AT&T Inc. (NYSE:T) is poised for significant growth and investment, attributing much of its optimistic outlook to the recently passed One Big Beautiful Bill Act.

Check out the current price of AT&T stock here.

What Happened: During its second-quarter 2025 earnings call, company executives detailed how the pro-investment provisions of Donald Trump’s legislation are directly fueling an acceleration in their 5G and fiber network expansion, alongside substantial commitments to its workforce.

John Stankey, AT&T’s Chairman and CEO, highlighted the profound impact of the new policy and said, “We intend to invest more rapidly in next generation networks.”

“Investment and policy tailwinds are as strong as I can remember since maybe the Telecommunications Act of 1996.” He emphasized that this favorable environment provides the confidence to reinvest the benefits gained strategically.

The company plans to significantly ramp up its fiber deployment, targeting a pace of 4 million new locations per year by the end of 2026. This accelerated build-out is expected to reach approximately 50 million customer locations and over 60 million total fiber locations by the end of 2030, a considerable increase from its current 30 million.

“This will support good-paying middle-class jobs all right here in the US,” Stankey added, underscoring the bill’s contribution to job creation.

Furthermore, the One Big Beautiful Bill Act provides AT&T with substantial cash tax savings, estimated between $6.5 billion and $8 billion from 2025 through 2027.

Pascal Desroches, AT&T’s CFO, confirmed the allocation of these savings, stating, “We intend to contribute $1.5 billion to our pension plan by the end of next year.” This move aims to elevate the plan’s funded status to approximately 95% and fully fund it by the early part of the next decade.

Why It Matters: AT&T reported revenue of $30.80 billion, exceeding the consensus estimate of $30.45 billion. Adjusted earnings per share stood at $0.54, also beating the analyst forecast of $0.52.

The telecom company reiterated its full-year 2025 financial outlook, anticipating consolidated service revenue growth in the low single-digit range. Adjusted EPS is forecast to be between $1.97 and $2.07, aligning with the analyst consensus estimate of $2.06.

Price Action: AT&T shares rose 1.20% on Wednesday. The stock was up 21.55% year-to-date and 44.83% higher over the past year.

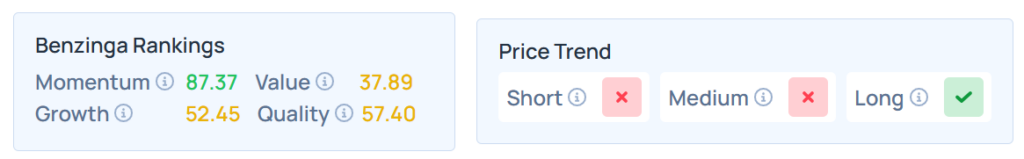

Benzinga Edge Stock Rankings show that AT&T had a stronger price trend over the long term but a weaker trend over the short and medium terms. Its momentum ranking was solid, but its value ranking was moderate at the 37.89th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Wednesday. The SPY was up 0.85% at $634.21, while the QQQ advanced 0.46% to $563.81, according to Benzinga Pro data.

On Thursday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jason Taylor AG via Shutterstock