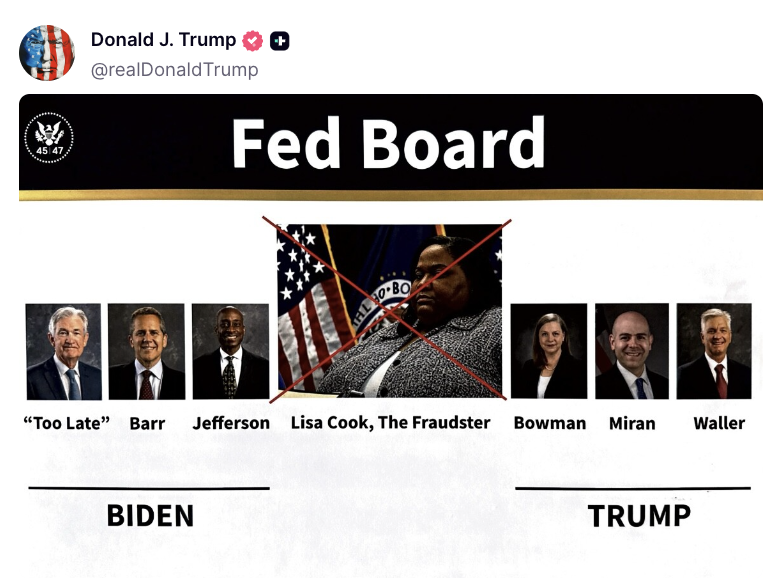

President Donald Trump escalated his Federal Reserve confrontation Friday, threatening to fire Governor Lisa Cook while mocking Chair Jerome Powell as “Too Late” in a Truth Social post that divided Fed board members into opposing camps.

Trump’s Fed Board Divide Graphic Sparks Market Attention

Trump shared an image dividing Federal Reserve officials into camps aligned with former President Joe Biden versus those siding with him. Powell, whom Trump originally appointed as Fed Chair in 2018, earned the “Too Late” label referencing his delayed rate cut timing, while Cook received a prominent red “X” marked “The Fraudster.”

The graphic positions Trump appointees Christopher Waller, Michelle Bowman and nominee Stephen Miran as administration allies. This comes as markets price in September rate cuts following Powell’s dovish Jackson Hole speech that sparked broad rallies across equities and cryptocurrencies.

Cook Mortgage Controversy Intensifies DOJ Review

Cook faces mortgage fraud allegations from Federal Housing Finance Agency Director William Pulte, who claims she improperly designated properties as primary residences for favorable loan terms in 2021.

“I’ll fire her if she doesn’t resign,” Trump told reporters Friday. Cook previously stated she has “no intention of being bullied to step down.”

Waller Emerges as Powell Replacement Frontrunner

Prediction markets show Waller leading Fed Chair succession odds at 51% on Kalshi, ahead of Kevin Hassett (30%) and Kevin Warsh (24%).

Waller dissented at July’s Federal Open Market Committee meeting, advocating immediate 25-basis-point cuts while Powell held rates steady. His proactive stance aligns with Trump’s preference for a forward-looking monetary policy.

“When labor markets turn, they often turn fast,” Waller stated, warning against falling behind the curve with GDP growth at just 1.2% in 2025’s first half.

Market Implications for Rate-Sensitive Sectors

Powell’s Jackson Hole pivot triggered significant moves across asset classes. The Dow Jones jumped 2% to new highs above 45,680, while the S&P 500 climbed 1.4% and the Russell 2000 soared nearly 4%.

Bitcoin (CRYPTO: BTC) gained 3.5%, with Ethereum (CRYPTO: ETH), Solana (CRYPTO: SOL) and Cardano (CRYPTO: ADA) posting double-digit gains as crypto markets entered “risk-on” mode.

Rate-sensitive sectors, including homebuilders, small caps, and regional banks, rallied sharply on accommodation expectations. Goldman Sachs‘ Jan Hatzius sees Powell’s remarks as “consistent with our expectation of a 25bp cut at the September FOMC meeting.”

Read Next:

Photo Courtesy: eamesBot on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.