Uber Technologies Inc. (NYSE:UBER) CEO, Dara Khosrowshahi, has outlined 3 possible robotaxi business models for Uber at the company's Q2 2025 Earnings call.

Three Uber Robotaxi Models

"We see kind of three different business models coming in generally depending on whom we're working with," Khosrowshahi said during the earnings call on Wednesday.

The CEO added that the first model would be a "merchant" model that sees Uber pay a fixed amount to the partner company for a dollar per trip per day or dollar per day, making the expense "very, very predictable."

The next model, Khosrowshahi outlined, was the agency model. "Think about it as a rev share. It's kind of the model that we have with our driver partners now," he said, adding that the company would also share risk if "you do less [revenue] on a market."

He also highlighted a model where Uber or the financing partner could own the Robotaxis after the cars have been bought. He then mentioned a licensing model for the Robotaxis.

Khosrowshahi added that the licensing could be "monthly licensing or per-mile licensing," and that the company would deploy all three models over the next 5 years.

Third-Party Financing Options For Robotaxis

Khosrowshahi also said that the company is in talks with "private equity players" and banks to discuss financing options to scale Robotaxi deployments.

"Once we prove out the revenue model, how much these cars can generate on a per-day basis, there will be plenty of financing to go around, third-party financing," he said.

Uber also said that the company could use some of the revenue generated from selling minority stakes to invest in the Robotaxi operations.

Uber Welcomes Tesla's Robotaxis, Signs Robotaxi Deal With Lucid

Speaking to CNBC, Khosrowshahi welcomed Tesla Inc.'s (NASDAQ:TSLA) entry into the Robotaxi sector, adding that Tesla could be "could be a competitor, could be a partner" for Uber.

Tesla, meanwhile, has announced the company is expanding its ride-hailing service in the San Francisco Bay Area. However, the service isn't a robotaxi as there is a safety driver present in the vehicle at all times.

Elsewhere, Uber also recently signed a deal with Lucid Group Inc. (NASDAQ:LCID) to deploy over 20,000 Lucid Robotaxis on the Uber platform over the next five years.

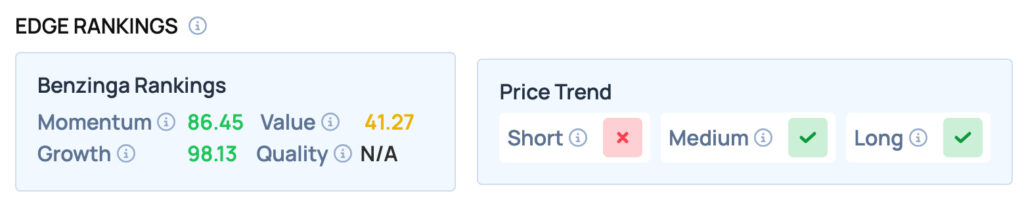

Uber offers Satisfactory Value, but scores well on the Momentum and Growth metrics. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Image Via Shutterstock