UiPath Inc. (NYSE:PATH) saw its stock rise 7.70% in pre-market trading on Thursday, reaching $16.79.

Check out the current price of PATH stock here.

The automation software company added $1.12 per share after the bell, building on a 5.13% gain during the regular session, which ended at $15.58, according to Benzinga Pro data.

According to Fortune, UiPath is shifting from traditional Robotic Process Automation (RPA) to "agentic" automation, embedding AI agents for complex tasks and strengthening its platform through strategic collaborations, including a ChatGPT connector with OpenAI.

CEO Completes Systematic Share Dispositions

Daniel Dines, CEO and chairman of UiPath, sold 122,734 shares of company stock on Wednesday at an average price of $14.89, bringing his total sales to 736,399 shares between Oct. 1 and Oct. 8

The sale was made under a pre-arranged Rule 10b5-1 trading plan set up under the Securities Exchange Act of 1934.

He sold approximately 122,733 shares on each trading day from Oct. 1 to Oct. 7, with 122,734 shares sold on Oct. 8.

| Date | Shares Sold | Price per Share (USD) |

|---|---|---|

| Oct. 1 | 122,733 | $13.3260 |

| Oct. 2 | 122,733 | $12.8412 |

| Oct. 3 | 122,733 | $13.0057 |

| Oct. 6 | 122,733 | $14.2442 |

| Oct. 7 | 122,733 | $14.9899 |

| Oct. 8 | 122,734 | $14.8901 |

Insider Holdings Structure

Following the Wednesday transaction, Dines holds 29,918,585 shares directly and 736,404 shares indirectly through Ice Vulcan Holding Limited, according to the SEC filing. His spouse holds an additional 240,000 shares indirectly.

The shares held through Ice Vulcan Holding Limited are structured with IceVulcan Investments Ltd. as the sole shareholder.

Daniel Dines is the sole shareholder of IceVulcan Investments Ltd. and retains exclusive voting and investment power over these holdings.

Current Valuation Metrics

The New York-based company has gained 22.58% so far in 2025, with a yearly trading range of $9.38 to $15.93. It has a market capitalization of $8.27 billion, an average daily volume of 19.72 million shares, and a price-to-earnings ratio of 427.08.

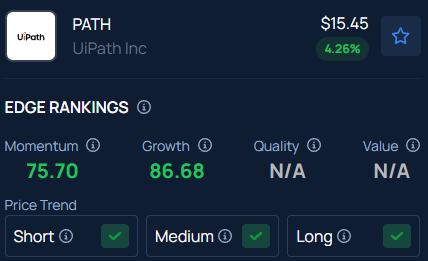

Benzinga’s Edge Stock Rankings highlight that PATH has a Growth score of 86.68. Track the performance of other players in this segment.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Ian Dewar Photography / Shutterstock