North America led the world in growth of wafer fab equipment (WFE) spending in Q1, posting a 50% increase year-over-year as multiple chipmakers began to pay for equipment for their new fabs in the U.S., according to a SEMI report. Meanwhile, Taiwan remained the global leader in WFE spending as TSMC continued procuring leading-edge tools for its fabs in the country.

SEMI announced this week that worldwide spending on semiconductor equipment has risen to $26.8 billion — up 9% year-over-year — in the first quarter of 2023. Taiwan led the pack with $6.93 billion, up 42% YoY; China followed with $5.86 billion, down 23% when compared to the same period a year ago; South Korea was third with $5.62 billion, up 9% from Q1 2022; and the U.S. was the rather distant fourth with $3.93 billion — but that was still up 50% YoY.

Right now, multiple companies are building up and equipping new fabs in the U.S., including Intel, Samsung Foundry, TSMC, and Texas Instruments. The renewed interest in building new fabs in the U.S. was largely catalyzed by the CHIPS and Science act.

"Semiconductor equipment revenue in the first quarter was robust despite macroeconomic headwinds and a challenging industry environment," said Ajit Manocha, SEMI president and CEO. "The fundamentals remain healthy for the long-term strategic investments needed to support major technology advancements for AI, automotive, and other growth applications."

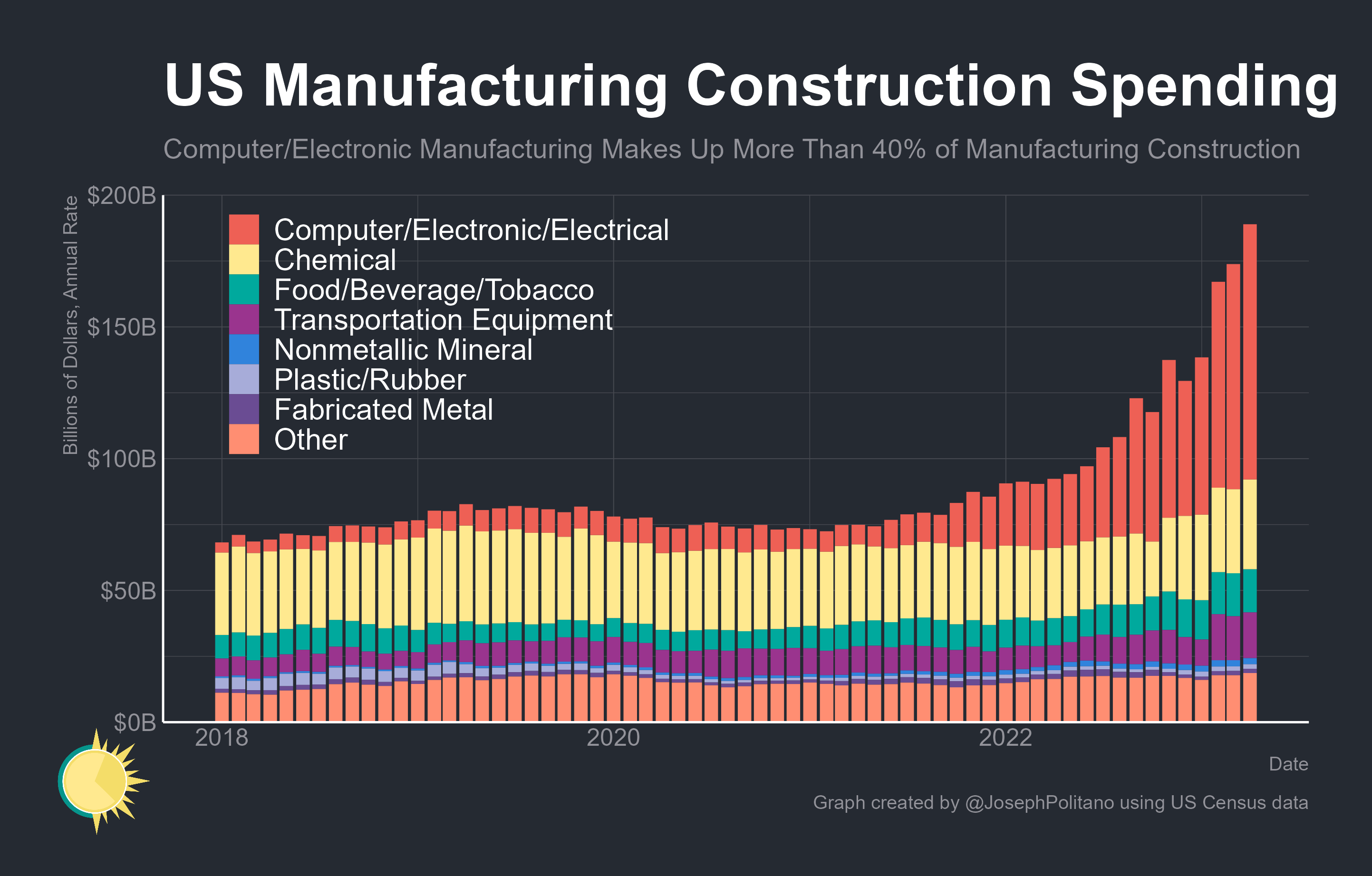

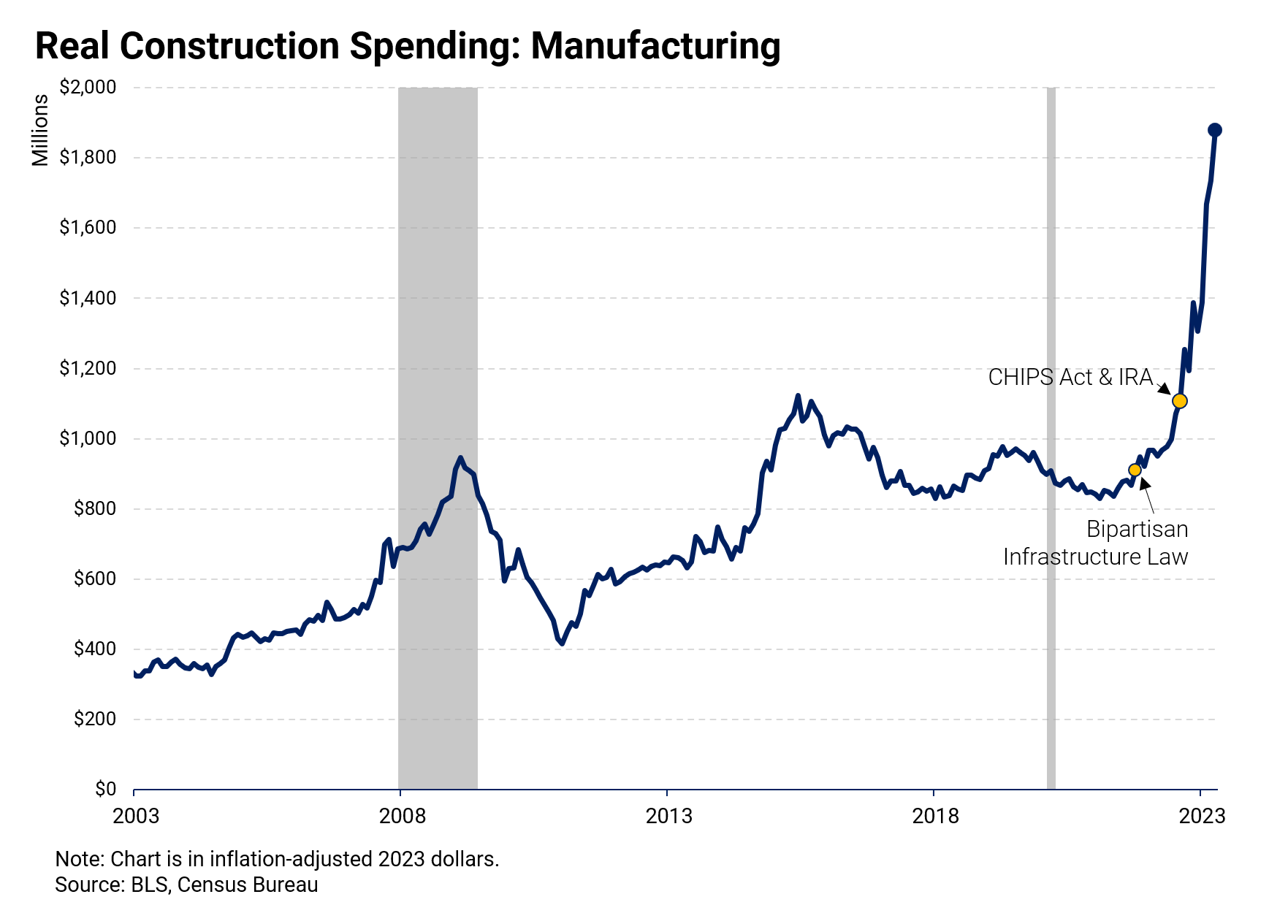

The figures from SEMI were confirmed by U.S. Manufacturing Construction Spending data from the U.S. Census Bureau, published by Joey Politano from Apricitas Economics, who attributed the rapid growth to the CHIPS and the Infrastructure Acts.

"The U.S. manufacturing construction boom is massive, I keep having to raise the Y-axis on this chart," Politano wrote on Twitter. "Historic increases in computer/electronic manufacturing thanks to the CHIPS Act, and massive increases in transportation equipment (read: cars/electric vehicles) thanks to the IRA."

As for specific states, Texas and Arizona are leading the pack.

"The surge in new U.S. manufacturing construction is really concentrated in the Texas region ($32B over the last year), the mountain West (especially Arizona, $30B over the last year), and the Rust Belt ($22B over the last year)," Politano wrote in another Tweet.