/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Political influence on Wall Street is nothing new, but it’s rare to see a U.S. president openly cheer for the success of a single stock. Semiconductor companies like Nvidia (NVDA) and Intel (INTC) typically trade on fundamentals such as chip demand, manufacturing capacity, and innovation pipelines. Yet now, a fresh wrinkle has entered the equation: political backing from none other than Donald Trump himself.

Analysts at Bernstein recently described this as an “unusual bull case” for Intel. Trump has repeatedly expressed his desire for Intel shares to rise, even posting about the stock’s performance on his social media platform. This kind of direct support from the Oval Office adds a new dynamic for investors weighing whether Intel’s turnaround potential is real or merely symbolic.

With Bernstein highlighting the risks and opportunities of this rare political endorsement, investors may wonder if INTC stock is worth buying now.

About INTC Stock

Based in California, Intel is known to work in the semiconductor business segment, designing, developing, and fabricating computing products and services all over the planet. The company operates under its segments: Intel Products, Intel Foundry, and all others. Intel sells several types of products, such as microprocessors, chipsets, standalone system-on-chips, and multichip packages. In addition, driving assistance, self-driving solutions, and intelligent edge platforms are other services that assist drivers in operating vehicles and achieving automation and data accuracy, powered by Intel and using AI.

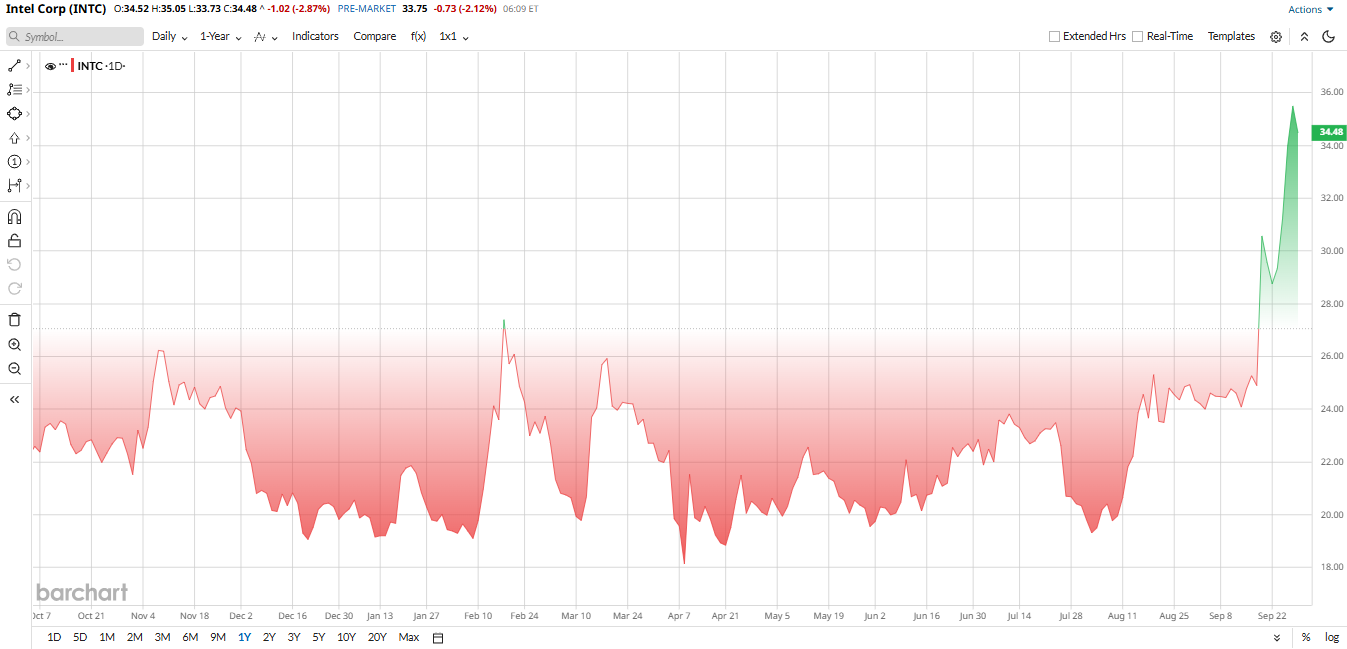

Valued at around $161 billion by market cap, Intel’s share price has catapulted in 2025. After trading below $20 last summer, INTC jumped as new deals emerged. In the past year, it has been up roughly 41% and 66% year-to-date (YTD). In September alone, rumors of an Apple (AAPL) investment and other news sent INTC up about 20 to 30%. Shares hit fresh 52-week highs in the mid-$30s by late September.

Despite this rally, INTC's valuation is relatively attractive, with an EV/Sales ratio of 3, slightly cheaper than the sector median of 4.

Trump’s Backing Creates an “Unusual” Bull Case

INTC is a stock that has soared dramatically in 2025 due to a sequence of bizarre and very high-profile affairs that have repositioned the company as both a political and technological point in the spotlight. August saw reports emerge that the company, Intel, had raised about 17 billion dollars through new money by a combination of state and corporate investors in September alone. In August, at President Trump's direction, the U.S. government became a 10% stakeholder valued at approximately $8.9 billion. Nvidia promised to invest around $5 billion to secure a 4% equity stake, and SoftBank (SFTBY) promised to invest $2 billion. Bloomberg also reported that Intel has been approaching Apple with an investment proposal, which, if Intel does so successfully, would provide still further strategic weight. These capital investments have boosted Intel's balance sheet and calmed investor sentiment.

