Valued at a market cap of $23.1 billion, Tyson Foods, Inc. (TSN) is a leading multinational food company and one of the world’s largest producers of animal protein. The company was founded in 1935 and is headquartered in Springdale, Arkansas. It operates across four core segments: chicken, beef, pork, and prepared foods, producing fresh, frozen, and ready-to-eat products sold to retail, foodservice, and wholesale customers worldwide.

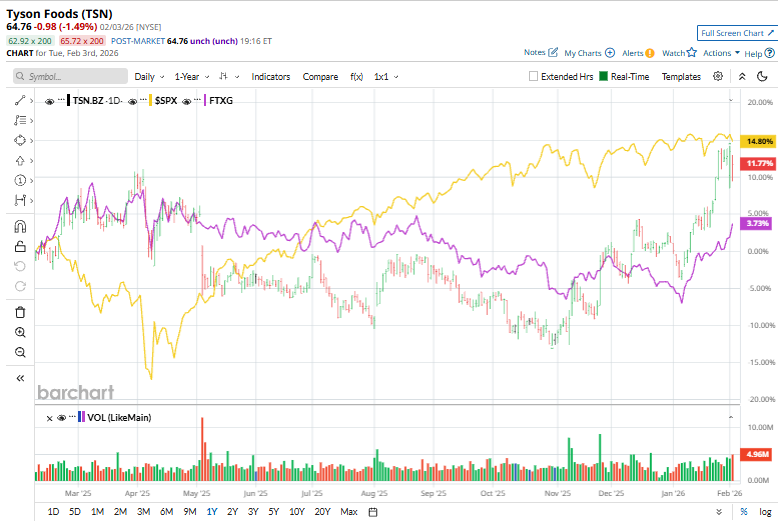

This food giant has considerably underperformed the broader market over the past 52 weeks. Shares of TSN have soared 12.2% over this time frame, while the broader S&P 500 Index ($SPX) has surged 15.4%. However, on a YTD basis, the stock is up 10.5%, compared to SPX’s 1.1% uptick.

Zooming in further, TSN has surpassed the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 2.1% rise over the past 52 weeks and 8.9% on a YTD basis.

On Feb. 2, Tyson Foods released its fiscal 2026 first-quarter earnings, and its shares dipped 1.5% as investors reacted to weaker profitability despite solid revenue growth. The company reported $14.31 billion in sales, up 5.1% year over year, but gross profit declined to $808 million. Its adjusted EPS of $0.97 beat expectations, and cash flow from operating activities remained strong at $942 million.

For the current fiscal year, which ends in September, analysts expect TSN’s EPS to grow 4.1% year over year to $3.95. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

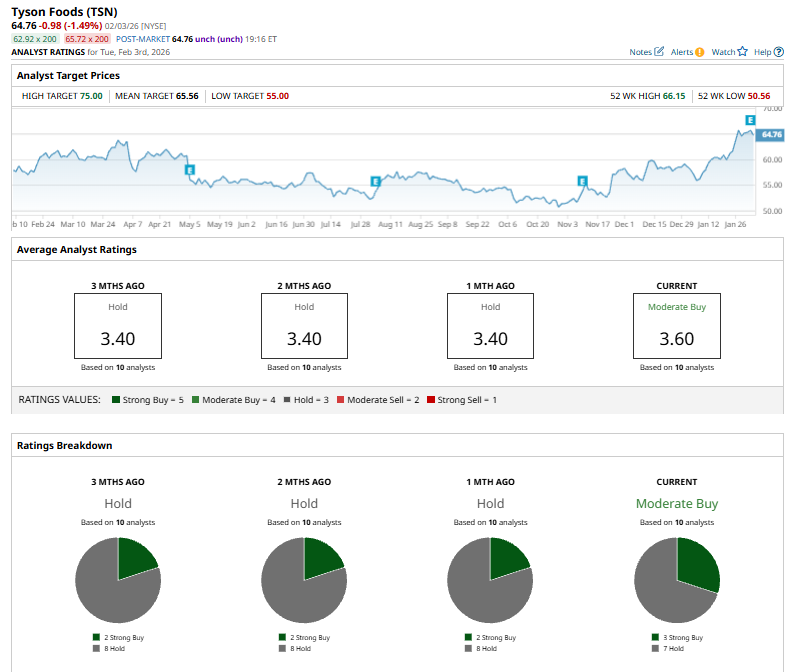

Among the 10 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on three “Strong Buy” and seven “Hold” ratings.

The current consensus rating is bullish than a month ago when the stock had an overall “Hold” rating.

On Feb. 3, Andrew Strelzik of BMO Capital Markets reaffirmed his “Outperform” rating on Tyson Foods and raised his price target from $67 to $73, an increase of about 9%, signaling continued confidence in the company’s growth prospects and future performance.

The mean price target of $65.56 represents a 1.2% premium from TSN’s current price levels, while the Street-high price target of $75 suggests an upside potential of 15.8%.