Even as President Donald Trump said that the U.S. won’t share Nvidia Corp.‘s (NASDAQ:NVDA) “advanced” chips with China, Microsoft Corp. (NASDAQ:MSFT) CEO Satya Nadella has revealed that the primary bottleneck for AI growth is no longer the supply of GPUs but a lack of power and data center infrastructure.

Not GPUs, Power Is The Evolving Issue In AI Arms Race

Speaking on the Bg2 podcast, Nadella provided a stark, real-world correction to the common narrative that a chip shortage is holding back AI. He explained that the physical buildout of new data centers and, more importantly, securing the power for them, is the real constraint.

“The biggest issue we are now having is not a compute glut, but it’s a power and it’s sort of the ability to get the builds done fast enough close to power,” Nadella said.

He confirmed this is not a theoretical problem but Microsoft’s current reality. “If you can’t do that, you may actually have a bunch of chips sitting in inventory that I can’t plug in. In fact, that is my problem today.”

Nadella stated, “It’s not a supply issue of chips. It’s actually the fact that I don’t have warm shells to plug into.”

Trump Refuses To Share NVDA’s Cutting-Edge Tech

Meanwhile, while speaking to CBS‘s Norah O'Donnell on Oct. 31, the president said that while the U.S. administration would let NVDA deal with China, “but not in terms of the most advanced.”

Adding that the administration “will not let anybody have them other than the United States.”

Azure Cloud Impacted Due To Lack Of Compute Capacity

This infrastructure crunch has had a direct impact on Microsoft’s cloud growth. Nadella confirmed on the company’s recent earnings call that its Azure cloud platform would have grown even faster if it had more compute capacity.

His comments on the podcast pinpoint that this capacity is now limited by physical infrastructure, not silicon.

See Also: Jeff Bezos Touts Data Centers In Space As Samsung And OpenAI Plan Floating Data Centers In The Ocean

Experts Tout Data Centers In Space Amid Power Shortage

The admission by Nadella shifts the focus from the complex manufacturing of semiconductors to the equally challenging logistics of construction, energy grids, and real estate.

Venture capitalist Chamath Palihapitiya warned that strain on power grids could mean “electricity rates will double in the next five years.” He proposed orbital data centers to harness 24/7 solar power and space vacuum for cooling.

Amazon’s Jeff Bezos echoed this, predicting orbital facilities could become cost-competitive within two decades. "We have solar power there, 24/7," Bezos said. "There are no clouds and no rain, no weather."

MSFT Returns Nearly 24% In 2025

While MSFT closed 1.51% lower on Friday, it has delivered 23.71% year-to-date returns and 26.77% over the past year.

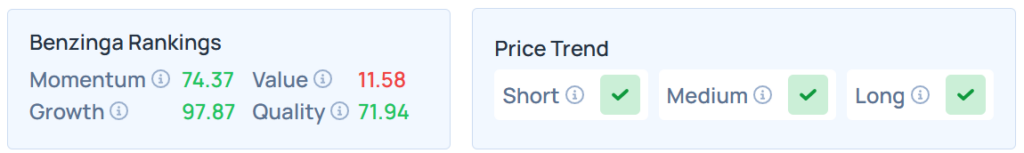

Benzinga’s Edge Stock Rankings indicate that MSFT maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Here are some energy sector ETFs to consider on rising energy demand.

| Energy Sector ETFs | YTD Performance | One Year Performance |

| Energy Select Sector SPDR Fund (NYSE:XLE) | 1.70% | -1.61% |

| Vanguard Energy Index Fund ETF (NYSE:VDE) | 1.43% | -0.33% |

| Fidelity MSCI Energy Index ETF (NYSE:FENY) | 1.28% | -0.37% |

| iShares Global Clean Energy ETF (NASDAQ:ICLN) | 49.14% | 28.62% |

| Alerian MLP ETF (NYSE:AMLP) | -4.27% | -0.32% |

| First Trust Natural Gas ETF (NYSE:FCG) | -10.75% | -5.36% |

| VanEck Oil Services ETF (NYSE:OIH) | 2.72% | 2.78% |

On Friday, all three indices advanced with the S&P 500 up 0.26%, while the Nasdaq 100 and Dow Jones rose 0.48% and 0.09%, respectively. On Monday, the futures of all three indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image created using artificial intelligence via DALL-E.