/Tyler%20Technologies%2C%20Inc_%20website%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Tyler Technologies, Inc. (TYL), headquartered in Plano, Texas, is a prominent public-sector technology company. It delivers a broad suite of software and IT solutions designed to support government functions, ranging from financial and education systems to courts, public safety, tax and appraisal, land records, planning, and civic services. Its market capitalization stands at $24.1 billion, underscoring its significant valuation in the public-sector software market.

Shares of Tyler Technologies slipped 3.5% on a year-to-date (YTD) basis, underperforming the S&P 500 Index’s ($SPX) 10.6% YTD gains in 2025. Over the past 52 weeks, TYL has declined 4.3%, while the SPX has delivered 16.3% returns.

Zooming in further, TYL stock is also lagging behind the SPDR S&P Software & Services ETF (XSW), which is up 1% in 2025, and has surged 23.4% over the past 52 weeks.

Despite stable financial results, TYL stock has underperformed the broader market. The primary headwind stems from its heavy reliance on government procurement cycles and public budgets, which remain prone to timing delays and policy shifts, creating uncertainty around near-term revenue visibility.

For the current fiscal year, ending in December 2025, analysts expect Tyler Technologies to report EPS growth of 14.6% year-over-year to $8.69, on a diluted basis. The company has an impressive earnings surprise history. It has topped the Street’s bottom-line estimates in each of the past four quarters.

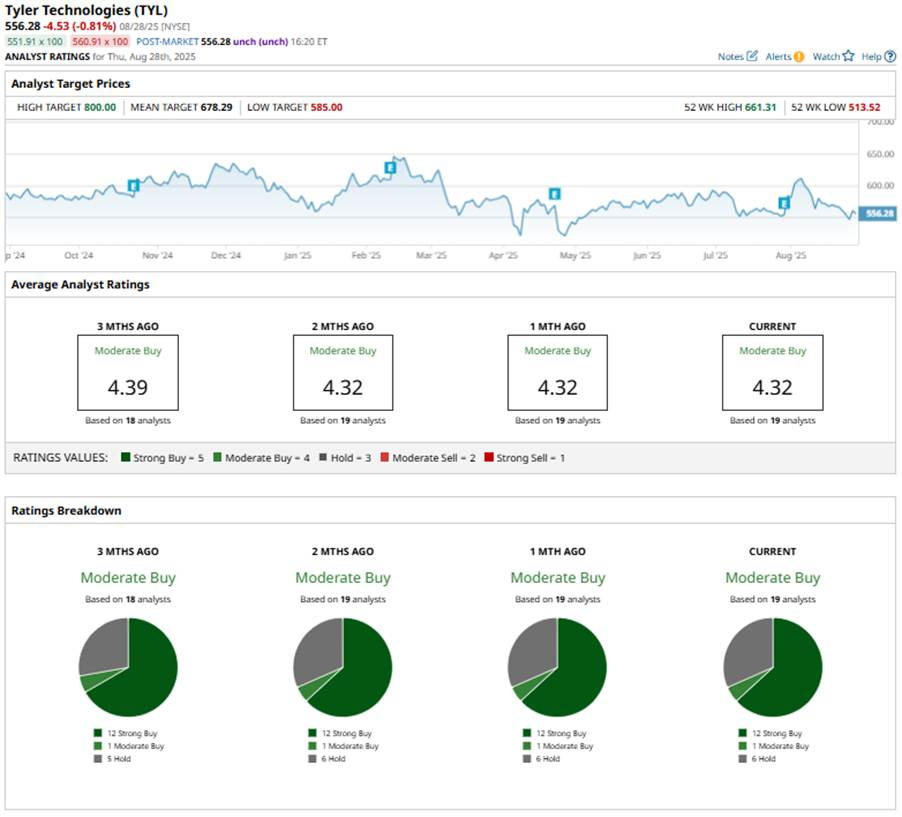

Overall, Wall Street appears cautiously bullish about TYL stock, with a consensus “Moderate Buy” rating. Of the 19 analysts offering recommendations, 12 suggest a “Strong Buy,” one maintains a “Moderate Buy,” and the remaining six are playing it safe with a “Hold” rating.

The current configuration has mainly remained consistent over the past few months.

Earlier this month, DA Davidson raised TYL’s price target to $585 from $570 while maintaining a “Neutral” rating after the company’s strong Q2 results. However, the firm described the move as only a “nudging” of its target rather than a bullish shift. On the other hand, JMP Securities reiterated its “Market Outperform” rating and $700 price target following the earnings release.

The mean price target of $678.29 represents a premium of 21.9% to TYL’s current price. The Street-high price target of $800 suggests an upside potential of 43.8%.