/Uber%20and%20Lyft%20by%20Thought%20catalog%20via%20Unsplash.jpg)

The ride-hailing industry has come a long way. Two names, Uber (UBER) and Lyft (LYFT), dominate this space in the U.S. Both companies are navigating challenges, expanding through partnerships, and investing in long-term bets like autonomous vehicles (AVs). Let’s dig into their second-quarter earnings to determine which stock deserves your money now.

The Case for UBER Stock

Uber has evolved far beyond being just a ridesharing company. It has leveraged its platform strength to drive growth across mobility, delivery, advertising, and even autonomous vehicles (AVs).

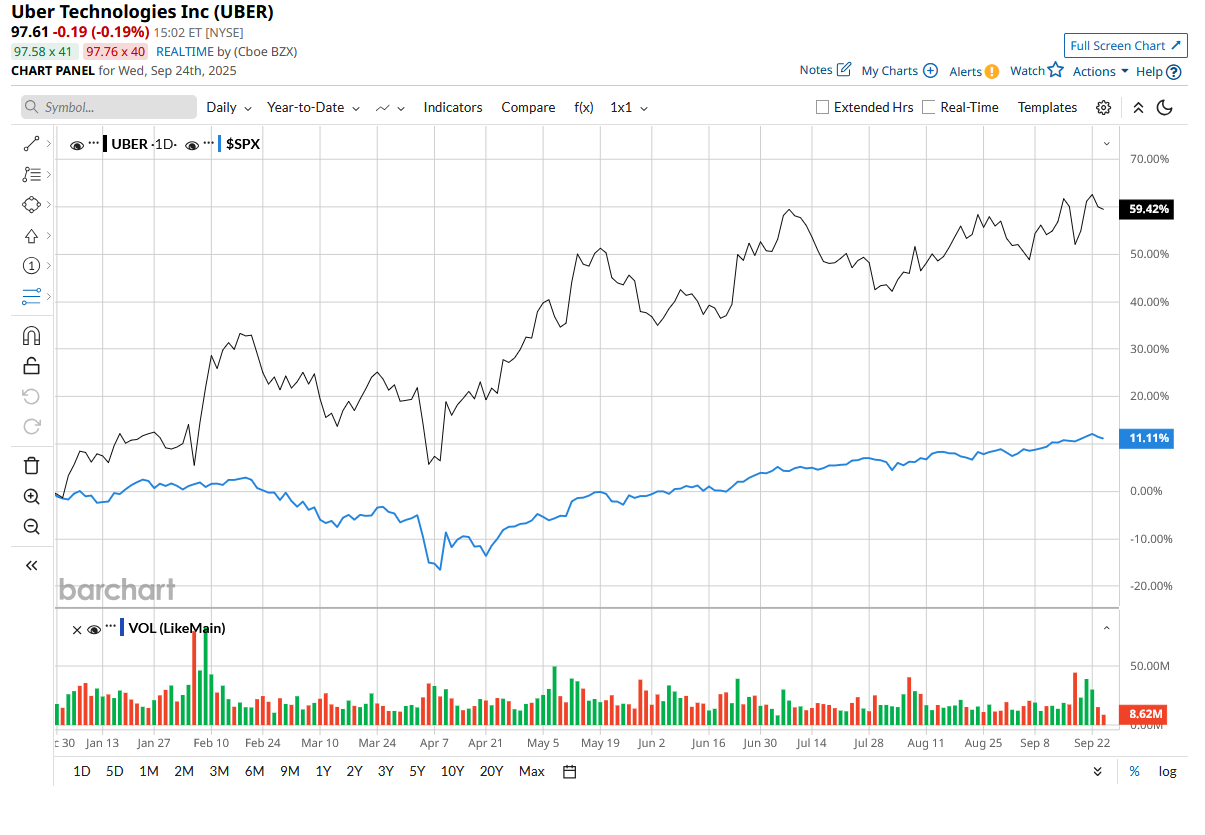

Valued at $203.5 billion, UBER stock has gained 60% year-to-date (YTD), compared to the broader market's gain of about 13%.

