Kenvue (KVUE) could really use some good news. The Johnson & Johnson (JNJ) spinoff faced longlasting troubles regarding its talc-based baby powder products, including allegations that they caused cancer and related lawsuits.

Now, the consumer health giant faces new troubles as President Donald Trump has accused its Tylenol product of increasing autism when used in pregnancy.

However, Kenvue is not backing off and taking the accusations head-on. In a submission to the Food and Drug Administration (FDA), the company said, “The expansive scientific evidence developed over many years does not support a causal link [between Tylenol use and autism], as confirmed in the Food and Drug Administration’s own public statements. For over a decade, and as recently as August, FDA has fully evaluated the emerging scientific evidence and repeatedly concluded that the data do not support a causal association.”

Kenvue stock has faced tough trading action for its whole life as a separately traded unit. Its shares are down more than 22% over the past two years and 30% in the year to date.

About Kenvue

Kenvue is a pure-play consumer health company with well-known brands such as BAND-AID, Tylenol, Neutrogena, Listerine, Aveeno, Johnson’s Baby, Zyrtec, and others in its stable. The company purportedly has a consumer base of about a billion in 165 countries and has a market cap of roughly $28.7 billion.

On a YTD basis, KVUE stock is down about 30%. However, the stock offers a dividend yield of 5.4%, which is more than double the sector median of 2.5%.

Yet, the sustainability of the dividend is questionable, as with a payout ratio of almost 75% and falling earnings, the scope for growth remains limited.

So, what should you make of KVUE stock? Is it all doom and gloom, or can Kenvue make a comeback? A look at its financial, strategic, and operational situation can give us an idea.

Financials Are Not as Bad as the Sentiment

Kenvue’s revenue and earnings decreased from the previous year. In fact, over the past two years, Kenvue’s earnings have witnessed a yearly decline.

However, Kenvue has been fairly consistent in beating estimates. In the most recent quarter, Kenvue reported earnings per share of $0.29, beating estimates of $0.28.

Net cash flow from operating activities was another bright spot, coming in at $1 billion for the first six months of 2025, significantly higher than the previous year’s figure of $727 million. Overall, Kenvue closed the quarter with a cash balance of $1.07 billion, lower than its short-term debt levels of $1.55 billion. The gap may not look material now, but the company should take steps to mitigate the decline in revenue and earnings so that its liquidity situation does not get out of hand.

Kenvue Has Been Here Before and Survived

What should give shareholders confidence is that Kenvue’s Tylenol was at the center of negative headlines before. In the 1980s, seven people died after taking cyanide-laced Tylenol. But the company is still here (and now spun off from Johnson & Johnson), and so is Tylenol, with no less than a billion dollars of sales last year.

This is because Tylenol continues to stand out as a preferred over-the-counter option for pain relief in the U.S. and many other countries, backed by decades of reliable performance and user confidence. For decades, medical professionals have turned to it first for tackling everyday pains or fevers, which has built up a brand following that’s a real hurdle for anyone trying to step in.

Kenvue, meanwhile, spreads its wings globally, balancing out its footprint across different regions and lines of business to better weather economic shifts. This kind of setup lets the company bring fresh products to market more nimbly and get them circulating worldwide with less friction. Driving that forward is a strong international R&D operation, pulling together 1,600 experts across science, healthcare, pharmacy, and engineering, giving it the heft for faster iteration and development of products.

Finally, the true strength of Kenvue’s position rests on how effortlessly its products have become embedded in consumers’ everyday habits. These span core areas such as personal hygiene, skincare, cosmetics, and essential categories like oral health and infant care. As staples in routine use, the brands have achieved deep market penetration and strong consumer endorsement. This foundation allows Kenvue to maximize revenue potential from its well-established portfolio.

