In a recent statement, it has been revealed that if President Trump secures a victory in the upcoming election, he intends to implement policies aimed at relieving Wall Street from what he deems as 'burdensome regulations.'

This announcement has sparked discussions and debates among various stakeholders, as the financial industry plays a crucial role in the overall economy. Supporters of deregulation argue that reducing restrictions on Wall Street could lead to increased investment, economic growth, and job creation. On the other hand, critics express concerns about the potential risks associated with loosening regulations, citing the 2008 financial crisis as a cautionary tale.

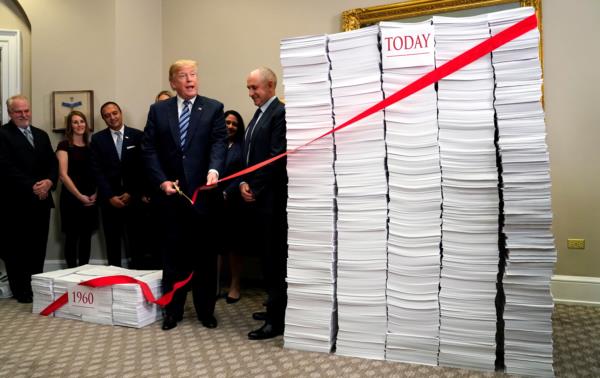

President Trump's stance on financial regulations has been a focal point of his administration, with efforts made to roll back certain provisions of the Dodd-Frank Act, a key piece of legislation enacted in response to the financial crisis. The administration has argued that these regulations stifle innovation and hinder economic progress.

If re-elected, President Trump's plans to further deregulate Wall Street could have far-reaching implications for the financial sector and the broader economy. Proponents believe that such measures could unleash the potential of the financial industry, while opponents warn of the dangers of repeating past mistakes.

As the election draws near, the future of financial regulation in the United States remains uncertain. The outcome of the election will likely shape the direction of policy in this critical area, impacting not only Wall Street but also Main Street and the American public as a whole.