In the second quarter, total trips jumped 8% year-over-year (YoY), fueled by a 15% increase in monthly active platform consumers (MAPCs) and a 2% rise in trips per MAPC. Gross bookings rose 17% YoY to $46.8 billion, leading to 18% growth in revenue to $12.7 billion and a net profit of $1.4 billion.

Uber is also tapping artificial intelligence (AI) to deepen engagement. Another factor contributing to stickiness and increased spending is Uber One, the company's membership program. Membership is up to 36 million, an increase of 60% YoY. Furthermore, Uber continues to broaden its addressable market with diverse options such as Moto (two-wheelers) in emerging markets, premium rides, which are already worth $10 billion, and reserve services. Uber also maintains a disciplined capital return program. Its trailing twelve-month free cash flow reached an all-time high of $8.5 billion, strengthening the company's reputation as a reliable cash generator.

Management stated that at least half of Uber's future cash flow will go into share repurchases. This commitment is supported by a strong $20 billion buyback authorization. The remaining half will be used to expand the company's AV ecosystem. Uber’s push into autonomous vehicles could be a game-changer. Recent Waymo deployments in Austin and Atlanta have shown promise, with AVs completing more trips per day than 99% of human drivers.

Aside from Waymo, Uber has partnerships with Baidu (BIDU), Lucid (LCID), Nuro, WeRide (WRD), Wayve, and others, providing it with extensive exposure to the AV ecosystem. While commercialization will take time, Uber has positioned itself as the leading platform for autonomous ride-hailing, which has the potential to significantly lower costs and increase margins in the long run.

Uber has now moved far beyond its early days of growth. With sustained profitability, a growing base of 3.3 billion trips per quarter, and a disciplined approach to capital allocation, Uber is positioning itself as the leader in the next era of global mobility. CEO Dara Khosrowshahi emphasized in the second quarter that Uber is still in the early stages of unlocking its full potential, even as it partners with 20 autonomous vehicle companies worldwide.

