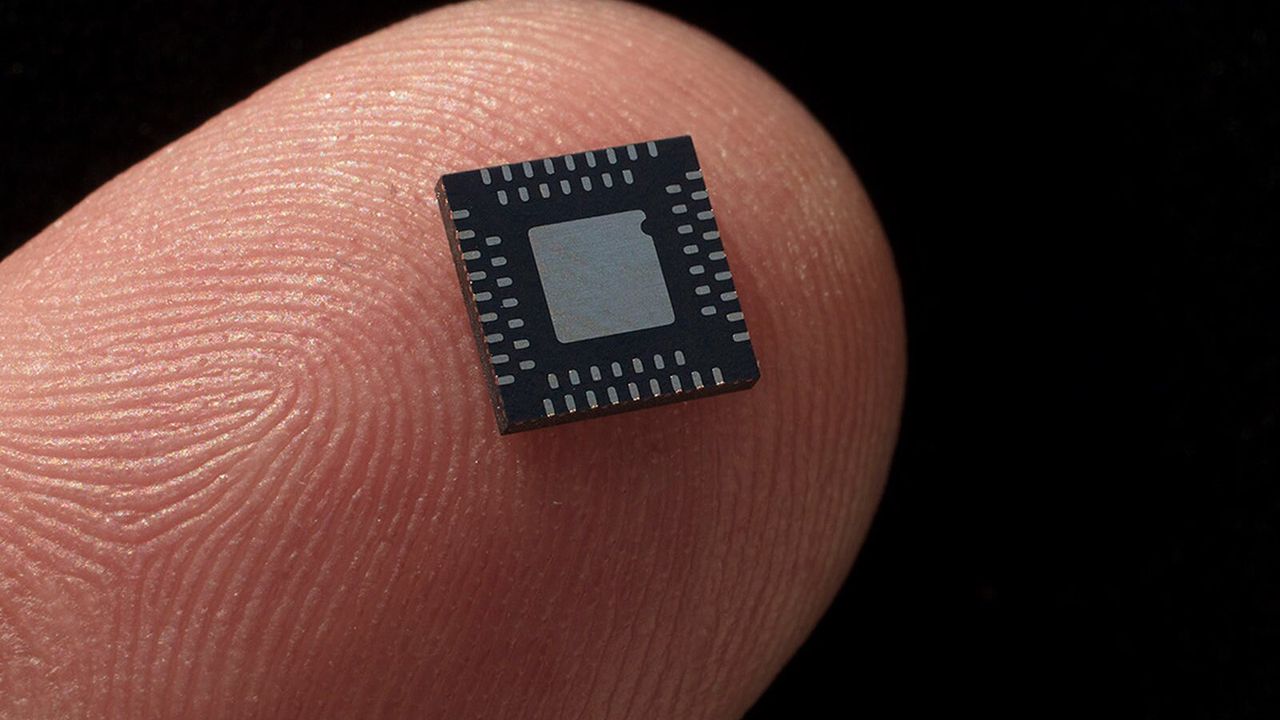

The U.S. government is evaluating a plan to tax imported electronics based on the number of chips they contain and their estimated value within the device, according to Reuters. This plan, which is still under internal review, could impact everything from basic gadgets like the Apple Watch to high-end servers, marking a shift toward chip-specific trade penalties. However, there are obvious difficulties associated with implementing such tariffs.

The proposed system would calculate tariffs as a percentage of the estimated value of semiconductors within a product. A preliminary version under consideration suggests rates of 25% for chip-dense imports and 15% for devices originating from Japan or the EU. Although still uncertain, the numbers indicate a shift toward creating a tiered tariff system based on origin and chip usage intensity.

In addition, the Trump administration is also working on a policy that would require chipmakers to produce one chip in the U.S. for every one they import into the country, or face steep tariffs, potentially as high as 100%. The plan ties tariff exemptions to actual production volumes in terms of unit count. However, the proposed 1:1 import-to-domestic ratio raises serious feasibility concerns due to the wide variation in chip types, from low-cost smartphone system-on-chips to high-end AI processors, making accurate tracking and fair enforcement difficult.

Major chipmakers outside the U.S., such as TSMC and Samsung, would be particularly exposed under the current draft of the plan, as while both companies have production capacities in the U.S., their production capacity in Taiwan and South Korea is dramatically bigger, and it hardly makes sense for them to match their American and domestic capacities.

Inflation concerns

Both policies aim to encourage (or rather, force?) chipmakers and chip designers to produce more chips in the U.S. However, such policies may create their own set of problems. Critics warn that the plan could exacerbate inflation, particularly given the current price pressures in the U.S. economy. Since chips are embedded in all electronic devices (even cheap kettles), a wide range of consumer products could become more expensive. Economists note that even goods assembled domestically might carry higher price tags due to increased costs of foreign components.

Sources familiar with the matter told Reuters the White House is opposed to broad exemptions, viewing them as weakening the intended pressure on industry players to localize operations. Apparently, while chip-making lithography tools from ASML are currently exempt from tariffs, the Commerce Department is at least considering tariffs on chip-making equipment, which could increase the costs of fabs in the U.S.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button!