Unity (U) has been on an impressive run, with its stock surging 97% over the past three months. Much of the momentum comes from growing optimism around Unity’s innovation in advertising technology. The company has introduced a new AI platform designed to enhance ad performance within games and apps, a key revenue stream for Unity.

Adding to the positives is the strength in the broader macroeconomic environment. With the economy remaining relatively resilient, expectations for increased advertising spending are also helping lift the market’s outlook for Unity stock. As more companies boost their ad budgets, Unity stands to benefit through its ad-tech ecosystem.

However, with Unity stock gaining significantly in value and its business still in transition toward a sustainable growth platform, is now the right time to buy, or is it time to cash in?

A New Engine for Ad Revenue: Enter Unity Vector

Notably, Unity has swiftly rolled out its Unity Vector, the company’s new AI-powered ad platform. Vector has already begun to show strong performance gains compared to Unity’s legacy ad products. For a company that derives a large chunk of its revenue from ad-based Grow Solutions, largely structured on revenue or profit-sharing models, these improvements are important. Unity’s advertising clients rely heavily on the company to generate their income, so higher performance means stronger incentives to keep spending on Unity’s platform.

Early results are promising. On Apple’s iOS platform, Unity Vector is driving higher install rates and better in-app purchase values, a win-win for app developers and advertisers alike. Though the Android rollout is still in its early stages, performance indicators are trending in a similar direction. This has already translated to a stronger-than-expected result in Unity’s first-quarter Grow segment revenue, which came in at $285 million, down 4% year-over-year, but still ahead of management’s guidance, thanks to the accelerated Vector rollout.

While the full impact of Vector won’t be fully visible in the company’s financials until future quarters, Unity is already setting expectations. In Q2, it projects the Grow segment’s revenue to hold steady, as gains from Vector are likely to offset declines in older ad products. The bigger bet is that Vector’s AI-driven adaptability will provide Unity’s customers with better return on investment over time, anchoring long-term loyalty and spending.

Strength in Create: A More Diversified Growth Story

Unity’s Create segment, which provides tools for game and interactive content development, has also been gaining traction. Subscription revenue is showing double-digit year-over-year growth, even as the company transitions away from its lower-margin professional services. Create segment's revenue in Q1 was $150 million, down 8% year-over-year. However, the quality of that revenue has improved, with the subscription business now comprising nearly 80% of the total.

A significant part of that success is Unity 6. Since launch, Unity 6 has surpassed 4.4 million downloads, with 43% of active users already upgraded.

What’s especially compelling is Unity’s growth beyond gaming. Its use case in industries such as healthcare, manufacturing, and architecture is now the fastest-growing segment of its subscription business. This diversification is opening new revenue streams and buffering the company against cyclicality in mobile gaming.

Unity Transforming Into a Leaner, More Disciplined Company

Despite some short-term revenue softness resulting from the strategic pivot, Unity’s operational improvements are evident. Its adjusted EBITDA margins grew 200 basis points year-over-year in Q1, reflecting cost discipline. The company also reported adjusted EPS of $0.24 for the quarter, signaling a renewed focus on shareholder returns, including tighter management of stock-based compensation and dilution.

Looking ahead, Unity expects second-quarter revenue to be between $415 million and $425 million, with adjusted EBITDA likely to be in the range of $70 million to $75 million. The company is confident that improved ad performance will help return the Grow segment to revenue growth, while Create continues to benefit from rising subscription momentum.

Analysts Remain Cautious, But Unity’s Long-Term Potential Is Solid

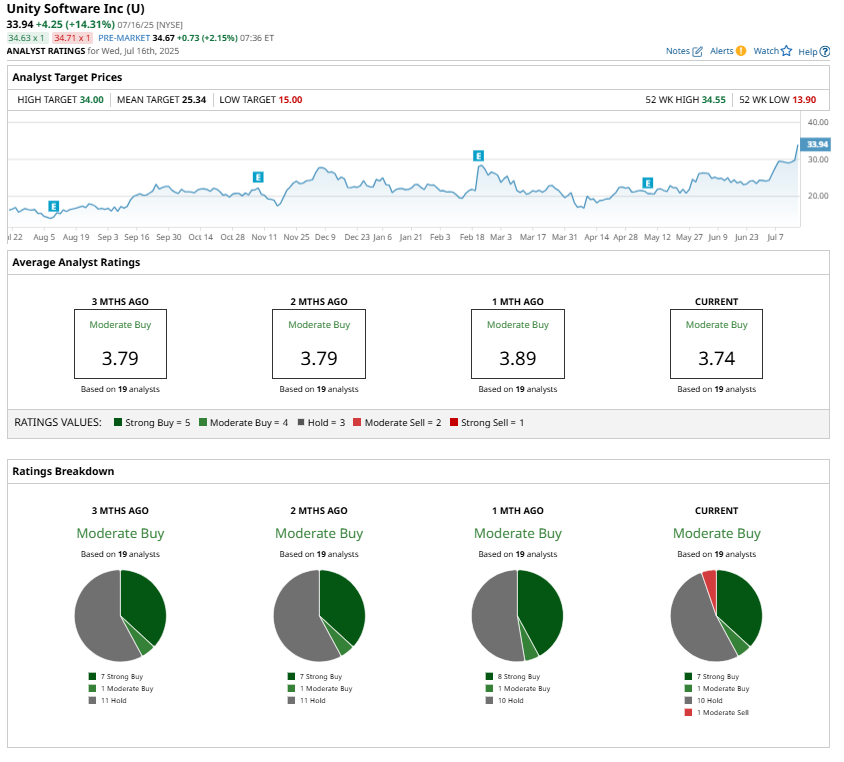

While Unity is poised to deliver strong financial performance driven by Vector and broader platform adoption, not all analysts are endorsing the stock due to the recent run. Unity currently has a “Moderate Buy” consensus rating, reflecting a mix of enthusiasm and caution. Furthermore, the stock is already trading above its Street-high price target, implying that analysts see limited upside.

That said, the long-term story remains compelling. The company is modernizing its core ad business, strengthening relationships with developers, and making real inroads into high-value industries outside of gaming. If Unity can maintain its execution and continue delivering on its AI and platform-driven vision, the company could evolve from a turnaround play into a sustainable growth story.

Final Take: A Stock to Watch, If Not Chase

With strong performance drivers, including Vector, improved financial metrics, and diversified growth avenues, Unity appears well-positioned for the future. While some caution is warranted after the recent price surge, investors may want to keep Unity on their radar, especially as a pullback offers a more attractive entry point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.