Analyst Opinions

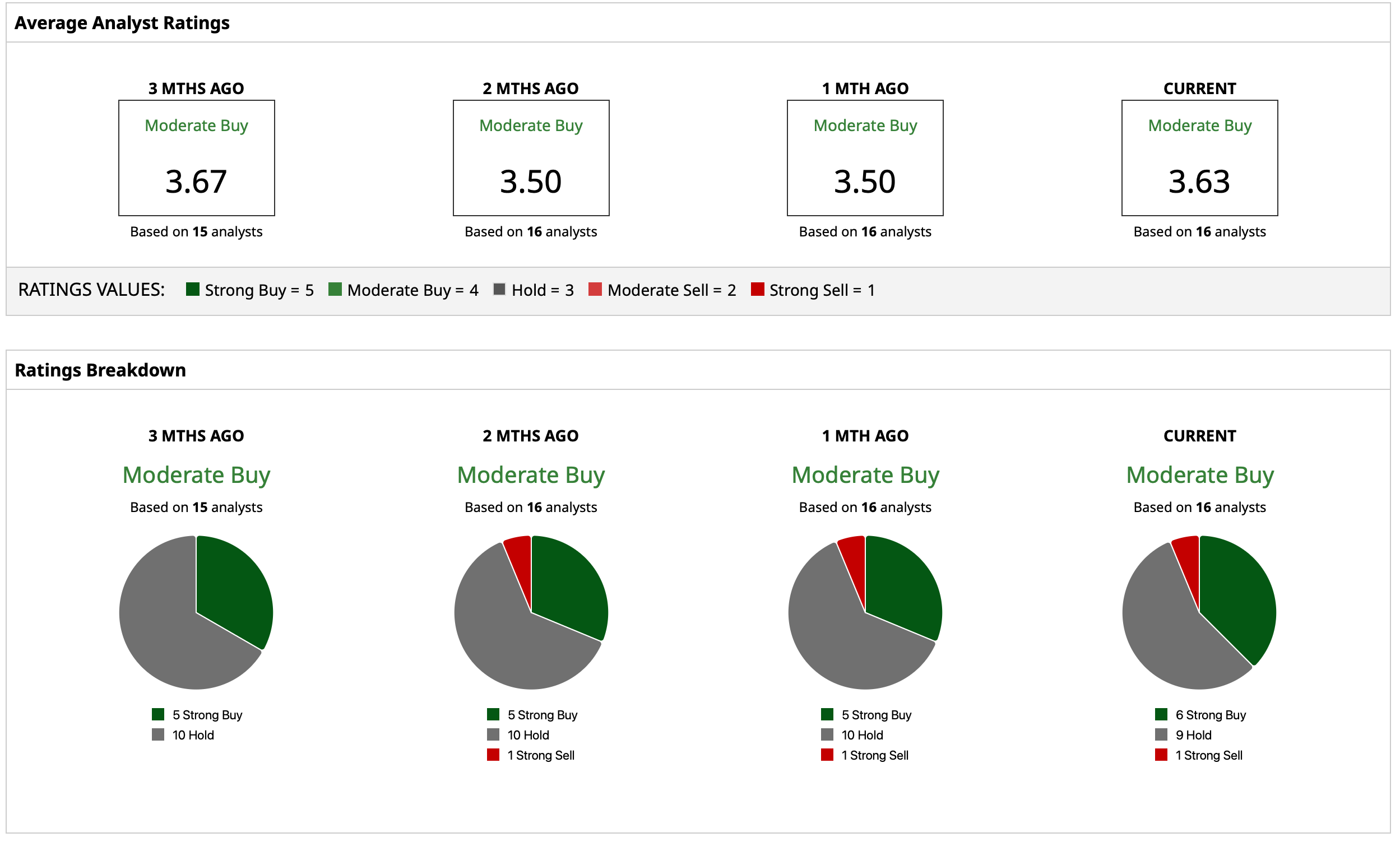

Analysts remain cautiously optimistic about KVUE stock, attributing to it a rating of “Moderate Buy” with a mean target price of $20.36. This indicates upside potential of about 32% from current levels. Out of 16 analysts covering the stock, six have a “Strong Buy” rating, nine have a “Hold” rating, and one has a “Strong Sell” rating.