NEW DELHI: With global oil prices surging to record highs, the government is taking several measures to ensure there is no adverse impact on end-use consumers in India.

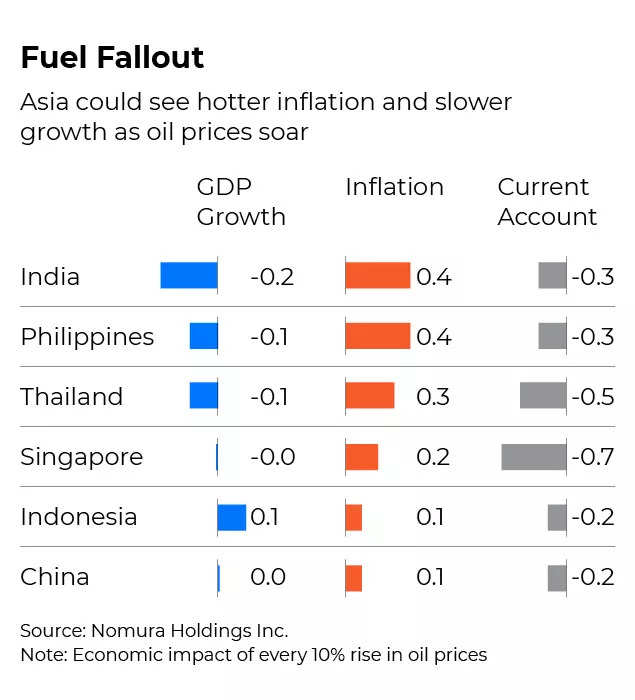

The country relies on overseas purchases to meet about 85 per cent of its oil requirement, making it one of the most vulnerable in Asia to higher oil prices.

The ongoing conflict between Russia and Ukraine had fueled fears of supply disruptions, thereby pushing up brent crude oil price to 14-year high of $130 per barrel earlier this month. Prices have now cooled a bit and is hovering around $105 per barrel currently.

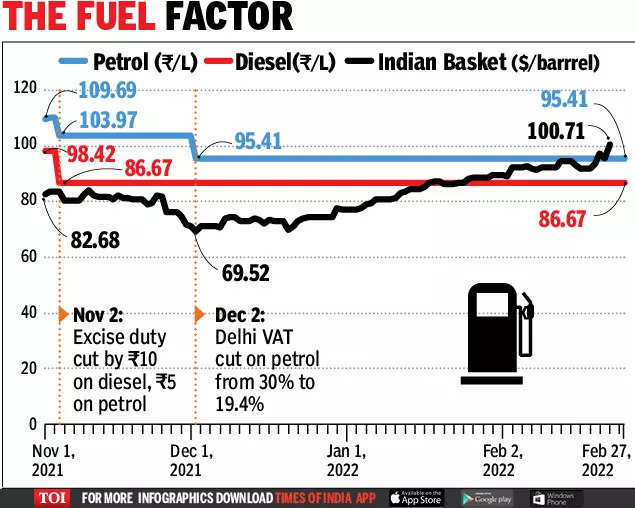

Speculations were high that the rising crude oil prices will push up prices of petrol and diesel in India, especially after results of state polls. However, retail petrol and diesel prices have remained unchanged for a record 130 days in a row. Rates were last revised on November 4, 2021, when international oil prices were at $81-82 per barrel.

On November 4, 2021, excise duty on petrol was cut by Rs 5 per litre and that on diesel by Rs 10 to provide relief to consumers reeling under record-high prices.

International rates have since climbed to multi-year highs but retail prices have remained stagnant.

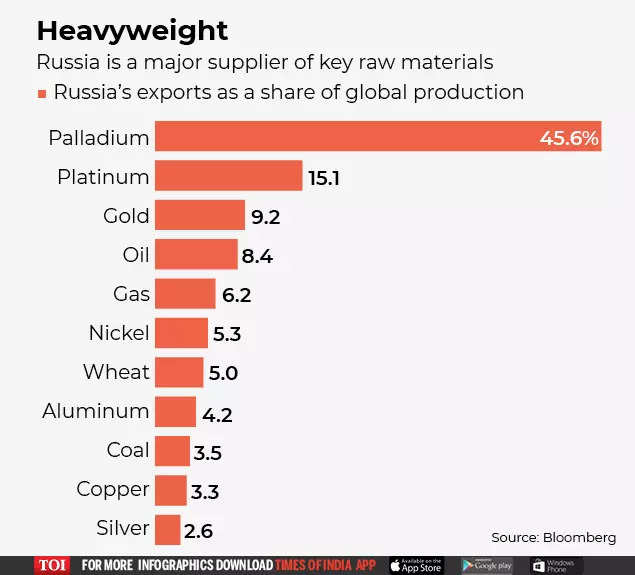

India buys only a fraction of its oil from Russia but has been hit hard by a spike in global oil prices due to Western sanctions against Moscow, the world's second largest crude exporter.

