Tyson Foods, Inc. (TSN), headquartered in Springdale, Arkansas, is a global leader in food processing, specializing in chicken, beef, and pork products. Its expansive operations include supplying high-quality protein to retail and food service markets across more than 80 countries.

With a market capitalization of $18.28 billion, Tyson Foods has announced new product launches and strategic investments to strengthen its market position and drive future growth, demonstrating a commitment to innovation and sustainability.

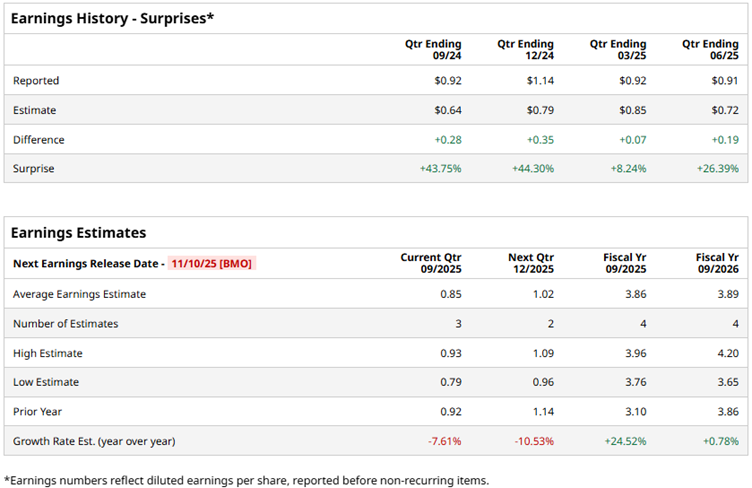

Tyson Foods is set to report its fourth-quarter results for fiscal 2025 on Nov. 10 before the market opens. Ahead of the results, Wall Street analysts have a mixed view about the company’s bottom-line growth trajectory.

For the quarter about to be reported, analysts expect Tyson Foods’ profit to decline by 7.6% year-over-year (YOY) to $0.85 per diluted share. On the other hand, for the current fiscal year, profit is projected to climb 24.5% annually to $3.86 per diluted share. It should also be noted that the company has a solid history of beating consensus estimates in each of the trailing four quarters.

The company is facing pressures such as tight supply and rising costs, including an agreement to pay $85 million to settle a lawsuit alleging the company colluded with rivals to inflate pork prices by limiting supply.

As a result, Tyson Foods’ stock has been underperforming the broader market. Over the past 52 weeks, the stock has dropped by 11.2%, and it is down 9.3% year-to-date (YTD), while the broader S&P 500 Index ($SPX) has gained 18.4% and 16.9% over the same periods, respectively.

Comparing it with the Consumer Staples Select Sector SPDR Fund (XLP), we see that the ETF has dropped 2.3% over the past 52 weeks and has marginally gained YTD. Therefore, Tyson Foods has underperformed its sector over these periods.

On Aug. 4, Tyson Foods reported its third-quarter results for fiscal 2025 (the quarter that ended on June 28). As the earnings topped estimates, the company’s stock gained 2.4% intraday on the same day. Its Q3 revenue increased by 4% YOY to $13.88 billion. Its adjusted EPS of $0.91 increased 4.6% from the prior year’s period and surpassed the analysts’ estimated figure of $0.72.

Wall Street analysts are cautious about Tyson Foods. Among the ten analysts covering the stock, the consensus rating is “Hold.” The ratings configuration is more bearish than it was a month ago, with the addition of one “Strong Sell” rating. The ratings are completed by two “Strong Buys” and seven “Holds.”

The mean price target of $59.90 indicates a 15% upside from current levels, while the Street-high price target of $75 implies a 44% upside.