/United%20Parcel%20Service%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $72.1 billion, United Parcel Service, Inc. (UPS) is a global leader in logistics and package delivery services, headquartered in Atlanta, Georgia. Founded in 1907, the company operates one of the world’s largest delivery networks, serving more than 200 countries and territories. UPS provides a wide range of services, including small package delivery, freight transportation, supply chain management, and logistics solutions.

Companies worth $10 billion or more are generally described as "large-cap stocks." UPS fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the freight and logistics industry. The company is best known for its signature brown delivery trucks and its reliable global air and ground networks. UPS caters to businesses of all sizes as well as individual consumers, with key segments including U.S. Domestic Package, International Package, and Supply Chain Solutions. In recent years, UPS has invested heavily in digital transformation, automation, and sustainability initiatives, including expanding its electric vehicle fleet and targeting carbon neutrality by 2050.

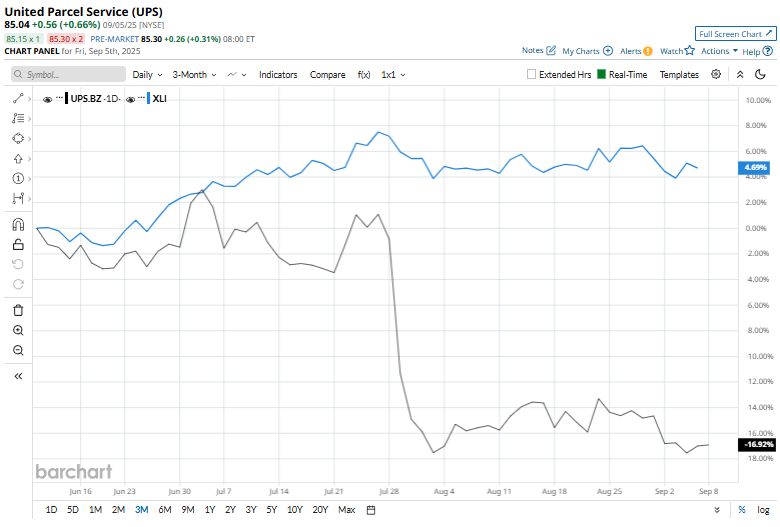

Despite its notable strength, UPS has retreated 41.4% from its 52-week high of $145.01, achieved on Oct. 24. Over the past three months, UPS stock fell 12.2%, trailing the Industrial Select Sector SPDR Fund (XLI), which has gained 4.1% over the same time frame.

Moreover, shares of UPS dipped 32.6% on a YTD basis and 33.3% over the past 52 weeks, significantly underperforming XLI’s YTD gain of 14.6% and 18.7% returns over the last year.

To confirm its recent downturn, UPS has been trading mostly below its 200-day moving average since last year and under its 50-day moving average since the end of July.

On Jul. 29, UPS announced its fiscal second-quarter earnings. The company generated $21.2 billion in revenue, down 2.8% year-over-year, but slightly above estimates. Meanwhile, adjusted EPS of $1.55 missed forecasts. U.S. Domestic revenue dipped 0.8% on lower volumes and margin pressure. International revenue rose 2.6% but was hurt by a steep drop in China–U.S. shipments, and Supply Chain Solutions revenue plunged 18.3% after divesting Coyote Logistics.

Citing weak consumer sentiment, tariff impacts, and soft demand, UPS withheld full-year guidance and announced $3.5 billion in 2025 cost cuts, including 20,000 layoffs, moves that, along with the earnings miss, triggered a 10.6% drop in its stock.

In the freight and logistics space, its rival, FedEx Corporation (FDX), has slightly outperformed in the long term, with its shares declining 19.1% on a YTD basis and 20.2% over the past year.

The stock has a consensus “Moderate Buy” rating from the 30 analysts covering it, and the mean price target of $104.45 suggests an ambitious potential upside of 22.8% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.