/United%20Airlines%20Holdings%20Inc%20logo-by%20fifg%20via%20Shutterstock.jpg)

Chicago, Illinois-based United Airlines Holdings, Inc. (UAL) owns and manages airlines that transport people and cargo serving customers worldwide. With a market cap of $30.2 billion, the company also offers catering, ground handling, flight academy, and maintenance services for third parties. The leading airline holding company is expected to announce its fiscal third-quarter earnings for 2025 on Wednesday, Oct. 15.

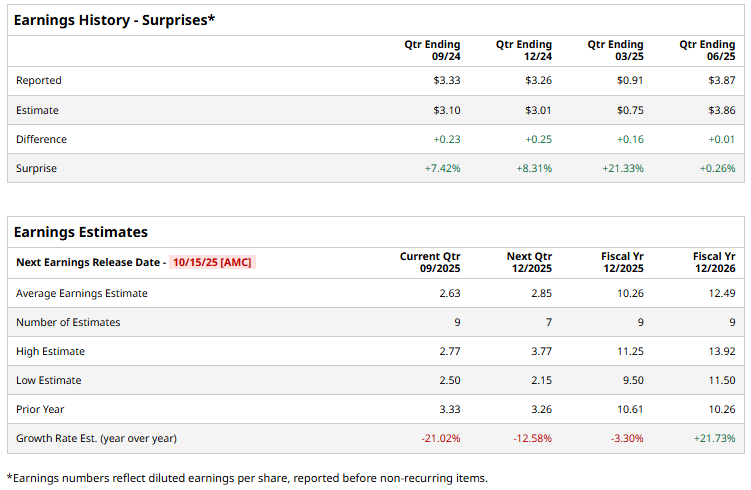

Ahead of the event, analysts expect UAL to report a profit of $2.63 per share on a diluted basis, down 21% from $3.33 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect UAL to report EPS of $10.26, down 3.3% from $10.61 in fiscal 2024. However, its EPS is expected to rise 21.7% year over year to $12.49 in fiscal 2026.

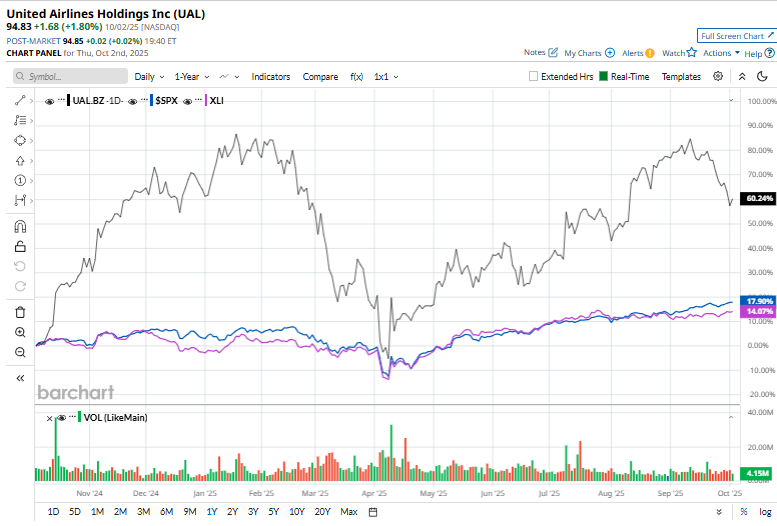

UAL stock has surged 70.1% over the past year, outperforming the S&P 500 Index’s ($SPX) 12.6% gains and the Industrial Select Sector SPDR Fund’s (XLI) 20.5% gains over the same time frame.

On Sept. 22, shares of United Airlines Holdings fell over 1% after aviation analytics firm Cirium reported a notable slowdown in transatlantic demand. According to the data, planned bookings from Europe to the United States for the fall season are down 11% compared with the same period last year. The decline highlights potential headwinds for major U.S. carriers, such as United, which rely heavily on lucrative international routes, particularly transatlantic travel, to drive revenue growth.

Analysts’ consensus opinion on UAL stock is highly bullish, with a “Strong Buy” rating overall. Out of 22 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and two give a “Hold.” UAL’s average analyst price target is $117.60, indicating a potential upside of 24% from the current levels.