/Southwest%20Airlines%20Co%20plane-by%20Eliyahu%20Parypa%20via%20iStock.jpg)

Chicago, Illinois-based United Airlines Holdings, Inc. (UAL) operates a global airline network that transports passengers and cargo worldwide. With a market cap of $29.2 billion, the company also provides a range of ancillary services, including catering, ground handling, aircraft maintenance, and pilot training for third parties.

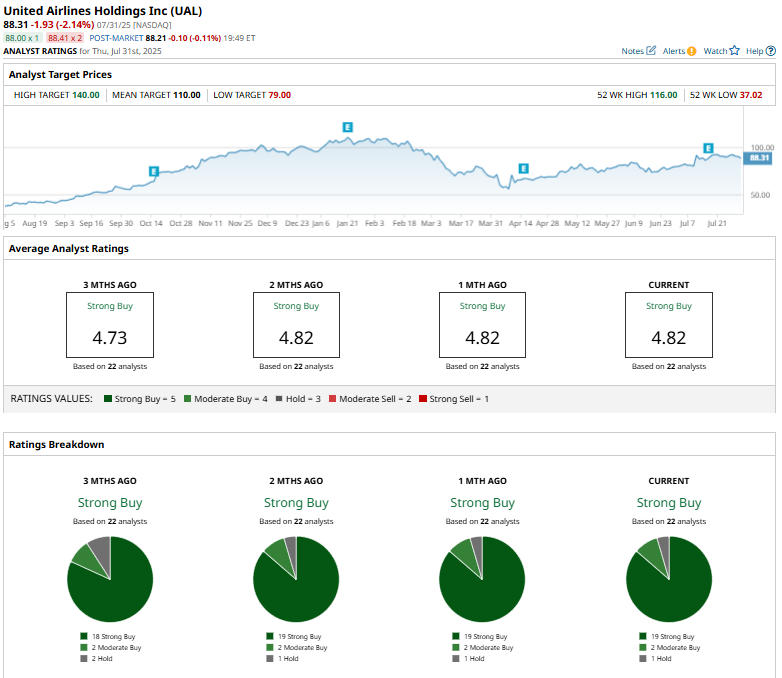

Shares of this leading airline holding company have outperformed the broader market considerably over the past year. UAL has gained 89.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.6%. However, in 2025, UAL stock is down 9.1%, compared to the SPX’s 7.8% rise on a YTD basis.

Zooming in further, UAL has also outpaced the U.S. Global Jets ETF (JETS). The exchange-traded fund has gained about 25.1% over the past year.

On Jul. 16, UAL posted its fiscal 2025 second-quarter earnings, and its shares popped 2.4%. It reported revenue of $15.2 billion, up 1.7% year-over-year, and an adjusted EPS of $3.87, beating estimates but down from last year’s $4.14. Net income fell 26.4% to $973 million, though premium cabin and loyalty revenues saw healthy growth. Despite trimming its full-year EPS guidance to $9.00–$11.00, United remains optimistic, citing a strong rebound in travel demand and improving booking trends starting mid-July.

For the current fiscal year, ending in December, analysts expect UAL’s EPS to decline 2.6% to $10.33 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

Among the 22 analysts covering UAL stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buy,” and one “Hold.”

This configuration is slightly more bullish than three months ago, when it had 18 “Strong Buy” ratings.

On July 18, UBS Group AG (UBS) analyst Thomas Wadewitz raised United Airlines’ price target from $103 to $114 while maintaining a “Buy” rating, reflecting continued confidence in the airline’s growth potential.

The mean price target of $110 represents a 24.6% premium to UAL’s current price levels. The Street-high price target of $140 suggests an ambitious upside potential of 58.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.