Intel Corp. (NASDAQ:INTC) has been downgraded by Fitch Ratings, which cited growing pressure from rivals Advanced Micro Devices (NASDAQ:AMD) and Qualcomm Inc. (NASDAQ:QCOM) and the company's ongoing struggle to maintain demand for its semiconductor products.

Fitch Cuts Intel's Credit Rating To BBB With Negative Outlook

Fitch downgraded Intel's long-term credit rating one notch from BBB+ to BBB on Monday and assigned a negative outlook, placing the chipmaker just two notches above junk status, reported Reuters.

The agency said Intel's "credit metrics remain weak" and highlighted it needs stronger end-market demand, successful product ramps, and debt reduction over the next 12 to 14 months to regain its former rating.

Fitch analysts referred to the intense competition from AMD, Qualcomm, Broadcom Inc. (NASDAQ:AVGO) and NXP Semiconductors (NASDAQ:NXPI), saying the company faces increased challenges in maintaining demand.

Despite Intel's strong market presence in PCs and enterprise servers, Fitch warned of higher execution risk and a relatively weaker financial structure, the report added.

See Also: American Airlines CFO Declares Worst Is Over, But Cautious Outlook Sinks Stock

Intel's Financial Strain Persists Despite Revenue Beat

The downgrade follows Intel's second-quarter results, which showed revenue of $12.86 billion, beating Wall Street's $11.91 billion forecast.

Still, the company posted an adjusted loss of 10 cents per share, missing expectations for a 1-cent profit. Client Computing revenue was down 3% year-over-year to $7.9 billion, while Data Center and AI rose 4% to $3.9 billion.

Fitch noted Intel's liquidity remains "solid," backed by $21.2 billion in cash and short-term investments and an untapped $7 billion credit revolver.

CEO Lip-Bu Tan Launches Massive Overhaul

Intel CEO Lip-Bu Tan, who took the helm in March, is leading a drastic restructuring. Intel plans to cut its global workforce by roughly 31%—from nearly 109,000 to 75,000—by year-end.

The Foundry division alone faces a 15–20% workforce reduction. Intel is also relocating assembly operations from Costa Rica to Vietnam and Malaysia and delaying its long-anticipated Ohio chip facility.

Intel expects the third-quarter revenue to be between $12.6 billion and $13.6 billion and forecasts a 24-cent loss per share, worse than analyst expectations.

Price Action: Intel shares rose 0.98% during Monday's regular trading session and edged up an additional 0.0015% in after-hours trading, according to Benzinga Pro.

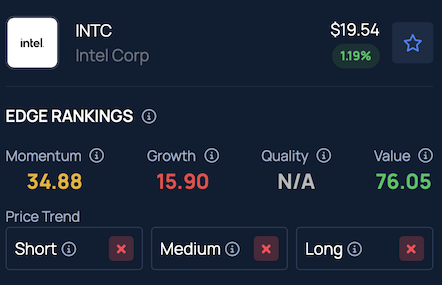

Benzinga's Edge Stock Rankings indicate that INTC maintains a downward trend across short, medium and long-term periods. Further performance details are available here.

Read Next:

Photo: Tada Images/ Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.