Deere & Co. (NYSE:DE) is navigating significant economic headwinds by focusing on internal discipline, company executives said Thursday, as it revealed that tariffs enacted under the Donald Trump administration are now expected to cost the company nearly $600 million this fiscal year.

Check out DE’s stock price over here.

Deere Tightens Profit Forecast

Speaking on its third-quarter earnings call, management outlined a strategy of aggressively reducing equipment inventories to match market demand while managing costs.

This approach comes as the agricultural and construction giant reported a 9% decline in net sales to $12.018 billion amid challenging market dynamics and customer uncertainty. The company has now tightened its full-year net income forecast to a range of $4.75 billion to $5.25 billion, compared to its previous forecast of $4.75 billion to $5.50 billion.

Inventory Drawdowns To Mitigate Tariff Impact

The core of Deere's strategy is a sharp focus on operational efficiency. “The best way for us to function as a business during times like these is to focus on what we can control, namely execution items like production, inventory levels and cost,” said Josh Beal, Director of Investor Relations.

This strategy is evident in the significant drawdown of inventory. In North America, inventories of large tractors are down 45% year-over-year, while combine inventories have been cut by 25%.

Cory J. Reed, a Deere president, emphasized the proactive nature of these cuts, stating the company has “intentionally and proactively responded to this downturn faster and more aggressively than ever before.”

See Also: Mortgage Rates Hit 10-Month Low, Giving Trump More Ammo To Push Fed For Aggressive Cuts

Pockets Of Global Strength Fuel Optimism

Despite the tariff impact and a cautious North American market, Deere noted “pockets of optimism,” raising its outlook for markets in Europe and Asia.

CFO Joshua A. Jepsen expressed confidence that the company's disciplined approach has it well-positioned for the future, stating, “We’ve done the hard work to enable continued success going forward.”

Price Action

Deere stock fell 6.79% on Thursday after the results and rose 0.18% in after-hours. The stock was up 14.51% year-to-date and 28.29% over a year.

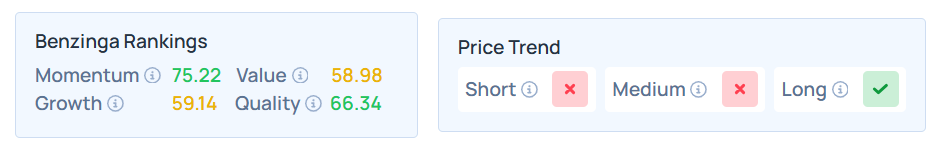

Benzinga's Edge Stock Rankings indicate that DE maintains a stronger price trend in the long term but a weaker trend in the short and medium terms. However, the stock scores well on quality rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended mixed on Thursday. The SPY was up 0.0093% at $644.95, while the QQQ declined 0.078% to $579.89, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock