/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

Tesla’s (TSLA) ambitious robotaxi program received a regulatory boost last week as President Donald Trump’s administration announced a streamlined approval processes for autonomous vehicles, potentially aiding the company’s June 22 launch in Austin, Texas. The timing couldn’t be better for CEO Elon Musk, who has been working to repair his relationship with Trump following their recent public disputes.

The National Highway Traffic Safety Administration has revealed that it will expedite the exemption processes for vehicles without traditional controls, such as steering wheels and brake pedals. This development directly benefits Tesla’s Cybercab platform, which lacks driver controls entirely.

Previously, regulatory approval for such vehicles could take years, but the new framework aims to reduce timelines to just months. Tesla shares surged over 2% on the announcement, reflecting investor optimism about faster regulatory pathways.

Will Tesla Finally Release Its Robotaxi?

Musk has been promising an autonomous car for several years and has failed to deliver on each occasion. He has repeatedly missed self-driving deadlines since 2016, when he predicted coast-to-coast autonomous trips would be achieved by 2017. Notably, the Austin pilot will be heavily geofenced and rely on virtual support, marking a departure from earlier promises of unsupervised self-driving in customer vehicles.

The program starts modestly with just 10 vehicles in restricted Austin areas, expanding to 1,000 vehicles within months, according to Musk’s projections. Tesla faces competition from Waymo, which already operates in four cities and provides over 200,000 paid rides weekly.

Moreover, safety concerns persist given Tesla’s involvement in numerous crashes and near-misses with existing driver assistance features. Critics argue that Tesla is prioritizing optics over thorough validation, given the compressed testing timeline compared to competitors.

Is Tesla Stock a Good Buy Right Now?

Tesla’s robotaxi ambitions could unlock substantial value for shareholders if the launch is successful. Analysts suggest the business model, which combines ride-hailing and vehicle licensing, could generate a sizeable revenue stream. Additionally, the regulatory tailwinds from the Trump administration will provide additional support for faster deployment.

Tesla’s robotaxi service represents a critical inflection point for the company’s valuation. TSLA stock currently trades at a forward price-earnings ratio of 175 times compared to the S&P 500 Index’s ($SPX) roughly 28 times.

Analysts expect Tesla’s sales to increase from $98 billion in 2025 to $142 billion in 2027. Comparatively, adjusted earnings per share are forecast to grow by over 40% annually over the next two years.

However, investors should carefully weigh the execution risks. Tesla’s revenue grew by just 6% between 2022 and 2024. In this period, its adjusted earnings narrowed from $4.07 per share to $2.04 per share. Tesla must deliver on ambitious autonomous driving promises to justify its current premium valuation.

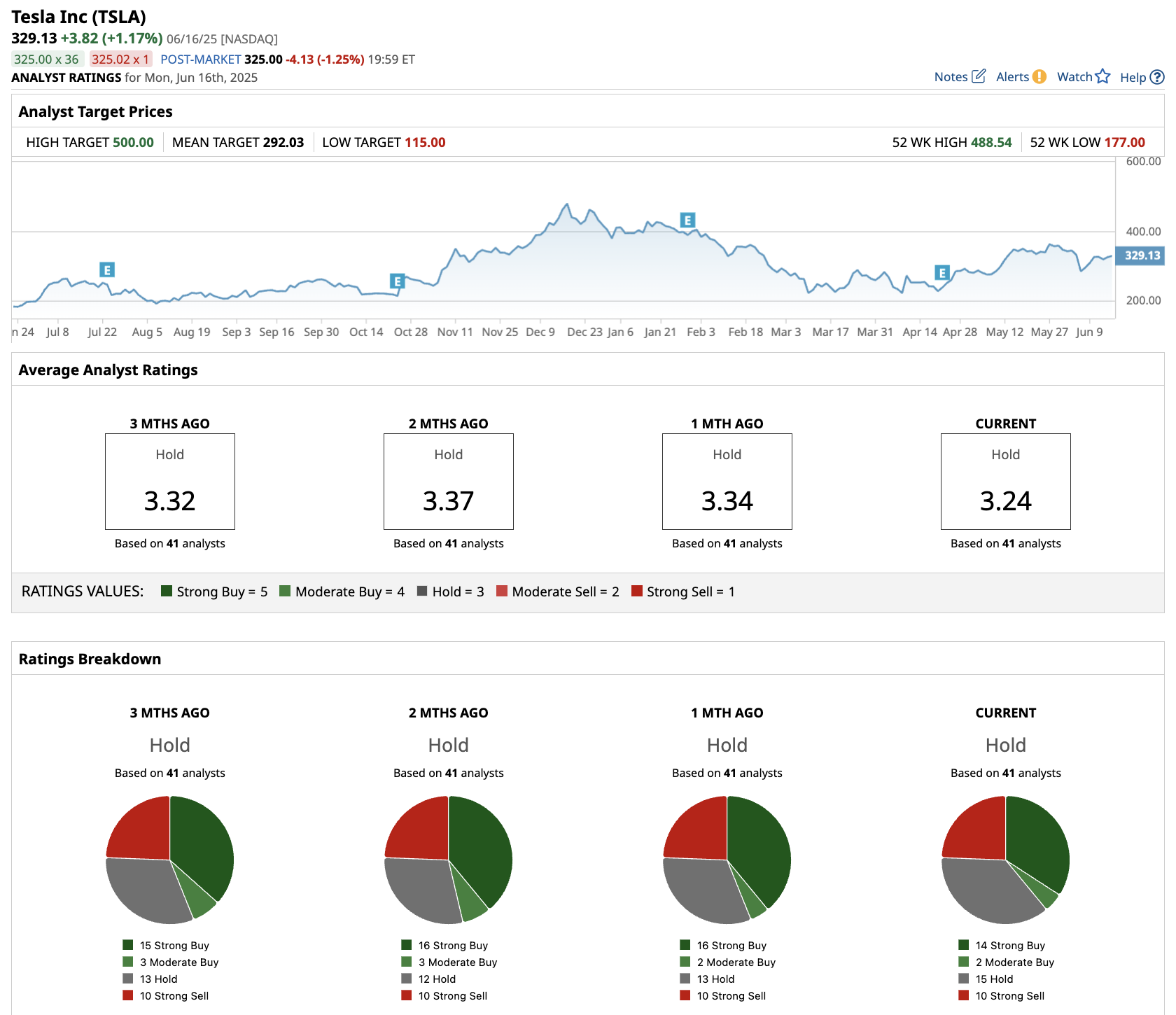

Out of the 41 analysts covering TSLA stock, 14 recommend “Strong Buy,” two recommend “Moderate Buy,” 15 recommend “Hold,” and 10 recommend “Strong Sell.” The average target price for TSLA stock is $292, 8% below the current price.

For potential investors, Tesla represents a high-risk, high-reward proposition. The regulatory environment has improved, but success depends on flawless execution of complex autonomous technology.

Conservative investors might wait for concrete operational results, while growth-oriented investors may view current levels as an entry point before potential robotaxi success drives further gains.