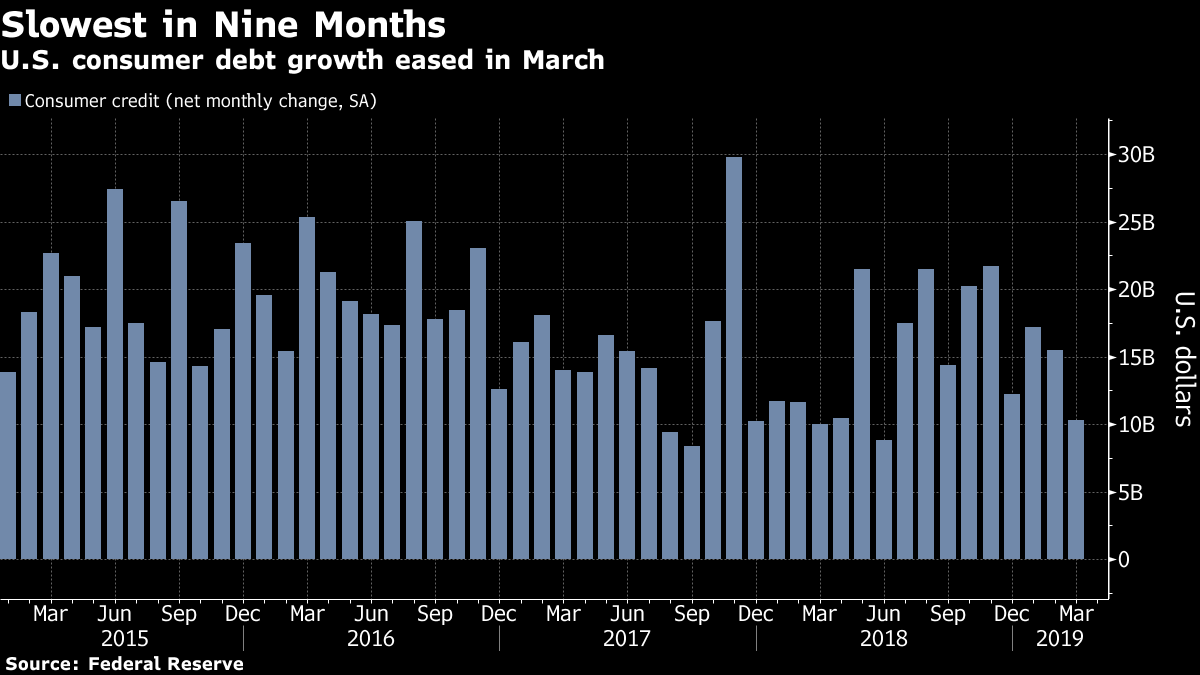

U.S. consumer debt growth eased in March with the smallest increase in nine months, suggesting Americans were less motivated to spend despite the strong labor market.

Total consumer credit rose $10.3 billion from the prior month, missing all economist estimates in Bloomberg’s survey, after an upwardly revised $15.5 billion gain in February, Federal Reserve figures showed Tuesday. Revolving debt outstanding fell for the second time in four months while non-revolving credit advanced.

Key Insights

- The increase, while unexpectedly weak, still points to an upbeat consumer. A healthy employment market along with steady wage gains will likely help households maintain spending in the coming months despite a soft start to 2019.

- A separate report last week showed the labor market remains robust, with job growth topping estimates in April as the unemployment rate hit a fresh 49-year low.

- Revolving credit outstanding, which includes credit card debt, decreased $2.18 billion after a $3.08 billion rise the prior month, indicating consumers ended the quarter more cautious about some borrowing.

- Non-revolving debt outstanding climbed $12.5 billion after $12.4 billion. Such debt includes loans for school and autos.

Get More

- Credit expanded at a 3.1 percent annual rate after growing 4.6 percent in February.

- Economists surveyed by Bloomberg had projected the credit gauge would rise by $16 billion.

- Lending by the federal government, which is mainly for student loans, rose by less than $1 billion before seasonal adjustment.

- The consumer credit report doesn’t track debt secured by real estate, such as home equity lines of credit and home mortgages.

--With assistance from Jordan Yadoo and Zoe Schneeweiss.

To contact the reporter on this story: Reade Pickert in Washington at epickert@bloomberg.net

To contact the editors responsible for this story: Scott Lanman at slanman@bloomberg.net, Jeff Kearns

©2019 Bloomberg L.P.