/The%20UiPath%20logo%20on%20a%20corporate%20office%20by%20Ian%20Dewar%20Photography%20via%20Shutterstock.jpg)

UiPath (PATH) stock is up 5% in the past five trading days on the back of recently announced deals.

Powered by the combination of automation and agentic AI, the company’s agentic automation platform is likely to continue gaining customer momentum. This can translate into further positive price action for PATH stock after an extended period of rangebound trading.

About PATH Stock

Headquartered in New York, UiPath is a provider of agentic automation. This automation helps enterprises to benefit from the full potential of AI agents. Therefore, with the growth in application of AI across industries and globally, UiPath is positioned to benefit.

Recently, UiPath signed collaboration agreements with tech majors. With these developments, coupled with steady top-line growth, PATH stock seems attractive. Amidst volatility, PATH stock has remained sideways in the last 12 months. This seems like a good accumulation opportunity.

The Catalyst of New Collaborations

PATH stock surged on Sept. 30 as the company announced multiple new collaborations with Nvidia (NVDA), Snowflake (SNOW), and Google (GOOG) .

With Nvidia, the company will be leveraging its agentic automation expertise to combine open NVIDIA Nemotron models with NVIDIA NIM. This partnership includes an integration service connector that connects UiPath and NVIDIA NIM and NVIDIA Nemotron.

The partnership with Google involves the launch of UiPath Conversational Agent where voice interaction will be enabled by Google’s Gemini models.

The company will also be combining its agentic automation platform with Snowflake’s Cortex AI Agents. Through this combination, customers can use structured and unstructured data for business insights.

Overall, these collaborations strengthen the use case for UiPath’s automation and agentic AI capabilities. This is likely to translate into upside in recurring revenues.

Steady Growth in ARR

Among the performance indicators, the annualized renewal run-rate provides insight on a company’s steady growth momentum.

To put things into perspective, UiPath reported an ARR of $1.55 billion for Q2 2025. For the most-recent-quarter (Q2 2026), ARR swelled to $1.72 billion with a year-over-year growth rate of 11%. Further, UiPath has guided for ARR of $1.83 billion by the end of January 2026.

This is a good indicator of the company’s ability to acquire new customers and maintain existing relationships. An uptrend in ARR is likely to ensure that top-line growth remains steady in the foreseeable future.

At the same time, UiPath reported a dollar-based net retention rate of 108% for Q2 2026. This is another good indicator of revenue retention within the same cohort. With new collaborations, the positive trend in key growth metrics is likely to sustain.

Strong Fundamentals to Support Growth and Innovation

For UiPath, the agentic automation platform has been driving growth. However, the basis for sustained growth is its investment in innovation and global expansion.

From the perspective of financial flexibility, UiPath is well positioned. As of July 2025, the company reported cash and equivalents of $1.52 billion. Further, for the first half of the year, operating cash flows were $160 million and implied annualized OCF potential of $320 million.

It’s also worth noting that for the first six months of 2025, UiPath reported subscription services recurring revenue of $455.7 million. On a year-over-year basis, subscription services revenue increased by 20%. As revenue from this segment swells, it provides a strong case for upside in key margins and cash flows.

What Do Analysts Expect for PATH Stock?

PATH stock has been largely sideways in the last 12 months. With recent business collaborations, steady growth in ARR, and an increase in FY 2026 revenue guidance, the outlook seems positive.

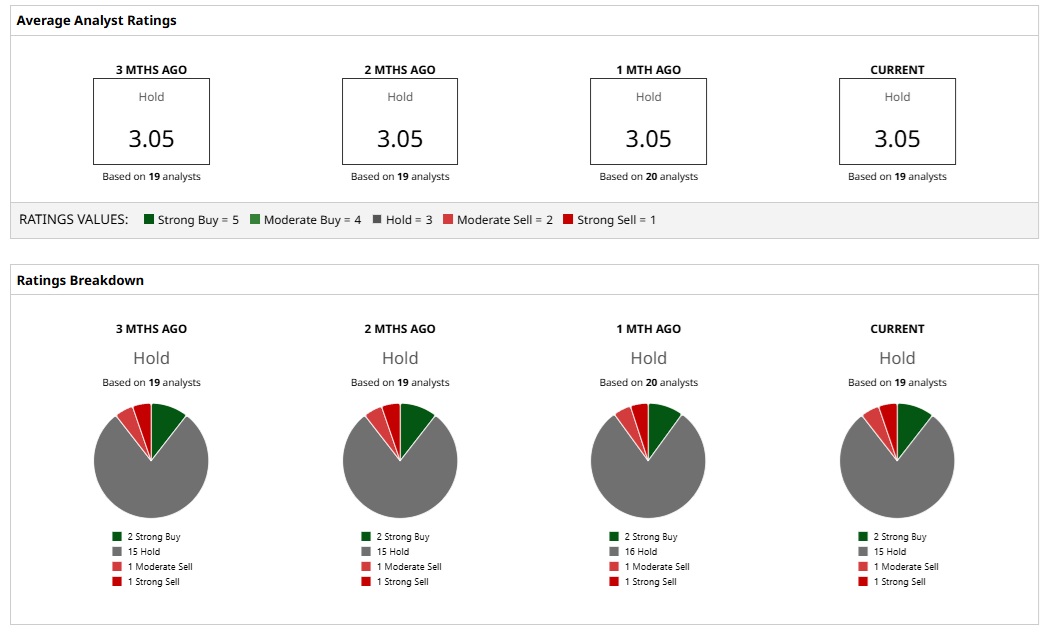

It’s therefore not surprising that out of 19 analysts covering PATH stock, 15 have maintained a “Hold” rating with two analysts advocating a “Strong Buy.”

While PATH stock trades marginally below the mean price target of $13, the Street-high target of $15 implies a potential upside of 17.6%.

It’s worth noting that analysts tracking PATH stock expect earnings growth of 200% and 118% for FY 2026 and FY 2027, respectively. Considering robust earnings growth expectations, it’s likely that PATH stock will trend higher.

.png?w=600)