Cannabis stocks are in focus on Friday, following an executive order from President Joe Biden and after earnings from Tilray (TLRY).

They're also in focus a day after a huge rally in the cannabis industry, as the ETFMG Alternative Harvest ETF (MJ) rallied almost 20% on Thursday.

As reported by TheStreet's Tony Owusu:

“Biden issued a proclamation pardoning all current U.S. citizens and permanent residents convicted on federal charges for simple possession of marijuana…Biden also called on governors to pardon low level marijuana offenders in state prisons and for Health and Human Services and the Attorney General to initiate the process of rescheduling marijuana under federal law.”

Tilray also reported earnings this morning, with both top- and bottom-line results missing expectations.

Generally speaking, cannabis stocks are not trading well on the day, highlighted by the near-10% fall in the MJ ETF.

Trading Canopy Growth Stock

Chart courtesy of TrendSpider.com

Let's run through a few cannabis stocks here, starting with Canopy Growth (CGC).

The stock made a push for the September high yesterday, but it’s coming into a key area with today’s fade. Bulls are hoping the $3 area will be support.

While Canopy Growth stock is below the 50-day moving average, it’s trying to hold the 10-day and 21-day moving averages, as well as the 61.8% retracement.

If it holds, the bulls will want to see the stock retest and ideally take out this week’s high at $3.83 and eventually climb to the third-quarter high at $4.30. Above that puts the 200-day moving average in play.

Conversely, if Canopy Growth breaks below $3, the September low will be in play at $2.60.

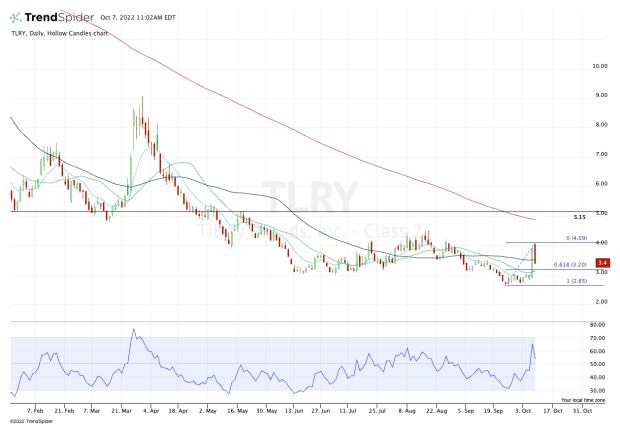

Trading Tilray Stock

Chart courtesy of TrendSpider.com

Down about 15% on Friday, Tilray is not having a great reaction to its earnings.

As with Canopy Growth, the Tilray bulls will want to see $3.20 act as support, where the stock finds its 61.8% retracement and the 10-day and 21-day moving averages.

Below $3 and the September low is in play at $2.65. It’s a setup similar to that of Canopy Growth.

Above $4 could put the 200-day moving average and $5 in play.

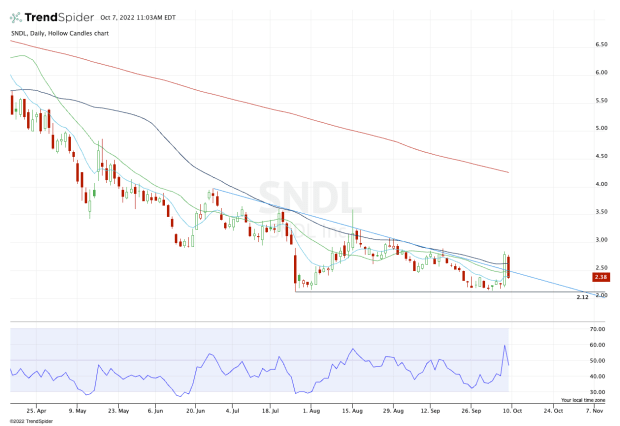

Trading SNDL Stock

Chart courtesy of TrendSpider.com

Then, we have SNDL (SNDL) stock.

The shares are back below downtrend resistance (blue line) and all its major moving averages. That's not a good look.

From here: The $2 to $2.20 area becomes vital. If the stock goes below it, there's no reason for traders to be long.

On the upside, the bulls need this stock to reclaim $2.50. If it can clear the 50-day, it puts this week’s high back in play near $2.85.

Of the three names on the list, this is the weakest-looking chart.