U.S. President Donald Trump's son-in-law, Jared Kushner, was reportedly instrumental in brokering the $55 billion take-private deal for Electronic Arts (NASDAQ:EA), and his investment company will own a 5% stake in the video game publisher.

Leveraged Strong Ties To Saudi As Envoy

Kushner, who is married to Trump's eldest daughter, Ivanka, teamed up with Egon Durban, who co-heads tech-focused private equity firm Silver Lake, to approach the FIFA publisher with a firm bid a month ago, according to a report by the Financial Times.

Kushner convinced Saudi Arabia's Public Investment Fund (PIF) to go for the take-private offer, according to the FT, in a sign of the strong ties he built in Saudi Arabia as an envoy during Trump's first presidency. Kushner's investment fund, Affinity Partners, is backed by PIF, which has been heavily investing in technology companies.

Affinity will end up owning about 5% of EA, the FT reported, while PIF will become the majority owner, followed by Silver Lake, which will be a large minority shareholder.

Could Invest More In Growth

The all-cash deal, one of the largest in the gaming sector, is backed by $36 billion in equity and $20 billion in debt from U.S. lender JPMorgan.

The consortium plans to invest additional money into EA or borrow more money to fund acquisitions, the FT report added.

Analysts reckon the company’s outlook hinges on the performance of its popular titles, although newer releases have lagged.

EA Price Action

The deal for Battlefields and Apex Legends maker EA, which was announced on Monday, sent its shares up as much as 5.3% to $203.75 a piece. The stock was up marginally in early trading on Tuesday.

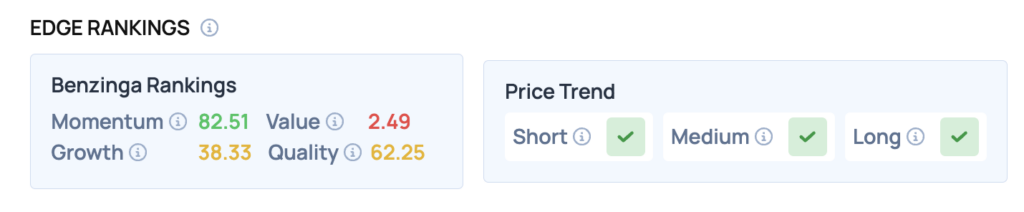

EA shows strong Momentum but struggles in Growth. However, its Short, Medium and Long-term outlook remains promising. Get deeper insights with Benzinga Edge Stock Rankings today!

Image via Shutterstock