Last week, President Donald Trump launched a national security probe into furniture imports into the United States, aimed at reshoring jobs and domestic manufacturing in the segment.

Tariff Rate Yet To Be Decided

In a Truth Social post on Saturday, Trump said, “Furniture coming from other Countries into the United States will be Tariffed at a Rate yet to be determined,” while referring to it as a “major tariff investigation” which will be concluded over the next 50 days.

Trump says the move is aimed at bringing the furniture business and jobs back to the United States, especially states such as “North Carolina, South Carolina, [and] Michigan.”

The investigation will be conducted under Section 232 of the Trade Expansion Act, a national security statute that allows the president to impose tariffs if imports are deemed a threat, according to a Reuters report.

The industry, however, remains skeptical, with The American Home Furnishings Alliance having previously criticized the tariffs, saying that no amount of it “will bring back American furniture manufacturing,” while adding that the move might instead “harm manufacturing still being done in the United States.”

Home Furnishing Stocks Feel The Heat

Furniture and home furnishing stocks have witnessed steep declines after hours following this announcement, given the industry’s reliance on imports.

| Stocks | Year-To-Date | After Hours |

| RH (NYSE:RH) | -38.32% | -5.67% |

| Wayfair Inc. (NYSE:W) | +69.00% | -4.10% |

| Williams-Sonoma Inc. (NYSE:WSM) | +8.46% | -5.06% |

| HNI Corp. (NYSE:HNI) | -9.18% | -0.33% |

| Steelcase Inc. (NYSE:SCS) | +41.51% | +0.18% |

| Arhaus Inc. (NASDAQ:ARHS) | +31.74% | -2.50% |

When the tariff fears first surfaced during “Liberation Day” in early April, RH, formerly known as Restoration Hardware, plunged 40% within a single trading day, and has been mounting a steady recovery ever since.

The company has since been leaning into the tariff chaos by diversifying away from China, which now makes up just 2% of its imports, down from 16%. It is now ramping up production in the U.S. and sees the situation as an opportunity, as competitors fail to keep up with the high tariff costs.

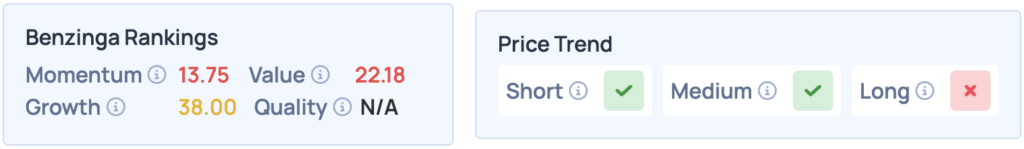

Shares of RH were up 11.39% on Friday, closing at $243.71, but are down 5.67% after hours, following Trump’s announcement of potential new tariffs on the segment. The stock scores poorly in Benzinga’s Edge Stock Rankings, but has a favorable price trend in the short and medium terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: Joey Sussman on Shutterstock.com