UnitedHealth Group Inc. (NYSE:UNH) is trending after the stock surged 10.69% in after-hours trading on Thursday following disclosure that legendary investors Michael Burry and Warren Buffett have taken significant positions in the healthcare giant.

Check out the current price of UNH stock here.

Burry’s Bold Contrarian Play

“Big Short” investor Burry disclosed call contracts against 350,000 shares of UnitedHealth through his hedge fund Scion Asset Management, according to Securities and Exchange Commission 13F filings released on Thursday. Burry’s firm also holds approximately 20,000 shares worth $6 million in common stock.

The move represents a notable shift for Burry, who typically maintains bearish positions. His high-leverage options strategy suggests confidence in UnitedHealth’s recovery potential despite the stock trading near five-year lows.

Buffett’s Berkshire Adds Healthcare Exposure

Buffett’s Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK) revealed a new 5,039,564-share position in UnitedHealth during the second quarter, marking the conglomerate’s latest healthcare investment.

The stake contributes to Berkshire’s diversification strategy, as Buffett reduced Apple Inc.‘s (NASDAQ:AAPL) holdings by 7% and completely exited T-Mobile US Inc.‘s (NASDAQ:TMUS) holdings during the quarter.

Regulatory Headwinds Create Value Opportunity

UnitedHealth faces ongoing antitrust scrutiny after the Department of Justice reopened investigations into the company’s 2022 acquisition of Change Healthcare. The probe examines data-sharing practices between UnitedHealth’s insurance and Optum services divisions.

Price Action And Market Position

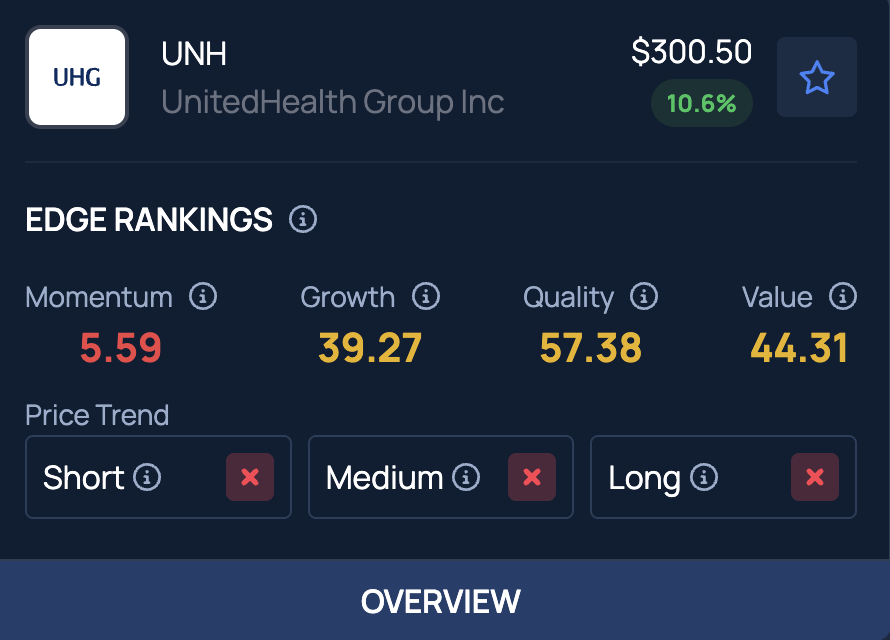

UnitedHealth closed regular trading Thursday at $271.49, down $0.21. After-hours trading saw the stock jump to $300.50, adding $29.01 per share, according to data from Benzinga Pro.

The stock remains down 46.19% year-to-date with a 52-week range of $234.60-$630.73. Trading metrics show a price to earnings ratio of 11.76 and a dividend yield of 3.26%, with market capitalization at $245.88 billion and average volume of 16.30 million shares.

UNH shows negative price trends across the short, medium, and long term, while its growth and value metrics reflect only modest performance, according to Benzinga Edge Stock Rankings — see how it stacks up against competitors.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: mark reinstein / Shutterstock.com