Oklo (OKLO) is an advanced nuclear technology company focused on designing and deploying next-generation fission power plants to deliver clean, safe, and affordable energy. Oklo has pioneered compact fast reactors, including its flagship Aurora powerhouse, which is capable of reliably producing between 15 and 75 MW of power. The company aims to serve off-grid applications such as data centers, remote industrial sites, and military bases, with plans for its first commercial deployment in 2027.

Founded in 2013, it is based in Santa Clara, California.

Oklo Stock Shines

Oklo shares have delivered extraordinary returns, climbing 24% over the past five days, 107% over one month, 630% over six months, and more than 1,190% over the trailing 52 weeks. This explosive rally sharply outpaces the Russell 2000 benchmark, which returned -0.4% over five days, -4.6% for the month, and is down nearly 2% year-over-year (YoY).

Oklo’s performance has been fueled by enthusiasm for its advanced nuclear technology and future energy solutions, but with significant volatility and a high beta, investors should exercise caution amid rapid price swings and speculative interest.

Oklo’s Q2 Results

Oklo reported a wider-than-expected loss for the second quarter of 2025, posting earnings per share of $0.18, which missed the analyst consensus estimate of -$0.11. The company generated no revenue this quarter as it remains in the pre-commercial phase, while operational expenses grew YoY due to increased investments in research, development, and regulatory milestones.

Financially, Oklo reported an operating loss of $28 million and a net loss of $24.7 million for the quarter. Despite the negative bottom line, the company maintains a robust balance sheet following a major equity raise, ending Q2 with $683 million in cash, cash equivalents, and marketable securities. Cash burn for the first half of 2025 totaled $30.7 million, in line with management’s projections, and Oklo’s minimal liabilities support its ongoing reactor development initiatives.

Looking ahead, Oklo reaffirmed its commitment to deploying its first Aurora power plant between late 2027 and early 2028. Management highlighted continued regulatory progress, including the completion of Phase I of its NRC licensing process and partnerships with industry and government stakeholders. Current cash reserves are expected to fund development through at least the next year, with a strategic focus on commercial readiness and market expansion.

Oklo Receives DoE Support

The U.S. Department of Energy has selected Oklo, along with Terrestrial Energy, TRISO-X, and Valar Atomics, for its advanced nuclear fuel line pilot program. As part of this initiative, Oklo will construct and operate three specialized fuel fabrication facilities to support its Aurora and Pluto reactors, as well as other fast reactor designs.

Each company chosen must fund the construction, operation, and eventual decommissioning of its facilities. They also must manage sourcing of nuclear material feedstock, though they may apply for high-assay low-enriched uranium (HALEU) from the Department of Energy’s supply. This program aims to establish a secure domestic supply chain for advanced nuclear fuels, stimulate private investment, and expedite commercial licensing.

The pilot projects are aligned with the Trump administration’s focus on reinforcing U.S. nuclear energy security and are a key component of the Department of Energy’s Reactor Pilot Program, which aims to have at least three reactors reach criticality by next year.

Should You Buy OKLO?

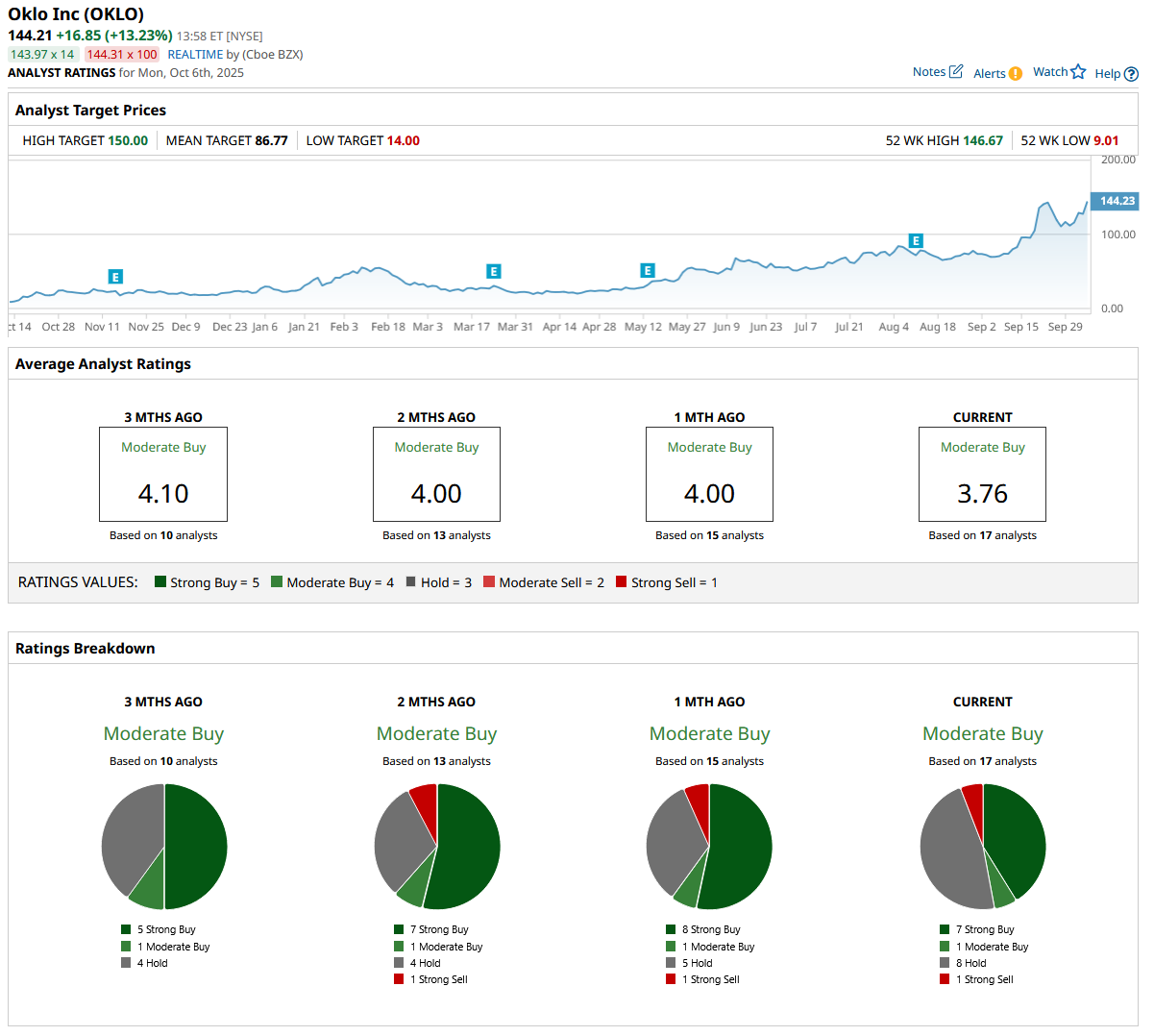

OKLO stock is in an interesting place at the moment. While the stock enjoys a consensus “Moderate Buy” rating from analysts, suggesting positive sentiment, the mean price target of $86.77 suggests a potential downside of 66% from the market rate. With the way OKLO has been going, analysts may need to reevaluate their price targets.

The stock has been rated by 17 analysts so far with seven “Strong Buy” ratings, one “Moderate Buy” rating, eight “Hold” ratings, and one “Strong Sell” rating.