President Donald Trump on Monday informed leaders of Japan and South Korea that the U.S. would impose 25% import tariffs on all goods made in these countries and shipped to the U.S. starting August 1. The move affects all industries, but the high-tech sector will likely face dramatic challenges as the vast majority of the world's memory is made in Japan and South Korea. In fact, Micron and SanDisk produce their DRAM and 3D NAND chips in Japan.

U.S. President Donald Trump sent formal letters to Japan’s Prime Minister Ishiba Shigeru and South Korea’s President Lee Jae-myung, informing them that new import duties of 25% will be applied to all goods from their respective countries starting August 1. This measure aims to address trade imbalances in the current trade relationships that are believed to be heavily skewed in favor of Japan and South Korea due to protectionist measures, including tariffs and regulatory barriers. As a result, all Japanese and Korean imports will face a flat 25% duty, separate from existing tariffs by sector.

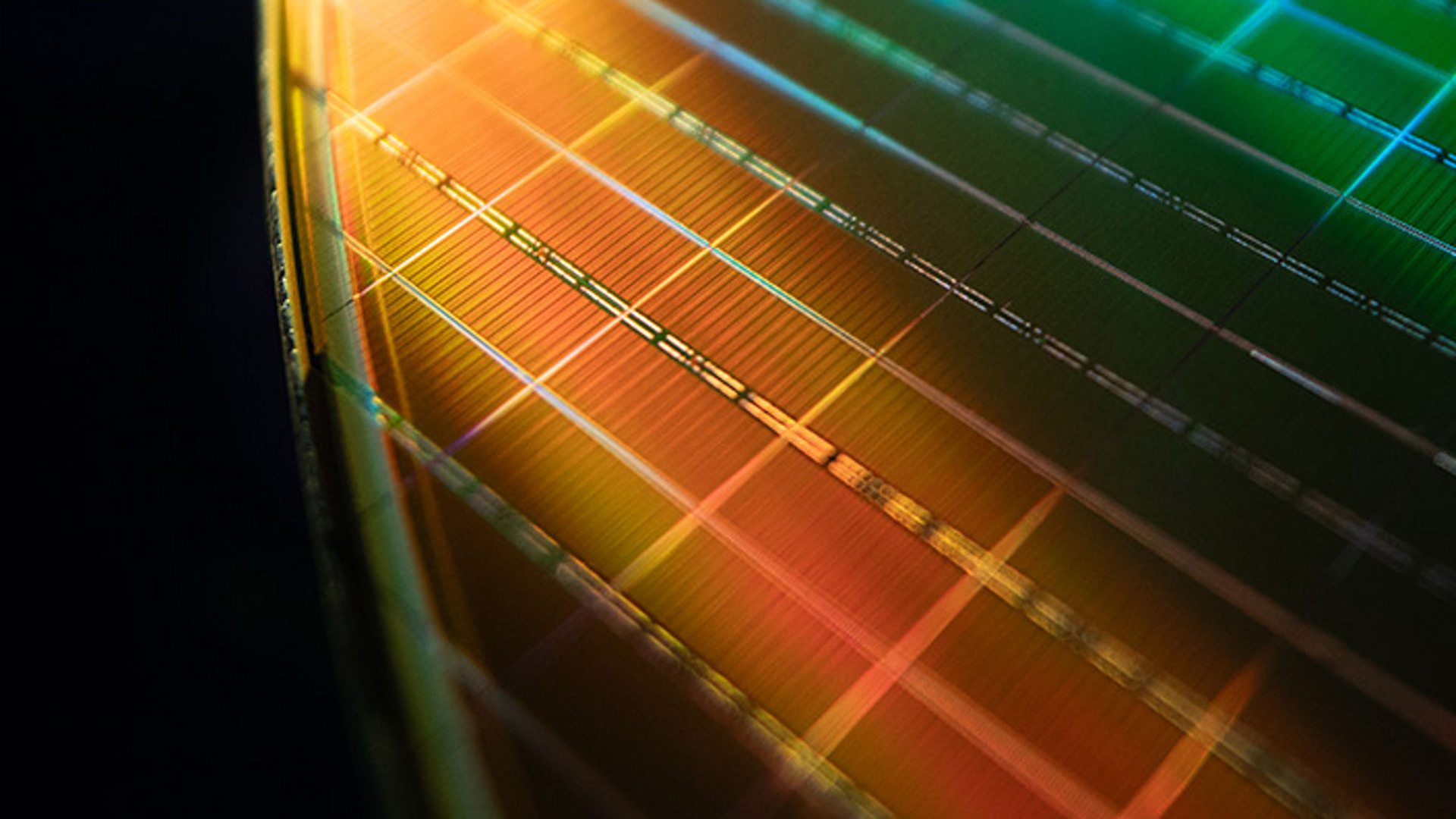

Japan and South Korea supply the U.S. with a variety of high-tech products, including cars, consumer electronics, wafer fab equipment, and semiconductors.

From Japan, the U.S. imports 3D NAND, advanced chipmaking equipment, automotive electronics, high-precision sensors, lithium-ion batteries, medical imaging systems, microcontrollers, and industrial equipment, just to name some. Major Japanese firms like Canon, Tokyo Electron, Renesas, and Kioxia provide tools and components used in everything from semiconductor fabs to electric vehicles and from consumer electronics medical devices. In fact, U.S.-based SanDisk produces DRAM 3D NAND at the same fabs as Kioxia, so the tariffs will hit the American company badly

South Korea's exports to the U.S. are led by memory chips (DRAM, NAND) from Samsung and SK hynix, which are used in consumer electronics, PCs, and servers (including AI servers) Additionally, South Korea ships OLED and LCD panels, smartphones, televisions, and lithium-ion batteries used in consumer electronics and electric vehicles. These imports are vital to American tech giants and automakers, meaning new tariffs on such goods could disrupt supply chains, raise costs, and slow sales across multiple sectors.

Trump noted that goods transshipped to evade a higher tariff will be subject to that higher tariff. For example, if a Korean company sends its products to, say, Vietnam first and then re-exports them to the U.S. labeled as 'Made in Vietnam' (a common transshipment tactic), the U.S. will still treat those goods as Korean and apply the 25% tariff. What remains to be seen is what happens to products based on chips from Japan or South Korea, yet assembled in other countries, such as China. Under U.S. laws, the country where a product underwent its final significant transformation is deemed the country of origin. However, we can only wonder whether the rules will be changed.

President Trump warned that any attempt by Japan and South Korea to retaliate with their own tariff hikes will be met with matching increases on top of the new 25%. However, companies from Japan or South Korea that choose to manufacture products within the United States will be exempt from these duties. The letters promise that regulatory approvals for such operations will be handled quickly and efficiently within weeks.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.