The list of worries continues to grow as the year wears on. Inflation, geopolitical turmoil, energy prices, increasing rates and rising food prices have all topped the list so far.

The latest addition? A potential rail strike in the US.

Inflation came in hotter than expected on Tuesday, the PPI report was mixed today and now there’s a new festering risk to the U.S. economy. As reported earlier by TheStreet:

“A possible strike by unionized workers at two of the country's biggest railroad operators -- Union Pacific (UNP) and CSX (CSX) -- that would bring a screeching halt to freight shipments is already having an impact on the flow of goods.”

“A massive rail strike could very well deal yet another blow to the U.S. economy, even a national economic disaster," in the words of the U.S. Chamber of Commerce.”

The White House is obviously hoping to avoid such an outcome, but it’s a risk that overhangs the market at this time.

Let’s look at the chart for these two railroad stocks.

Trading Union Pacific Stock

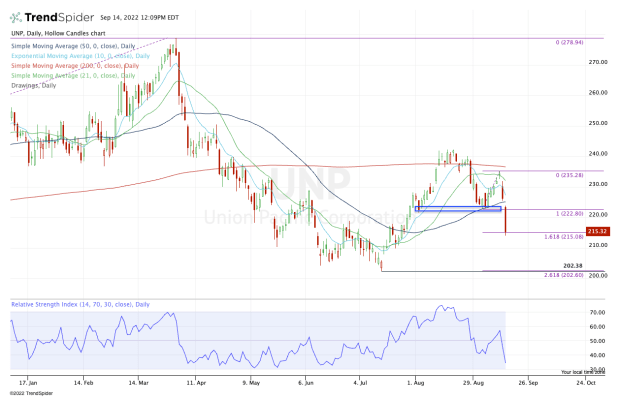

Chart courtesy of TrendSpider.com

On the daily chart above, one can see how poorly Union Pacific has performed over the past two days. At today’s low, the shares were down 9% from Monday’s high.

With today’s gap down, Union Pacific stock opened just below the 50-day moving average, then plunged below this month’s low and last month’s low.

As the shares have dived, we’re into the 161.8% downside extension. Given the current market conditions, it’s hard to expect this level to hold as robust support.

In the event that it does, let’s see how the stock does on a rebound to the $223 to $225 area.

Does it quickly reclaim this zone and repair some of the technical damage or is it resistance?

On the downside, be open to the possibility that Union Pacific stock continues to decline, particularly if the overall market comes under pressure and/or if the news with the rail strike worsens.

In that case, I think we may need to keep an eye on the low-$200s as possible support. That zone can also be seen on the weekly chart, here.

Trading CSX Stock

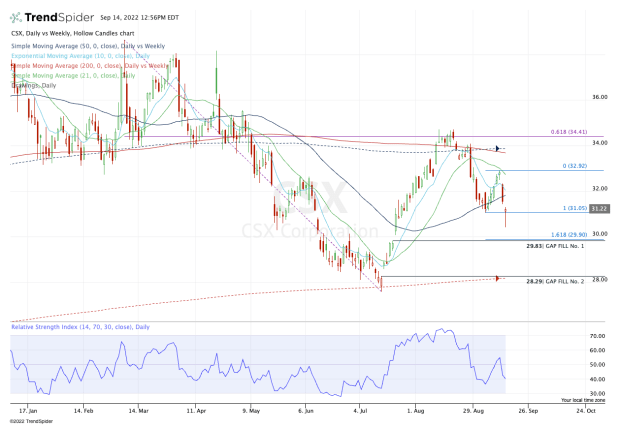

Chart courtesy of TrendSpider.com

Like Union Pacific, CSX stock undercut the August and September lows, although it’s trying to recover this area now between $31 and $32.

If the shares go on to take out today’s low, it opens a move to the $29.75 to $30 area. There, the stock finds its 161.8% downside extension and the first of two gap-fills.

Should CSX stock continue lower, then the $28.25 area becomes of interest. In that zone, we find the second gap-fill level, as well as the 200-week moving average. The latter was support earlier this summer when CSX stock bottomed and went on a 25% rally.

If the shares do dip this far, then technically speaking the 2022 low is also on the table at $27.60.