Highlands Ranch, Colorado-based UDR, Inc. (UDR) is a real estate investment trust (REIT) that focuses on owning, operating, acquiring, renovating, and developing multifamily apartment communities. Valued at a market cap of $11.9 billion, the company is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Wednesday, Oct. 29.

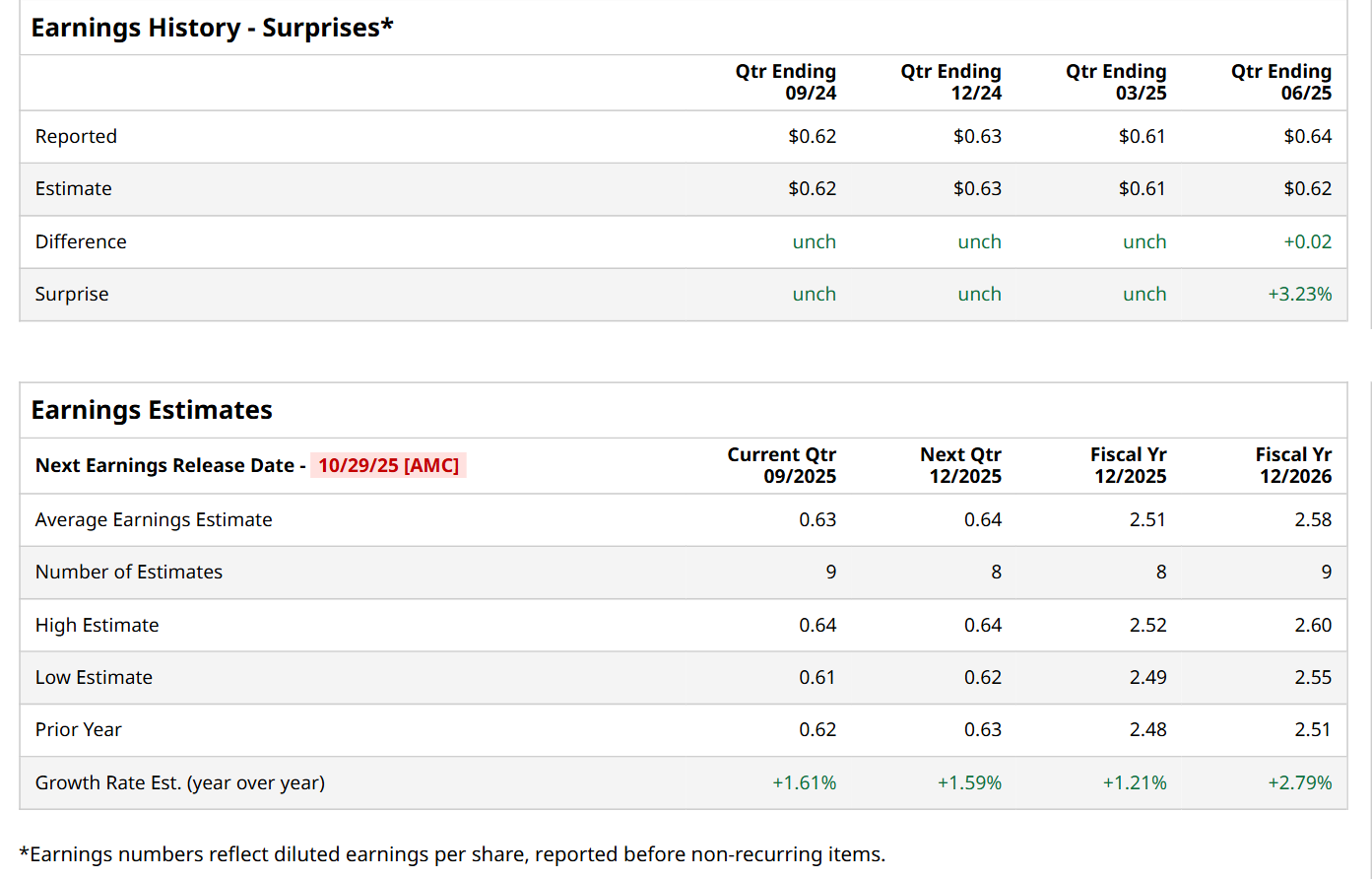

Before this event, analysts expect this residential REIT to report an FFO of $0.63 per share, up 1.6% from $0.62 per share in the year-ago quarter. The company has met Wall Street’s FFO estimates in three of the last four quarters, while surpassing on another occasion. Its FFO of $0.64 per share in the previous quarter exceeded the consensus estimates by 3.2%.

For the current fiscal year, ending in December, analysts expect UDR to report an FFO of $2.51 per share, up 1.2% from $2.48 per share in fiscal 2024. Its FFO is expected to further grow 2.8% year-over-year to $2.58 in fiscal 2026.