Actually, maybe the most prominent factors stated by Bernstein analysts were Trump's public support for the stock and that, as well as financial investment by the government, represented an unusual but, at the same time, an unprecedented bull case. That argument was reaffirmed by Trump himself, who, in a publicly recorded statement, indicated on record that he wants Intel to succeed—an extraordinary degree of political support indeed.

At the same time, Intel is pushing forward on critical technology milestones under CEO Lip-Bu Tan. In Q2 2025, the company rolled out its new Xeon 6-series AI CPUs, while its next-generation Panther Lake processors are slated to ship by the end of 2025. Intel has also begun production of its Intel 18A process technology in Arizona, a symbolic and strategic win for U.S. chipmaking independence. Alongside these advances, Intel monetized part of its Mobileye (MBLY) stake with a $922 million IPO sale and continued to strengthen its leadership team with key hires.

Q2 Financials: Flat Revenue, Ongoing Losses

Intel’s second-quarter 2025 results showed progress on revenue but lingering challenges on profitability. The company reported $12.9 billion in revenue, essentially flat from last year but slightly above guidance, ending its streak of year-over-year (YoY) declines.

Within segments, the Client Computing Group, which covers PC chips, brought in $7.9 billion, down around 3%. Data Center and AI chips contributed $3.9 billion, up 4%, while the foundry business delivered $4.4 billion, a modest gain that highlights Intel’s push into chip manufacturing for external customers.

Despite stable revenue, bottom-line results stayed weak. Intel posted a net loss of $2.9 billion as restructuring and impairment charges weighed heavily on results. GAAP earnings per share came in at a loss of 0.26. Meanwhile, gross margin fell into the mid-20% range, reflecting ongoing cost pressures.

On the positive side, Intel generated $2.1 billion in operating cash, supported by expense reductions. Management reiterated its 2025 spending targets, aiming for about $17 billion in operating expenses and $18 billion in capital expenditures. For Q3, Intel guided revenue of $12.6 to $13.6 billion, with continued losses expected despite stable sales momentum.

Analysts' Opinion and Final Words

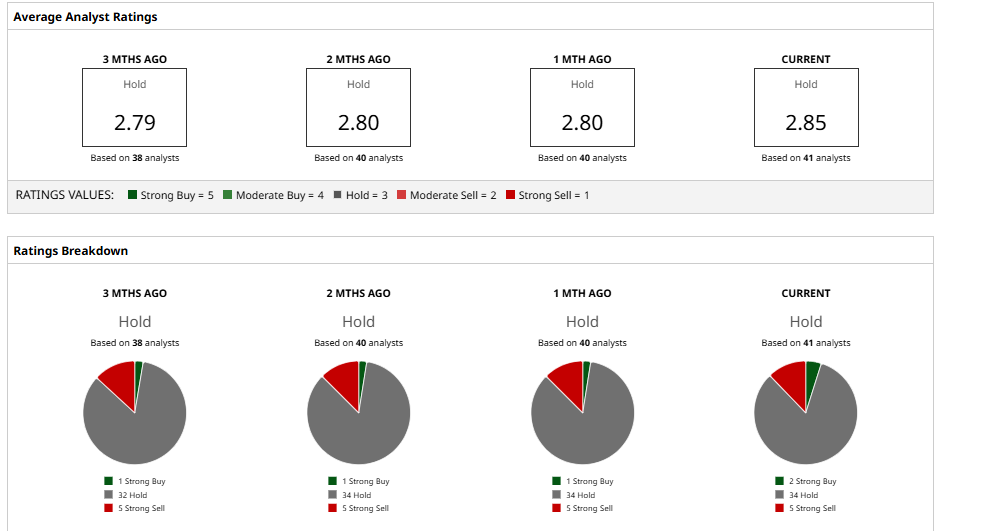

Wall Street analysts are cautiously maintaining a consensus “Hold” rating. Among 43 analysts tracked by Barchart, two recommend a “Strong Buy,” 34 call it a “Hold,” and five assign a “Strong Sell.” The stock currently trades well above its average price target of $25.43 and is moving toward the Street-high target of $43, which stands about 26% above current levels.

Intel is experiencing a recent boom in large headlines and large amounts of money, which is a strange kind of bull story in its own right. On the one hand, new capital and state bailouts would stabilize Intel and invest in its foundry and AI future. The stock will go further depending on further announcements of deals. Intel, on the other hand, still has a problem in its main business; that is, it continues to make the new money unprofitable and needs to demonstrate to the world its ability to match AMD, among others, in chips. Investors would then consider the political/economic momentum against the fundamental outlook.

As Bernstein said, money is not the solution, but customers can make Intel. Of course, the shares could be carried away by media hype this time, but the capital structure would reach its medium-term objectives only on as many occasions as Intel can present its manufacturing and chip precision.