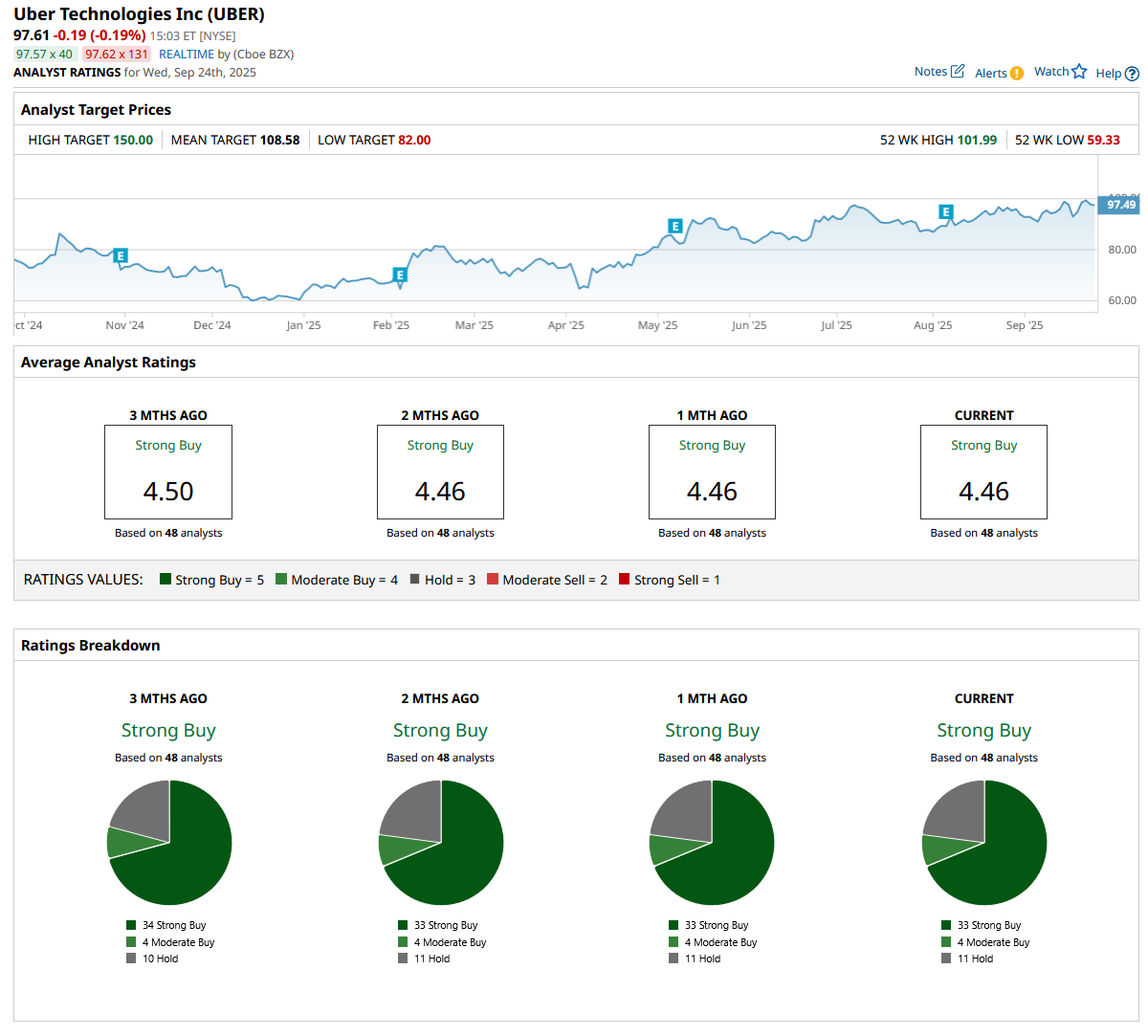

Analysts who cover UBER stock expect earnings to dip by 36.1% in 2025, followed by earnings growth of 21.7% in 2026. Trading at 27x forward 2026 earnings, Uber is still a reasonable buy.

Overall, Wall Street rates UBER stock a “Strong Buy.” Of the 48 analysts covering UBER, 33 have rated it a “Strong Buy,” four have a “Moderate Buy” recommendation, and 11 suggest a “Hold.” Its mean price target of $108.58 implies the stock could rise as high as 11% from current levels. The Street-high estimate of $150 suggests the stock could rally as much as 54% over the next 12 months.

The Case for LYFT Stock

While Uber dominates in scale, Lyft is reinventing itself through acquisitions, partnerships, and a strategy transformation. The most notable recent move is Lyft’s acquisition of FREENOW, a major European player. Europe's ride-hailing market is nearly the same size as the U.S., but it remains untapped, with more than half of taxi bookings still offline. By acquiring FREENOW, Lyft obtains not only access to this large market but also the opportunity to update its infrastructure using Lyft technology.

Lyft played it smartly. Instead of investing billions of dollars in expansion, Lyft plans to exploit existing demand, streamline operations, and gradually expand its worldwide footprint. This move has boosted its stock price by 62.7% YTD, well surpassing the broader market.

In the second quarter, gross bookings went up 12% YoY to $4.5 billion, boosting revenue growth by 11% to $1.6 billion. Total rides grew 4% YoY and marked the ninth straight quarter of double-digit growth. Net income came in at $40.3 million, a sharp improvement from $5 million in the prior-year quarter. The company generated $993 million in free cash flow over the trailing twelve months and repurchased shares worth $200 million.

Lyft's increasing network of alliances with Baidu, BENTELER Mobility, and United Airlines (UAL) also contributed to Q2 growth. Lyft expects gross bookings to increase by 13% to 17% in the third quarter, owing to sustained momentum in rider engagement and the integration of FREENOW.