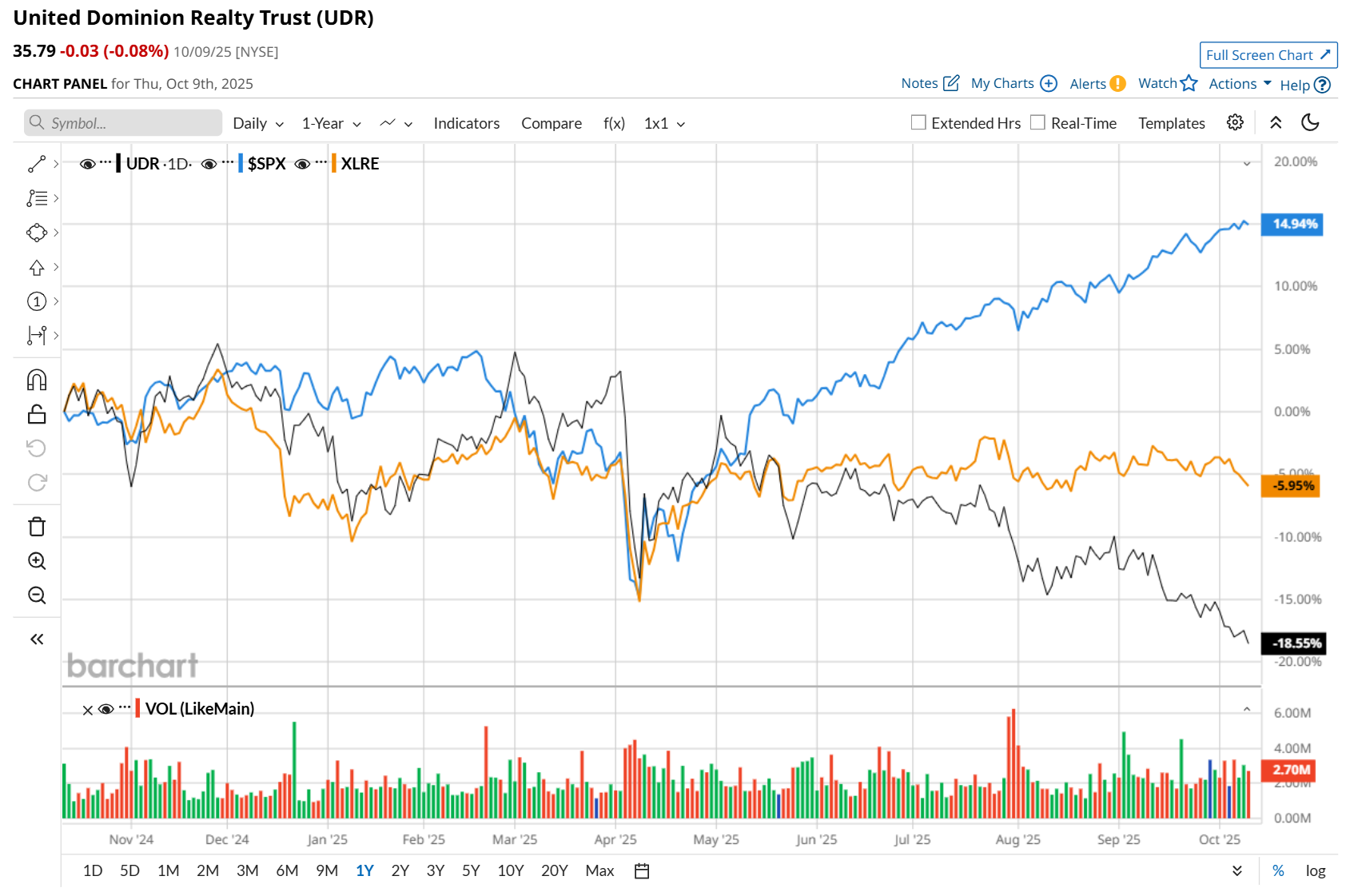

Shares of UDR have declined 17.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.3% return and the Real Estate Select Sector SPDR Fund’s (XLRE) 4% downtick over the same time frame.

On Jul. 30, UDR reported better-than-expected Q2 results. The company's total revenue advanced 2.4% year-over-year to $425.4 million, surpassing consensus estimates by a slight margin. Moreover, its funds from operations as adjusted (FFOA) of $0.64 improved 3.2% from the prior-year quarter and came in 3.2% ahead of analyst estimates. However, despite reporting an upbeat performance, its shares plunged 1.3% in the following trading session.

Wall Street analysts are moderately optimistic about UDR’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, eight recommend "Strong Buy," 16 indicate "Hold," and one suggests a "Strong Sell” rating. The mean price target for UDR is $43.38, implying a 20.9% potential upside from the current levels.