Among the 45 NYSE stocks hitting new 52-week lows on Tuesday was wood pellet outdoor grill manufacturer Traeger (COOK). The once-promising Salt Lake City-based business hit its 47th new 52-week low of the past 12 months yesterday, suggesting its best days could be in the rearview mirror.

For those unfamiliar with Traeger, it went public on July 29, 2021, selling shares at $18 apiece, raising $424 million in the process. The 2021 IPO valued the wood pellet stove manufacturer’s equity at $2.12 billion. Today, its market cap is about one-twelfth that amount.

As a result, its shares are in penny-stock territory, perilously close to falling below $1, and risk delisting by the NYSE for non-compliance.

The company has initiated Project Gravity to rightsize the business and return it to profitability. The question for investors is whether this will be enough to stem the bleeding.

Down nearly 50% in 2025 and 66% over the past year, the future looks bleak for the once-promising stock.

Is Traeger’s goose cooked? Maybe. Maybe not.

How Did Traeger Get Here?

Back when Traeger went public in 2021, times were significantly better for outdoor grill companies, thanks to COVID, which prompted consumers to engage in more outdoor activities, such as golfing and barbecuing.

Another competitor, Weber, went public around the same time, selling $250 million of its stock at $14 a share. Weber’s IPO valued its equity at nearly $4 billion.

In fiscal 2020 (September year-end), Weber saw its sales increase by 18% to $1.30 billion, while Traeger’s jumped 50% higher to $546 million. Traeger received the higher multiple — 3.9 times sales, compared to 3.1 times for Weber — and its shares skyrocketed to an all-time high of $32.59, less than two weeks after its IPO.

Its shares have lost 96% of their value over the past four years.

Interestingly, MarketWatch published an article just after Traeger’s IPO, warning investors about the firm’s worrisome financials.

“RapidRatings, a risk and financial analysis company that examines the financial health of thousands of companies, took a close look at their financials and found Weber had a far higher financial health rating than Traeger at 75 out of a possible 100, compared with Traeger’s 44,” wrote MarketWatch contributor Tonya Garcia.

In March 2021, Traeger had approximately $475.8 million in total debt and just $17.1 million in cash, resulting in a net debt of $458.7 million. It used some of the proceeds of its IPO to pay down some of this debt. By the end of 2021, its total debt had been reduced to $420.5 million, while its equity value had dropped to $606.0 million, approximately one-quarter of its value in August 2021.

Fast forward to today.

Traeger had a total debt of $436.9 million as of June 30, about 1.6 times its market cap. In the third quarter of the calendar year, the company’s market cap fell by another 40%, so its total debt is now 2.7 times its market cap — and rising.

The biggest problem facing Traeger is declining sales. They were $546 million in 2020, the fiscal year immediately preceding its IPO. They jumped 44% in 2021, to $786 million, but have fallen every year since. They’re on pace to decrease by 9% in 2025 to $548 million.

Cue Project Gravity.

Can Project Gravity Save COOK Stock?

Anything is possible. Of course, cutting costs is the easy part of any turnaround. The hard part is reigniting sales growth without resorting to an expensive marketing campaign, lowering prices, or a debt-laden strategic acquisition.

Traeger should be taken private, where the buyers can cure what ails it. In August, B. Riley analysts downgraded the company’s stock from "Buy" to "Neutral" and reduced its price target to $1.50 from $3.00.

The reason: prolonged sales weakness. Its grill sales, which account for over 50% of its revenue, fell by 22% in the second quarter. B. Riley expects year-over-year sales to decrease for at least the final two quarters of 2025.

The B. Riley analysts believe that the $30 million in annual cost savings Traeger expects to achieve by the end of 2026 won’t be sufficient to offset the decline in sales resulting from tariffs imposed by the Trump administration.

Lastly, the analysts emphasized that its debt was almost six times trailing 12-month EBITDA (earnings before interest, taxes, depreciation and amortization), a worrisome figure given the lack of sales growth.

Traeger’s Altman Z-Score--a measure of the likelihood of a company going bankrupt in the next 24 months--as of June 30 was 0.07. A score below 1.81 indicates that a company is distressed and is likely to enter bankruptcy proceedings.

Project Gravity could be too little, too late.

Who Might Buy COOK Stock?

There’s no question that only aggressive investors should consider an investment in Traeger.

It went public with too much debt, and that hasn’t changed. The only hope is that a very wealthy buyer comes along with patient capital to mend it back to health. The turnaround isn’t a six-month project. It will likely take 18-24 months before investors see significant traction.

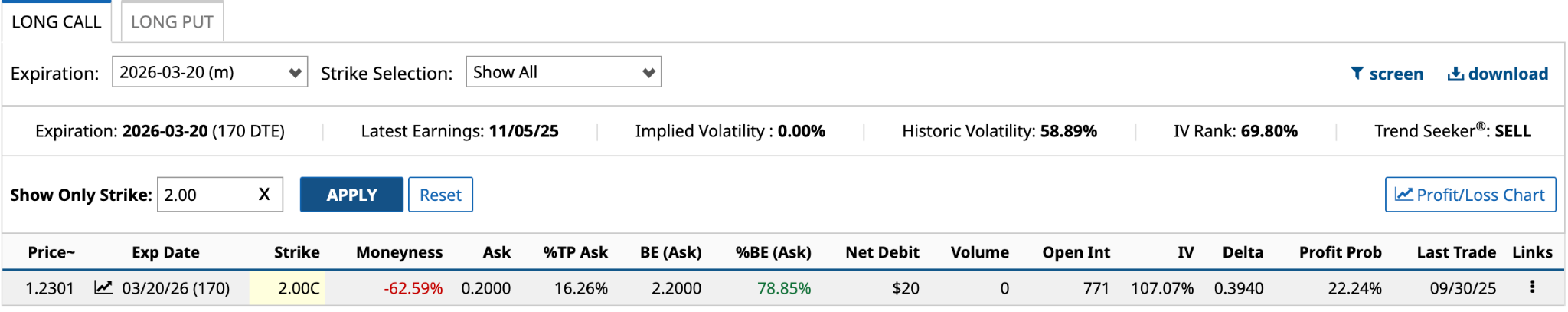

Given a $1.22 share price, it’s not going to cost you much to take a flyer on a couple thousand shares. A better play, though, might be to use options to limit the potential loss. The last time Traeger had 1,000 options contracts traded was Sept. 23. You’ll have to be patient.

The March 20/2026 expiration date has an expected move of 31.35% in either direction. The $2 call strike has a net debit of $20 or about 16% of its current share price. With a delta of 0.3940, if the share price moves up 51 cents and you close the position before March 20, you could double your money.