/United%20Parcel%20Service%2C%20Inc_%20plane-by%20Carlos%20Yudica%20via%20Shutterstock.jpg)

With a market cap of $74 billion, United Parcel Service, Inc. (UPS) is a global logistics powerhouse based in Atlanta. Operating through its U.S. Domestic, International, and Supply Chain & Freight segments, and backed by the extensive UPS Airlines network, it delivers over 22 million packages each day to more than 200 countries worldwide.

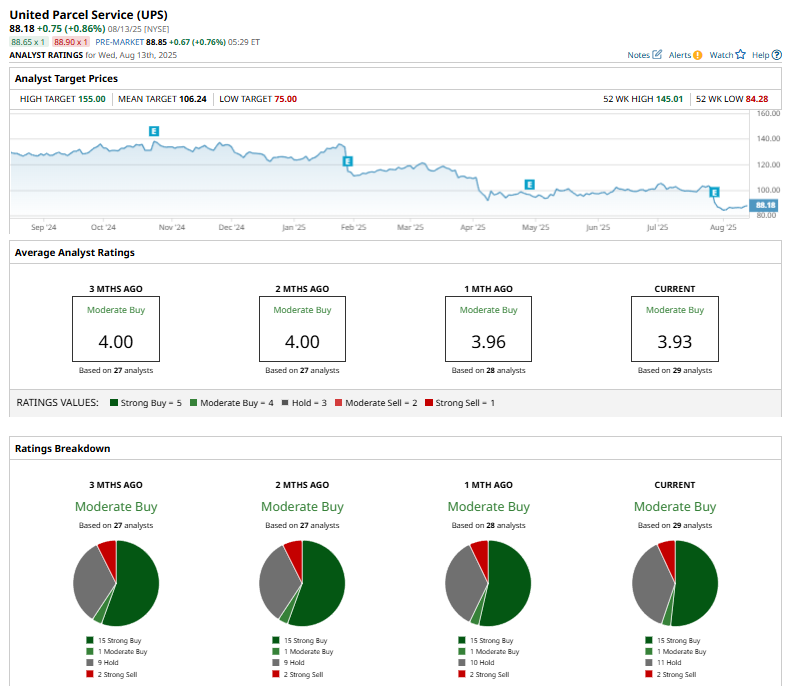

Shares of the delivery company have underperformed the broader market over the past year and in 2025. UPS stock has plunged 30.1% over the past 52 weeks and 23.8% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 19% over the past year and 10% in 2025.

Narrowing the focus, UPS has also lagged behind the iShares Transportation Average ETF’s (IYT) 10.2% surge over the past 52 weeks and its 4.5% rise this year.

On Jul. 29, UPS announced its fiscal second-quarter earnings. The company generated $21.2 billion in revenue, down 2.8% year-over-year, but slightly above estimates. Meanwhile, adjusted EPS of $1.55 missed forecasts. U.S. Domestic revenue dipped 0.8% on lower volumes and margin pressure. International revenue rose 2.6% but was hurt by a steep drop in China–U.S. shipments, and Supply Chain Solutions revenue plunged 18.3% after divesting Coyote Logistics.

Citing weak consumer sentiment, tariff impacts, and soft demand, UPS withheld full-year guidance and announced $3.5 billion in 2025 cost cuts, including 20,000 layoffs, moves that, along with the earnings miss, triggered a 10.6% drop in its stock.

For the current year ending in December, analysts expect UPS’ EPS to decline 15.4% year over year to $6.53. Moreover, the company has surpassed analysts’ consensus estimates in three of the past four quarters, while only missing on one occasion.

Among the 29 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and two “Strong Sells.”

On July 31, Citigroup Inc. (C) analyst Ariel Rosa maintained a “Buy” rating on UPS but cut the price target by 10.24%, from $127 to $114.

UPS’ mean price target of $106.24 indicates a premium of 20.5% from the current market prices. Its Street-high target of $155 suggests a robust 75.8% upside potential from current price levels.