The Indian basket of crude oil had jumped to $112.59/barrel by March 11, after averaging $84.67/barrel in January and $94.07 in February.

Release more oil from reserves

In a written reply to the Parliament, MoS petroleum and natural gas Rameswar Teli indicated that India could release more oil from national stocks, if required.

"Government of India is ready to take all appropriate action, as deemed fit, for mitigating market volatility and calming the rise in crude oil prices," Teli said.

The minister said that the government is "closely monitoring global energy markets as well as potential energy supply disruptions as a fallout of the evolving geopolitical situation".

Resumption of crude oil supplies from Iran, Venezuela

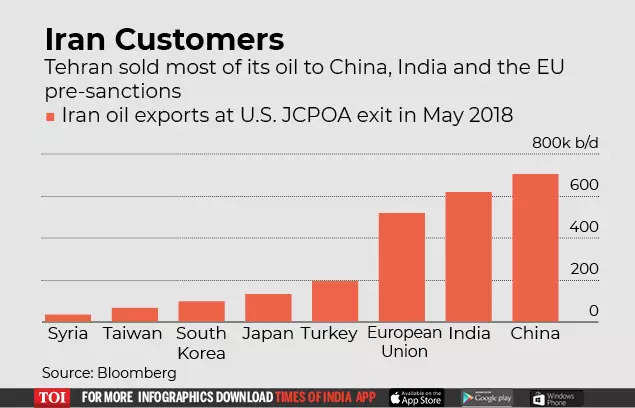

According to reports, India is also looking forward to resumption of crude oil supplies from Venezuela and Iran to safeguard itself against globally high price.

Replying to supplementaries during question hour in the Rajya Sabha, oil minister Hardeep Singh Puri said oil export from Venezuela and Iran had been hit due to sanctions.

The two nations are among those with the highest oil reserves in the world and were significant suppliers to India before US sanctions halted purchases.

"It is our hope and expectation that oil, not only from Venezuela, but other countries under sanction, will become available," he said.

"I am hopeful that we will all use collectively, our margin of persuasion... to request the international community to make more oil available including from Venezuela," he added.

Indian oil companies will enter into agreements with Venezuela and "equally (with) Iran" no sooner their oil comes into the market, he said.

The minister also hoped that "apart from oil which will become available by countries who, hitherto, were not supplying on account of sanction, existing Opec plus will increase their production" to cool oil price.

He added that rates in India have gone up only by 5 per cent as compared to over 50 per cent in countries like the US, Canada, Germany, and the UK.

Discounted Russian oil

The government is also considering taking up Russia's offer to buy its crude oil and other commodities at discounted prices with payment via a rupee-rouble transaction.

"Russia is offering oil and other commodities at a heavy discount. We will be happy to take that. We have some issues like tanker, insurance cover and oil blends to be resolved. Once we have that we will take the discount offer," a government official told news agency Reuters.

After the US and UK imposed sanctions of Russian oil, some international traders have been avoiding becoming entangled in them. However, sanctions don't prevent India from importing the fuel.

Russia has urged what it describes as friendly nations to maintain trade and investment ties.

India has longstanding defence ties with Russia and abstained from a vote at the United Nations condemning the invasion, although New Delhi has called for an end to the violence.

Rupee payments for trade?

Reports also suggest that the government is working out a mechanism to facilitate trade with Russia using rupee.

The government is discussing how trade can be settled in rubles and rupees as Indian exporters are awaiting payments of about $500 million that have been stuck after the sanctions on Russian banks, Reuters reported.

Under the proposed mechanism, ruble could be deposited into an Indian bank after converting it into rupee and vice versa. There are some concerns, however, on how to peg the currencies, and also on ways to balance the trade as India is a net importer of Russian goods, which include defence equipment.

The government is also preparing a list of items it can export to Russia to narrow about $5 billion trade deficit it currently runs. It wants to opt for a floating exchange rate given the rouble crashed in recent weeks.

IEA members moved to build cushion

Earlier this month, members of International Energy Agency (IEA), including India, had agreed to release 60 million barrels of oil from their emergency stockpiles.

IEA members hold emergency reserves of 1.5 billion barrels. The 60 million barrels amounts to 4 per cent of those stockpiles. This is equivalent to 2 million barrels a day for 30 days against a daily global supply of approximately 100 million barrels before the pandemic.

India has a daily consumption of 4.5 million barrels per day of crude and has a stockpile of 39 million barrels, or roughly 8-9 days supply, spread across three locations.

In November, the Centre had agreed to release 5 million barrels from its stockpile as part of a US-led initiative for co-ordinated release by major oil consumers such as China, Japan and South Korea to cool prices as oil prices breached the $80 per barrel mark.

This was the first time that India had tapped its emergency reserves for market intervention.

(With inputs from agencies)