Commerce Secretary Howard Lutnick said the Trump administration plans to convert federal funding pledged to Intel Corp. (NASDAQ:INTC) under the CHIPS Act into an equity stake, arguing that taxpayers deserve a return instead of providing “giveaways to rich companies.”

‘Good Return For The American Taxpayer’

On Tuesday, Lutnick emphasized the need to make chips in the U.S., as opposed to Taiwan, “which is 9,500 miles away from us and only 80 miles from China,” while speaking on CNBC’s ‘Squawk on the Street.’

“We want to make them here. That's a key part of our initiative,” he said, while highlighting the critical role that Intel could play in strengthening domestic semiconductor production. “It would be lovely to have Intel be capable of making a U.S. node or a U.S. transistor, you know, driving that in America,” he said.

See Also: Why We Believe The US Mulling A 10% Stake In Intel Is Negative

According to Lutnick, President Donald Trump wants taxpayers to receive equity in return for the billions of dollars already committed through the CHIPS Act. “That is exactly Donald Trump's perspective, which is why are we giving a company worth $100 billion this kind of money? What is in it for the American taxpayer?”

Lutnick says the plan is to “deliver the money, which was already committed under the Biden administration,” but ensure “we'll get equity in return for it.” He says this shift would “get a good return for the American taxpayer instead of just giving grants away.”

Responding to criticism regarding government interference in corporate governance, Lutnick insists that the government will not be getting involved in governance and that its stake in the company will be “non-voting.”

Volatile Times For Intel

There’s been a lot happening around Intel in recent weeks, starting with Trump calling for the resignation of its CEO, Lip-Bu Tan, on Truth Social, calling him “highly CONFLICTED and must resign, immediately.”

Trump, however, changed his tone the following week, after meeting with Tan, referring to it as “very interesting.” He called Tan’s success and rise “an amazing story,” adding that Tan will be working with his Cabinet members.

Early this week, Japan’s Softbank Group Corp. (OTC:SFTBY) announced that it will be investing $2 billion in Intel, which came alongside news of the U.S. government’s plans to acquire a 10% stake in the company.

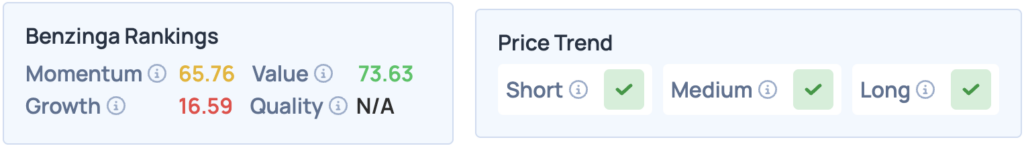

The stock popped 6.97% on Tuesday, following the news, closing at $25.31 a share, and is down 1.22% after hours. The stock scores poorly in Benzinga’s Edge Stock Rankings, faring well only on Value, but has a favorable price trend in the short, medium and long terms. Click here for more insights into the stock.

Read More:

Photo courtesy: Shutterstock