C3.ai (AI) has been in the news and headlines a lot this year.

Of course, its ticker — AI — helps momentum given the recent enthusiasm surrounding artificial intelligence.

I have followed C3 for quite some time, specifically after CEO Thomas Siebel sat down with TheStreet in 2015 for this interview.

By the time it went public in December 2020, the valuation had ballooned amid a raging bull market.

Now, though, the shares have been punished amid the bear market. C3.ai has suffered a peak-to-trough decline of roughly 95%.

While it was resurging a bit this year thanks to investors’ focus on artificial intelligence, more turbulence has ensued.

C3.ai shares slumped 26% yesterday and at last check the stock was down 13% in follow-through selling. That decline comes after “accounting and disclosure allegations from short-seller Kerrisdale Capital.”

Accounting issues can be a recipe for disaster in the stock market. Let’s take a closer look at the share price.

Trading C3.ai Stock

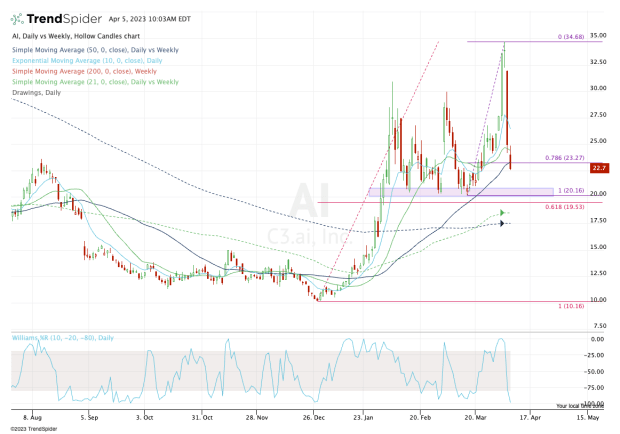

Chart courtesy of TrendSpider.com

Given the current volatility and headlines surrounding AI stock, the risk of owning the shares has gone up considerably. That will likely cause some investors to avoid this stock and push others to buy calls or call spreads instead of common stock.

In any regard, the bulls are wondering where support might come into play.

On Monday C3.ai stock held the 21-day moving average and closed near $25. This morning it looked like it was going to hold the $23 area, which is the 50-day moving average and 78.6% retracement.

While the situation is volatile, the setup here is pretty simple: Either C3.ai stock reclaims this area and holds it as support or it doesn’t.

If it doesn’t hold as support, it puts the low-$20s on deck. That area has been multimonth support, while the 61.8% retracement from the first-quarter high to the 2022 low comes into play near $19.50.

If it does end up regaining and holding the 50-day moving average as support, investors will want to see C3.ai stock rebound back to $25, followed by the 10-day moving average (currently near $27.50 but moving quickly to the downside).

Above the 10-day and the $28 level is back in play, followed by $30.

The ranges in this name can be very wide as long as volatility persists.