UDR, Inc. (UDR), formerly known as United Dominion Realty Trust, Inc., is a leading multifamily real estate investment trust (REIT) that manages, acquires, and develops apartment communities in major U.S. cities. It owns over 60,000 apartment homes, emphasizing long-term value for investors and quality living experiences for residents.

Founded in 1972, UDR has built a strong reputation for consistent performance and innovation in urban housing. The company is headquartered in Highlands Ranch, Colorado, and serves as a trusted provider of residential real estate solutions across the nation. The REIT has a market capitalization of $12.39 billion, which categorizes it as a “Large cap” stock.

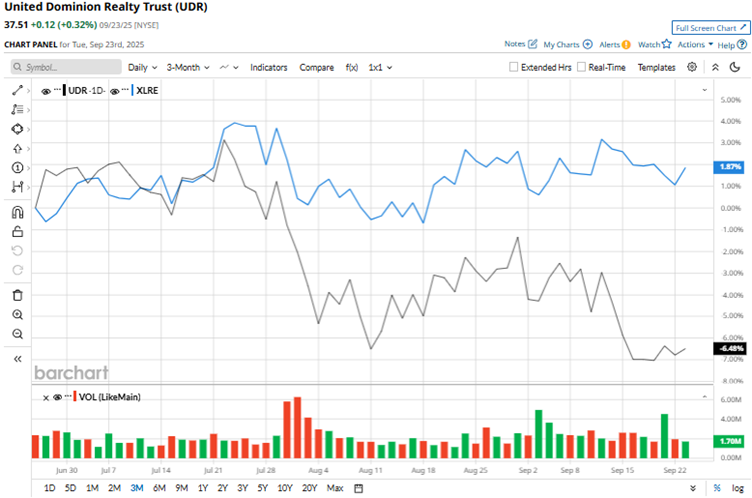

The company’s stock has been facing pressure from the broader REIT market and concerns about still-high interest rates. UDR’s shares dropped to a 52-week low of $36.61 in April, but are up 2.5% from this low. Over the past three months, the stock has declined by 9.4%. The broader real estate sector, as indicated by the Real Estate Select Sector SPDR Fund (XLRE), is down marginally over the same period. Therefore, the company’s stock is currently underperforming its sector.

Over the longer term, this underperformance persists. The stock has declined 19.1% over the past 52 weeks and 13.6% year-to-date (YTD). On the other hand, the Real Estate Select Sector SPDR Fund has dropped 6.4% over the past 52 weeks but gained 3.3% YTD. The stock has been trading below its 50-day and 200-day moving averages since early August.

On July 30, UDR reported its second-quarter results for fiscal 2025. The REIT’s total revenues increased by 2.4% year-over-year (YOY) to $425.40 million. This was higher than the $422.20 million that Wall Street analysts were expecting.

Its funds from operations as adjusted (FFOA) grew by 3.2% from the prior year’s period to $0.64 per share. This was also higher than the $0.62 per share figure that Wall Street analysts had expected. Despite these better-than-expected results, UDR’s stock dropped 2% intraday on July 30 and 1.3% on July 31.

One of UDR’s close rivals, Equity Residential (EQR), also experienced a decline, facing broader market headwinds. Over the past 52 weeks, EQR’s stock has declined by 15.2%, while it is down 8.5% YTD. However, EQR has performed a bit better than UDR during these periods.

Wall Street analysts are moderately bullish on UDR’s stock. The stock has a consensus rating of “Moderate Buy” from the 24 analysts covering it. The mean price target of $43.90 indicates a 17% upside compared to current levels. However, the Street-high price target of $48 indicates a 28% upside.