President Donald Trump announced that new “reciprocal tariffs” have taken effect, claiming the move will bring billions of dollars into the U.S. from countries that have long taken advantage of it.

What Happened: Trump also issued a warning, suggesting that the only threat to new fiscal policy would be intervention from “a radical left court that wants to see our country fail.”

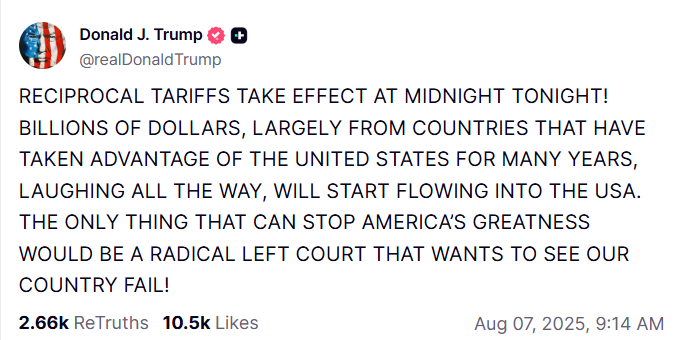

In a series of posts on his social media platform, Truth Social, Trump first declared, “Reciprocal tariffs take effect at midnight tonight! Billions of dollars, largely from countries that have taken advantage of the United States for many years, laughing all the way, will start flowing into the USA.”

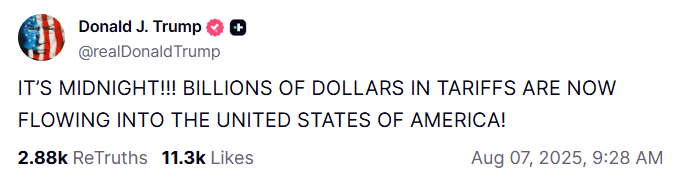

He then added the warning about potential judicial interference. A subsequent post after midnight confirmed the action, stating, “It’s midnight!!! Billions of dollars in tariffs are now flowing into the United States of America!”

Trump’s mention of “a radical left court” suggests his administration is anticipating legal challenges to the new trade policy.

In May, the Court of International Trade ruled that imposing tariffs exceeded his executive powers. During a hearing at the U.S. Court of Appeals for the Federal Circuit in Washington, judges expressed continued doubt about the legality of those actions.

Following that, the U.S. Court of Appeals for the Federal Circuit also heard oral arguments on July 31 in the case. However, it has not said when it will issue a decision

Why It Matters: The “reciprocal tariffs” are a key component of Trump’s economic policy, designed to level the playing field for American companies by imposing tariffs equal to those placed on U.S. goods by other countries.

However, the early signs of tariff-driven inflation had sparked a controversial debate as U.S. businesses are now sending a clear message—price pressures are mounting fast, and inflation is making a comeback.

This surge in costs is occurring alongside signs of stagnation and contraction in other economic metrics, indicating that the U.S. economy may be transitioning into a phase of stagflation—a period of slowing growth and rising prices.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Thursday. The SPY was up 0.46% at $635.72, while the QQQ advanced 0.49% to $570.12, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editor

Image Credit: The Burlington Free Press-Imagn Images