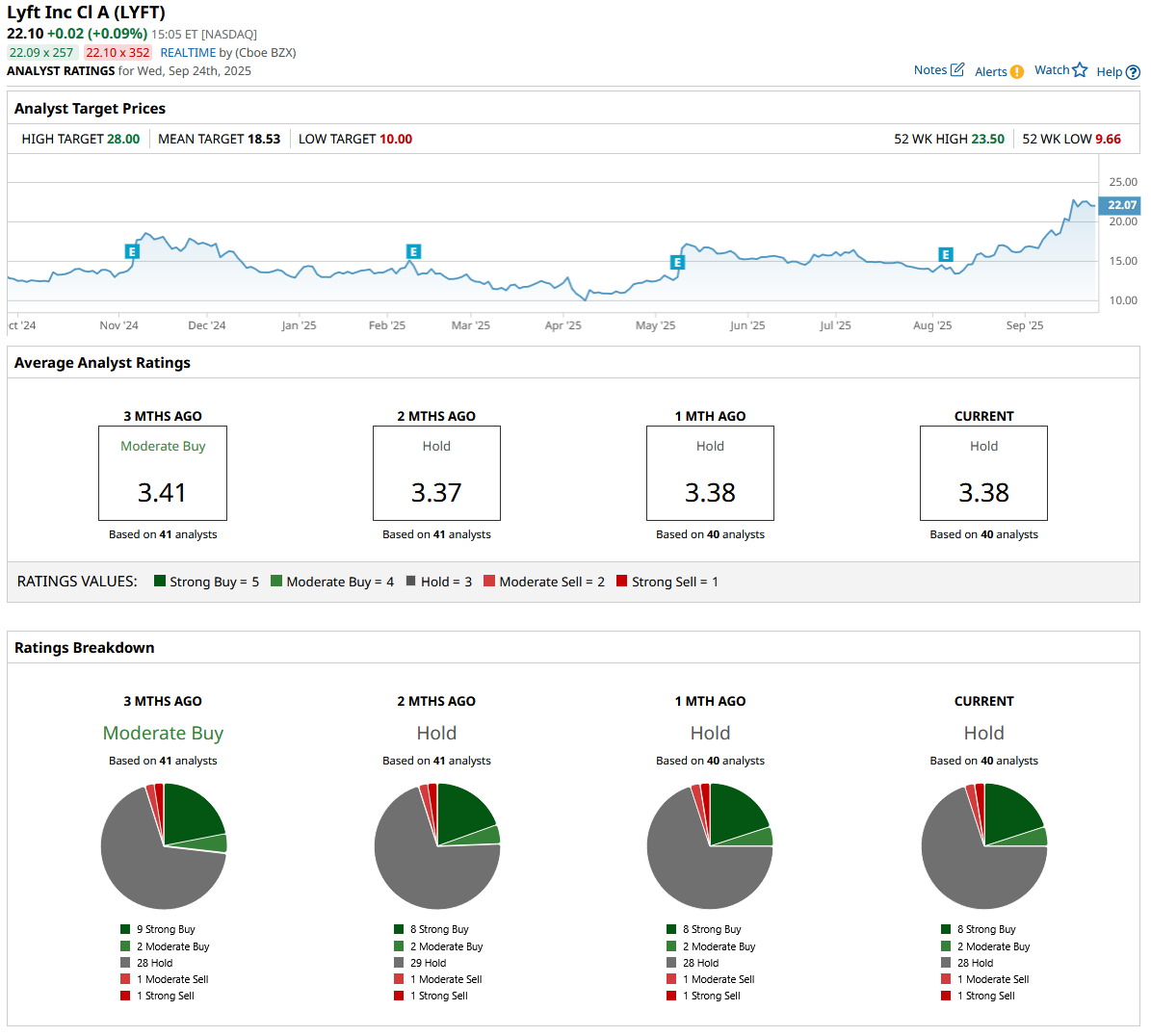

Analysts expect earnings to increase by 27.9% to $1.21 per share in 2025, with earnings further rising by 15.7% in 2025. Trading at 15x forward 2026 earnings, LYFT stock is cheap now.

Overall, on Wall Street, LYFT stock is a “Hold.” Of the 40 analysts covering LYFT, eight have rated it a “Strong Buy,” two have a “Moderate Buy” recommendation, 28 suggest a “Hold,” one says it is a “Moderate Sell,” and one a “Strong Sell.” LYFT has surpassed its mean price target of $18.53. Its Street-high estimate of $28 suggests the stock could rally as much as 26.1% over the next 12 months.

Which Stock Deserves Your Money?

Both Uber and Lyft are evolving beyond simple ride-hailing apps into platforms supported by partnerships, advertising, and eventually autonomous vehicles. While Lyft's attempts to build its business are commendable, Uber leads by a wide margin. Its global presence, deeper integrations, and diversified operations give it unmatched scale. For investors looking for long-term growth in technology-driven consumer services, UBER stands out as a ride-sharing stock that truly deserves your money.