/Transdigm%20Group%20Incorporated%20logo%20on%20mobile-by%20madamF%20via%20Shutterstock.jpg)

With a market cap of $74.1 billion, TransDigm Group Incorporated (TDG) is a prominent aerospace company specializing in the design, production, and supply of engineered aircraft components. Founded in 1993 and headquartered in Cleveland, Ohio, TransDigm focuses on proprietary, highly engineered parts for commercial and military aircraft, including control systems, pumps, valves, and cockpit instruments.

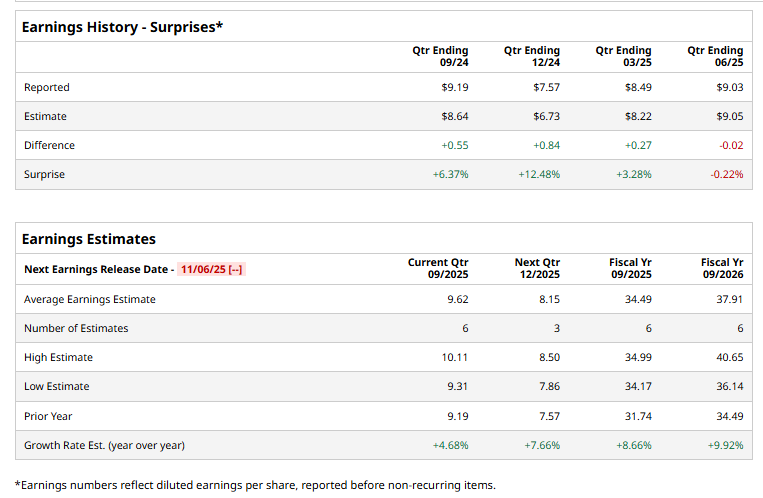

The aerospace titan is expected to release its fiscal Q4 2025 earnings results shortly. Ahead of this event, analysts project TDG to report an EPS of $9.62, a 4.7% growth from $9.19 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in three of the last four quarters, while missing on another occasion.

For fiscal 2025, analysts forecast TransDigm to report EPS of $34.49, up 8.7% from $31.74 in fiscal 2024. Moreover, EPS is expected to grow 9.9% annually to $37.91 in fiscal 2026.

Over the past 52 weeks, TDG stock has fallen marginally, underperforming the broader S&P 500 Index's ($SPX) 16.2% return and the Industrial Select Sector SPDR Fund's (XLI) 13.2% gain over the same period.

On Oct. 15, shares of TransDigm dropped 4.4% after Morgan Stanley (MS) lowered its price target to $1,600 from $1,750, citing higher debt and increased interest expenses following recent debt transactions and a $90-per-share special dividend. Despite the adjustment, the firm kept an “Overweight” rating, noting the new target still implies a potential 21.9% upside.

Analysts' consensus view on TransDigm stock is bullish, with an overall "Strong Buy" rating. Among 22 analysts covering the stock, 16 suggest a "Strong Buy," and six provide a "Hold" rating. Its mean price target of $1,555.10 represents a premium of 15.2% from the prevailing price levels.