In a significant shift in U.S. industrial policy, the Donald Trump administration has acquired direct ownership stakes in five major publicly traded companies. This series of interventions, framed as a national security strategy, marks a new era of government involvement in key industries to secure domestic supply chains for semiconductors, critical minerals, and steel.

Trump Administration’s New Portfolio

The government’s acquisitions include a 10% stake in semiconductor giant Intel Corp. (NASDAQ:INTC), a 15% stake in rare earth producer MP Materials (NYSE:MP), a 10% stake in Lithium Americas Corp. (NYSE:LAC), a 10% stake in Trilogy Metals Inc. (NYSE:TMQ), and a “golden share” in US Steel Corporation.

Intel

- The administration converted previously awarded CHIPS Act grants into a $5.7 billion investment for a 10% equity stake in the semiconductor giant. The unprecedented deal is designed to prevent a potential spinoff of Intel’s deeply unprofitable foundry business.

- The agreement also includes a five-year warrant allowing the government to acquire an additional 5% at $20 a share if Intel’s ownership in the foundry unit drops below 51%.

- Completing the deal on Aug. 22, the stock closed at $24.80 per share on that day, returning nearly 47.54% by Oct. 6, closing at $36.59 per share.

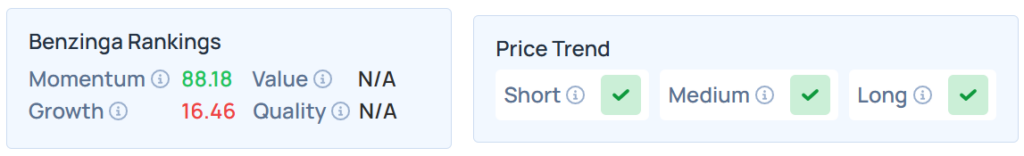

- This stock maintained a stronger price trend over the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

MP Materials

- To counter China’s dominance in the global rare earth market, the Department of Defense (DoD) entered a public-private partnership with MP Materials.

- Through the deal, the DoD acquired a stake representing about 15% of all shares, making it potentially the company’s largest shareholder. MP Materials operates the only fully integrated rare earth mining and processing facility in the U.S.

- Finishing the deal on July 11, the stock has gained 64.77% since then, jumping from $45.11 per share to $74.33 as of Oct. 6 close.

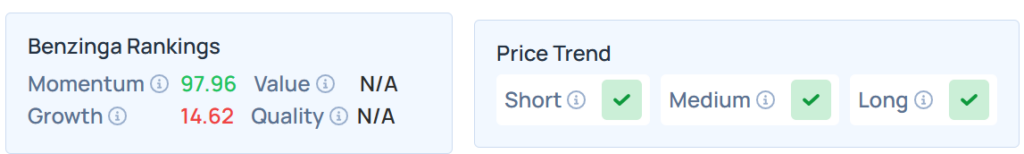

- MP maintained a stronger price trend over the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

See Also: Trump’s Mineral Gambit After Lithium Americas—These Names Could Be Next

Lithium Americas

- The administration pursued a 10% ownership stake in Lithium Americas as part of negotiations to restructure a $2.26 billion federal loan.

- The loan supports the company’s Thacker Pass lithium mine in Nevada, which is expected to become the largest lithium operation in the Western Hemisphere when production begins in 2028. The project is intended to strengthen America’s domestic lithium supply chain for products like electric vehicle batteries.

- It has advanced by 20% since the government’s stake acquisition on Oct. 1 at 7.04 per share to $8.45 as of Oct. 6 close.

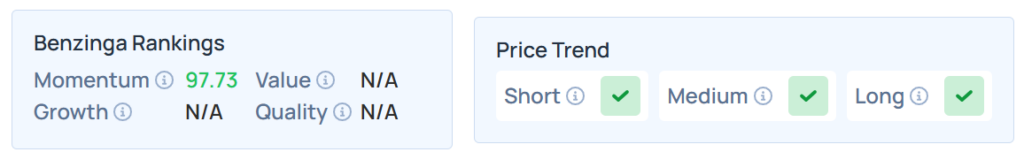

- LAC maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

Trilogy Metals

- The White House announced plans to take a 10% stake in Trilogy Metals through a $35.6 million investment to support mining exploration in Alaska’s Ambler Mining District.

- The investment includes warrants to purchase an additional 7.5% of the company. The move is designed to unlock access to one of the world’s largest undeveloped copper-zinc mineral belts.

- The deal announcement saw the stock skyrocket 215.30% in after-hours trading on Monday.

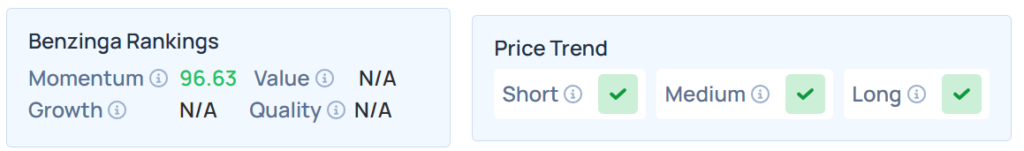

- TMQ maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

US Steel Corporation

- In a unique arrangement, the administration secured a “golden share” in US Steel as part of its acquisition by Japan’s Nippon Steel Corp. (OTCPK: NISTF).

- This does not represent a typical equity stake but instead grants the U.S. government permanent veto authority over key corporate decisions, including relocating the headquarters from Pittsburgh, shifting production overseas, or closing facilities.

- The government acquired this golden share in the firm on June 18, and since then, the OTC market stock is down 77.80%.

Trump Administration Eyes Defense Contractors

This strategy of direct investment may extend further, as Commerce Secretary Howard Lutnick confirmed the administration is considering buying ownership stakes in major defense contractors.

Lutnick pointed to firms like Lockheed Martin Corp. (NYSE:LMT), noting that since they derive nearly all their revenue from the U.S. government, they are “basically an arm of the U.S. government”. The news prompted a rally in defense stocks.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, advanced on Monday. The SPY was up 0.36% at $671.61, while the QQQ rose 0.75% to $607.71, according to Benzinga Pro data.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were lower on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock