payments

$1.43 billion / 0.10 = $14.33 billion market value

That is still +66% higher than AAL stock's current market cap of $8.617 billion, according to Yahoo! Finance. That is, AAL stock is potentially worth +66% more or $21.66 per share.

Just as a double check, let's assume that its H1 FCF of $2.096 billion doubles to $4.192 billion. If it paid out 1/3rd of that amount or $1.4 billion, and the market gave it a 10% yield, the value would be:

$1.4b / 0.1 = $14.0 billion, i.e., +62.5% upside

That could be why analysts now have higher price targets. For example, AnaChart.com says 17 analysts now have an average price target of $16.35 per share.

The bottom line is that AAL stock looks cheap today. That could be why there is so much interest in its call options for expiry on Sept. 26.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.