/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

Healthcare stocks are typically seen as defensive plays, especially during market uncertainty, but even industry giants aren't immune to volatility. UnitedHealth Group (UNH), once considered a reliable pillar in the managed care space, has suffered a stock decline of more than 44% in 2025. The selloff has been fueled by a mix of rising costs in its Medicare Advantage segment, a surprise CEO exit, and ongoing federal scrutiny into its billing practices.

Despite these significant headwinds, Bernstein is bullish on UNH. The brokerage firm recently named UnitedHealth one of its “Top Picks” ahead of Q2 earnings, pointing to its discounted valuation and the potential for a strong margin recovery in the coming years. Bernstein also sees normalization in Medicaid and Medicare Advantage trends, and is expecting UNH’s earnings to double by 2029, at a compound annual growth rate (CAGR) of 19%.

For long-term investors with an eye for value amid chaos, here’s why this beaten-down healthcare heavyweight could be at a “very attractive entry point,” according to Bernstein.

About UNH Stock

Based in Minnetonka, Minnesota, UnitedHealth Group (UNH) is a diversified healthcare and insurance company operating through two main segments: UnitedHealthcare, which provides health benefits; and Optum, which offers healthcare services and technology. The company boasts a market capitalization of around $255.9 billion.

UNH has endured a difficult year, with its stock plunging about 44% year‑to‑date - significantly underperforming the S&P 500 Index ($SPX), which has gained 7.3%. This underperformance has been driven by multiple headwinds, including surging Medicare costs, disappointing earnings, reported Department of Justice probes, a cyberattack, and the CEO’s sudden resignation.

Following the sharp sell-off, UNH’s valuation is “significantly depressed,” according to Bernstein. Its forward price‑to‑earnings ratio is 13.95x - well below the sector median, and roughly a 40% discount to its own 5-year average earnings premium. Bernstein analyst Lance Wilkes sees this as a prime opportunity to buy UNH stock at a discount.

Separately, value investors will note that the stock yields 3.13% at current levels, offering solid income potential.

UnitedHealth Prepares to Report Q2 Earnings

Looking ahead, UNH is expected to report Q2 earnings before the open on July 29. Analysts see EPS falling about 25% year-over-year to around $4.94, with revenue expected at $111.59 billion on average. For the full year 2025, consensus earnings are now forecast around $21.38 per share.

On April 17, UnitedHealth Group reported mixed Q1 2025 results, sparking a sharp sell-off as rising medical costs pressured profits. Revenue grew nearly 10% year-over-year to $109.5 billion, but earnings came in light. Adjusted EPS rose 4.2% to $7.20 - the company’s first earnings miss since 2008, even as GAAP net income rebounded sharply to $6.3 billion, compared to a $1.4 billion loss in Q1 2024.

Higher-than-expected medical costs, especially in Medicare Advantage and post-acute care, weighed on margins. CEO Andrew Witty acknowledged the company didn't perform as expected and is taking steps to address the issues.

Still, free cash flow remained strong at $4.6 billion, and UnitedHealth returned $5 billion to shareholders through dividends and buybacks. Cash and short-term investments totaled roughly $30.7 billion, or $34.3 billion including marketable securities.

Bernstein’s Bullish Take on UNH Stock

Bernstein analyst Lance Wilkes sees UNH as a contrarian value buy here, even as he lowered the insurer's 2025 EPS forecast by 10% to account for reserve build-ups and higher costs. However, Wilkes expects a sharp earnings rebound by 2026, and projects that EPS could roughly double from 2025 to 2029 as utilization normalizes in Medicaid/Medicare and pricing in government plans “hardens” to more typical levels. In other words, this quarter’s weak margins are viewed as cyclical.

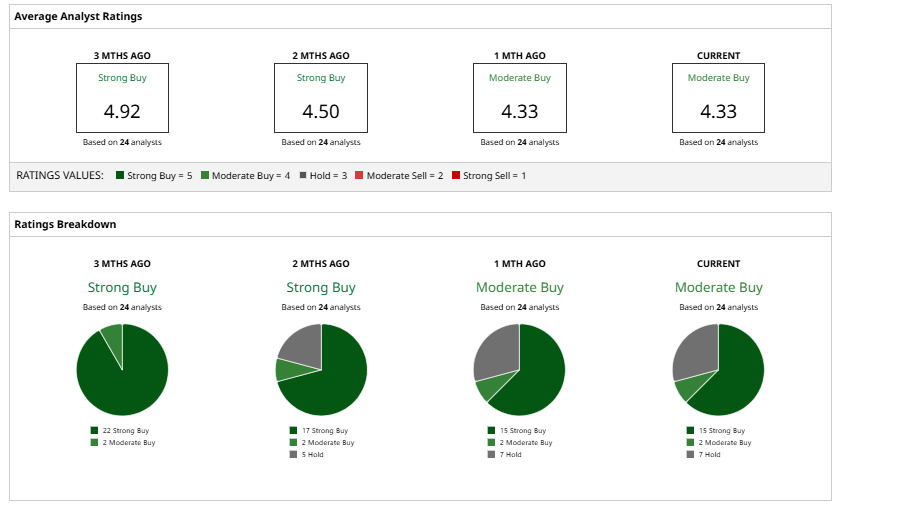

Despite some recent price-target cuts, Wall Street broadly agrees with Bernstein’s bullish opinion. The stock holds a consensus “Moderate Buy” rating, with an average 12-month price target of $358.29, suggesting an upside potential of about 25.6% from current levels.